Buy Motherson Sumi Wiring India Ltd For the Target Rs. 71 by Choice Broking Ltd

Despite reporting a weak set of numbers in Q3FY25, with EBITDA margin to continue to remain impacted in the near term; we remain positive of the long term growth potential of MSUMI

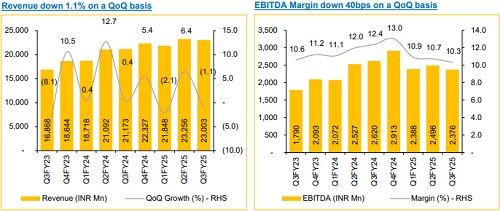

* Revenue for Q3FY25 was at INR 23,003 Mn, up 8.6% YoY and down 1.1% QoQ (vs CEBPL est. at INR 24,077 Mn).

* EBITDA for Q3FY25 was at INR 2,376 Mn, down 9.3% YoY and down 4.8% QoQ (vs CEBPL est. at INR 2,648 Mn). EBITDA margin was down 205 bps YoY and down 40 bps QoQ to 10.3% (vs CEBPL est. at 11.0%).

* PAT for Q3FY25 was at INR 1,400 Mn, down 16.6% YoY and down 8.0% QoQ (vs CEBPL est. at INR 1,634 Mn)

Revenue growth to be driven by Greenfield projects:

MSUMI is in the process of setting up three greenfield plants for new programs (EV/ICE) for Maruti Suzuki, Mahindra, and Tata Motors. These plants are located in Pune (Maharashtra), Navagam (Gujarat), and Kharkhoda (Haryana). These greenfield plants are in different stages of completion and rampup. The management anticipates annual revenues of approximately INR 21,000 Mn to come on stream, once all the plants are in production phase by H2FY26. We believe the EBITDA margin will remain impacted for the coming quarters, with normalization in margin to be seen by H2FY26 as new plants start production and ramp up

View and Valuation:

We revise our FY26/27 EPS estimates downwards by 9.3%/8.7% and roll over our forecasts forward to come up with a revised target price of INR 71; valuing the company at 37x (unchanged) on FY27E EPS while upgrading our rating to ‘BUY'. Auto ancillary companies like MSUMI stand to gain from the increase in consumption led by revision of the income tax structure outlined in the Budget 2025. We expect MSUMI to benefit from the transition to EV and hybrid powertrains, leading to an increase in content value per vehicle. We believe the company will continue to maintain its growth trajectory driven by capacity expansion and new order wins.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)