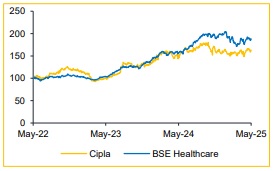

Reduce Cipla Ltd For Target Rs. 1,445 - Choice Broking Ltd

EBITDA to Hit from Increased Costs; Downgrade to REDUCE

Cipla is in an investment phase, with elevated capex and R&D spend aimed at strengthening its pipeline, including Biosimilars. While this supports long-term growth, it is likely to weigh on EBITDA margins and PAT in the near term. Further, the upcoming loss of exclusivity for gRevlimid by Q4FY26—a key revenue contributor—may lead to a decline in North America revenue. Reflecting these headwinds, we revise our earnings estimates downward by 9.0%/7.7% for FY26E/FY27E

Accordingly, we downgrade our rating to REDUCE and revise our target price to INR 1,445 (from INR 1,865 in Q3FY25). Our valuation is based on an average of the PE and DCF methodologies (refer to Exhibit 1), applying a PE multiple of 20x (unchanged) on FY27E EPS

Revenue in-line, EBITDA Miss Estimates: Revenue grew 9.2% YoY but declined 4.9% QoQ to INR 67.3 Bn (vs. consensus estimate: INR 67.1 Bn). EBITDA rose 16.9% YoY but declined 22.7% QoQ to INR 15.4 Bn (vs. consensus estimate: INR 15.6 Bn); margins expanded 150 bps YoY but contracted 527 bps QoQ to 22.8% (vs. consensus: 23.2%). Adj. PAT increased 30.1% YoY but declined 22.7% QoQ to INR 12.2 Bn (vs. consensus estimate: INR 10.1 Bn); PAT margin at 18.2%.

North America Growth to Moderate as gRevlimid Winds Down: North America revenue grew modestly at 2.3% YoY and remained flat QoQ. The region continues to be heavily reliant on gRevlimid, which is expected to lose exclusivity by Q4FY26. As a result, the waning contribution from this key product is likely to weigh on overall regional growth. We project North America sales to grow at a mid-to-high single-digit rate in FY26. That said, an increase in Albuterol market share and upcoming launches such as Nilotinib Capsules could provide some incremental support to growth.

Margin Pressures Likely Due to Increased R&D and Evolving Product Mix: The company’s margins declined sharply, contracting 527 bps QoQ to 22.8%. Management expects FY26 margins to moderate to 23.5–24.5%, down from 25.9% in FY25. This is largely attributed to an increase in R&D spend, expected at 7–7.5% of sales (vs. 5.5% in FY25), primarily for Biosimilar and complex product development. Additionally, a shift toward the base business and new product launches is also expected to contribute to the margin moderation.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131