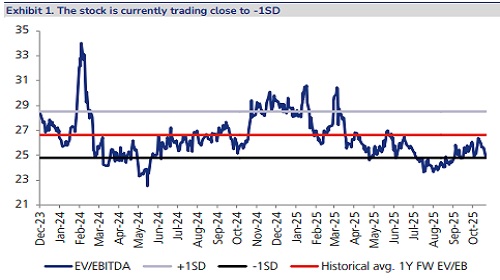

Buy Jupiter Life Line Hospitals Ltd For Target Rs. 1,935 By JM Financial Services

ARPOB led growth, expansion plans on track

JLHL delivered a strong quarter with beat on all fronts. The company reported Revenue/EBITDA/PAT of INR 3.9bn/922mn/575mn, which were +22%/+23%/+12% on YoY basis. The performance was led by 16% YoY ARPOB growth, offsetting the 3% decline in patient volumes. The occupancy took a dip (64% vs 73% in 2QFY25) on account of increased capacities; however, the company saw a 9% YoY increase in absolute occupied beds. The greenfield expansion plans are on track, with Dombivli being the first project coming live in 1QFY27. However, the company expects a drag on EBITDA margins for FY27 owing to the same, with the breakeven for Dombivli unit expected in the second year of commissioning. The Pune-II and Mira units are expected to commercialise in CY28 and CY29, respectively. In our view, Jupiter has carefully chosen its target markets in the under-served micro-markets of Western India. Further, the new additions, along with maturing of Pune and Indore units, provides long runway for growth and value creation for investors. Over FY25-28, we expect the company to grow at 19%/20%/19% on revenue/EBITDA/PAT. Thus, we maintain BUY with a TP of INR 1,935 (28% upside).

* Lower incidence of infectious diseases this quarter: Typically, a higher infection load drives stronger occupancy in 2Q for the company, but Pune experienced a lower outbreak this year, affecting peak occupancy. Thane occupancies have stabilised at around 70%, and Pune is trending toward similar levels, while Indore continues to ramp up well. Case mix improvement in Indore and insurance rate revisions are contributing to ARPOB growth.

* Dombivli project- set to launch in 1QFY27: The Dombivli project is progressing as planned and is expected to be commissioned in 1QFY27. Recruitment discussions have already begun to support the ramp-up. The company has incurred INR1.1bn of capex on the project this year. The market has limited supply, which should support strong demand for the new facility. Breakeven is expected by the second year of operations at an occupancy level of around 40–50%. ARPOBs will be aligned with MMR market pricing over time, although they may remain slightly lower during the initial period.

* Change in revenue reporting format: The company has started reporting unbilled revenue in its presentation from this quarter. This represents revenue related to admitted patients where billing is not yet completed or payment is still pending. The unbilled revenue for the quarter stood at INR 192mn, which creates a one-time delta in the reported numbers. The associated cost for this unbilled revenue is INR 123mn, which has been included under professional fees. Of this, INR 30mn relates to direct costs, while INR 93mn is accounted for as a provision.

* Expansion plans on track: All three greenfield projects at same stage as previous concall. Dombivli (500 bed capacity) is progressing as scheduled and will be commissioned in 1QFY27. The second Pune hospital’s (500 bed capacity) construction is set to begin from 3QFY26 and is expected to operationalize by CY29.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361