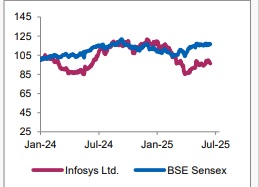

Hold Infosys Ltd For Target Rs. 1,870 by Axis Securities Ltd

In-line Performance; Steady Growth Ahead

Est. Vs. Actual for Q1FY26: Revenue – INLINE ; EBIT Margin – BEAT ; PAT – INLINE

Recommendation Rationale

• Macro Headwinds: The business environment remains uncertain due to unresolved tariffs and geopolitical situations, leading clients to be cautious with discretionary spending and delaying decision-making.

• Deal Wins/Pipeline: Infosys secured $3.8 Bn in large deals, with 55% being net new. This includes vendor consolidation deals totalling over $1 Bn, featuring one megadeal with a major global bank. The company is benefiting from vendor consolidation, supported by its strong delivery capabilities and AI innovation.

• AI Implementation: The company is developing 300 AI agents across business operations and IT. These agents are designed to assist clients in making faster decisions, enhancing customer experience, and improving operational efficiency

Sector Outlook: Cautiously optimistic Company Outlook & Guidance: The revenue guidance for FY26 has been revised to 1% to 3% growth in constant currency terms, up from the earlier guidance of 0% to 3%. Additionally, the company does not foresee any significant change in Q2FY26 and expects performance to remain at similar levels, indicating continued caution amid a challenging macroeconomic environment

Current Valuation: 24x FY27E P/E

Current TP: 1680/share

Recommendation: We resume our coverage with a HOLD rating on the stock.

Financial performance

In Q1FY26, Infosys reported revenue of Rs 42,279 Cr vs Rs 39,315 Cr (Q1FY25), up 7.5% YoY and 3.3% QoQ. EBIT stood at Rs 8,803 Cr vs Rs 8,288 Cr (Q1FY25), up 6.2% YoY and 2.7% QoQ, driven by higher topline growth. EBIT margin declined by \~13 bps to 20.8% due to compensation increases, higher variable pay, currency movements, and sales investments, partially offset by improved realisation from Project Maximus and seasonality. Net income stood at Rs 6,924 Cr vs Rs 6,374 Cr (Q1FY25), up 8.6% YoY and down 1.6% QoQ, impacted by higher tax expenses. In CC terms, revenue grew by 2.6% QoQ and 3.8% YoY. Attrition rose by 170 bps to 14.4% vs 12.7% YoY (Q1FY25). The TCV for the quarter stood at \$3.8 Bn vs \$4.1 Bn, lower by 7.3% YoY and higher by 46.2% QoQ

Valuation & Recommendation

The revised guidance reflects an expectation of a steady environment rather than an improving one, considering Q1 and the visibility for Q2. Moreover, management expects H2FY26 to be weaker than H1FY26 due to normal seasonality. Therefore, we resume our coverage with a HOLD rating on the stock and assign a 24x P/E multiple to its FY27E earnings to arrive at a TP of Rs 1,680/share, implying an upside of 8% from the CMP.

Outlook.

• From a near-term perspective, global uncertainties will keep overall growth muted. However, the company’s core efficiencies, investments, and deal momentum across regions will support overall business over the next couple of quarters.

Key highlights

• In CC terms, North America witnessed a growth of 0.4% YoY while it grew sequentially by 2.9% QoQ as 20 out of 28 large deals in Q1 came from the region. Europe grew 12.3% YoY, more than three times the company average, driven by past investments and large deal wins. India and Rest of the World (ROW) remained flattish YoY.

• On the segmental front, BFSI grew by 5.6% YoY; Manufacturing grew by 12.2% YoY; Energy, Utilities, Resources & Services grew by 6.4% YoY; Communication grew by 4.0% YoY, while Hi-tech and Retail saw flattish growth of 1.7% and 0.4%, respectively. The company saw de-growth in Lifesciences and other verticals by 7.9% YoY and 15.3% YoY.

• During the quarter, Infosys secured $3.8 Bn in large deals, with 55% being net new. This included vendor consolidation deals totalling over $1 Bn, including one megadeal with a major global bank. Looking ahead, the company continues to benefit from clients consolidating vendors due to its strong delivery capabilities, AI innovation, and multi-service capabilities.

• The company is witnessing strong interest in AI, especially agents and large enterprise AI platforms, as well as in cloud, data and analytics, and enterprise application areas. However, some sectors like logistics, consumer products, manufacturing, and auto are facing constraints due to the economic environment.

• Infosys is strategically focused on building 300 AI agents across business operations and IT. These agents help clients with faster decisions, improved customer experience, and operational efficiency.

• The management stated that current large deals, including vendor consolidation and GCC deals, are not negatively impacting their balance sheet or cash flow, and they expect to maintain over 100% free cash flow conversion to net profit in future as well. Free cash flow stood at $884 Mn, which is 109% of net profit, marking the fifth consecutive quarter of free cash flow being over 100% of net profit.

• The revenue guidance for FY26 has been revised to 1% to 3% growth in constant currency terms, from the earlier guidance of 0% to 3%. This revision reflects the continued uncertain macroeconomic environment and prolonged decision-making by clients. However, the EBIT margin remains unchanged at 20-22%.

Key Risks to our Estimates and TP

• The demand environment is uncertain because of the potential threat of recession from the world’s largest economies.

• The rising subcontracting cost and cross-currency headwinds may impact operating margins negatively

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633