Buy Global Health Ltd For Target Rs. 1,707 By JM Financial Services

Healthy 2Q; developing units drive growth

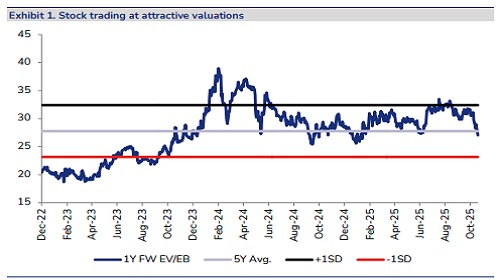

Medanta delivered a healthy performance in 2QFY26 with rev./EBITDA/PAT growing at 15%/1%/21% YoY, and EBITDA margins coming in at 21%. The quarter was led by stellar performance in developing units, growing +28% YoY (excl. Noida) and primarily volume led. Mature units reported +5% YoY growth (+7.9% adjusted for pharmacy shift) with margins of 23.5% (-120bps YoY). However, start-up losses at Noida (INR 197mn), and elevated employee costs (due to Ranchi expansion) impacted margins, which contracted 286bps YoY. On the expansion front, the newly commissioned 226-bed Noida facility became operational in Sep’25, Medanta also secured FSI for its Mumbai hospital, upgrading the plan from 500 beds to 750 beds, and acquired land in Guwahati for a greenfield unit. The company has outlined a cumulative capex of INR 41.2bn planned over the next 3–5 years. We remain positive on Medanta due to its high growth visibility, superior operational matrix, execution and operating leverage potential post Noida scale up. In our understanding, the company will deliver 17%/21%/24% CAGR in revenue/EBITDA/PAT over FY25-28. Thus, we value the company at 32x the Sept’27 EBITDA to arrive at a TP of INR 1707. Maintain Buy.

* Key metrics: The Occupied bed days increased by 7.7% YoY, representing an occupancy of ~64% on increased bed capacity. ARPOB grew by 5.5% YoY to INR 65,570 in 2QFY26. Volume growth remained robust, with In-patient count increased by 12.7% and Out-patient count increased by 14.9% YoY. International Patients Revenue increased by 48.5% YoY to INR 762mn in 2QFY26. OPD Pharmacy (Hospital & Retail) revenue increased by 23.9% YoY to INR 456mn in 2QFY26.

* Developing hospitals: The developing hospitals, excl. Noida, reported revenue at INR 3.5bn (+28% YoY), growth of 28.3% YoY. The recently commercialised Noida generated INR 39mn in 2QFY26. The growth was primarily volumme led. For the segment, volume grew 26% YoY and ARPOB grew 2%. While Patna saw fairly strong ARPOB growth on account of complex offerings, Lucknow ARPOB growth was moderate due to addition of lower ARPOB offerings which were not there earlier (eg Pediatrics). Occupancy was at 67% (70% excl. Noida) vs 60% in 2QFY25, reflecting strong growth. Margins excluding Noida came in at 34%, while Noida gave a INR 197mn EBITDA loss bringing the segmental EBITDA margin to 25.6%.

* Mature hospitals: The mature hospitals reported INR 7.2bn in sales (+5% YoY). Adjusting for Gurgaon unit’s OPD pharmacy business now being parked under a separate subsidiary, growth was 7.9% YoY. Growth was led by a mix of ARPOB and volumme. ARPOB grew 10%, while IP volumes grew by 5% with occupancy falling to 61% vs 67% in 2QFY25. Volumes were impacted on account of lower vector borne diseases this quarter vis-à-vis 2QFY25. The EBITDA margins saw a minor contraction, coming in at 23.5% vs 24.7% in 2QFY25. The contraction was due to employee costs, primarily in staffing the new 110 bed Ranchi unit and some addition in Guragon unit.

* Expansion traction: The 226 bed Noida unit became operational in September 2025, commercial within 3 years of announcement. Medanta also received additional FSI approval for the Bombay hospital, upgrading plans from 500 beds to 750 beds. Medanta has planned INR 15.3bn CAPEX approved for hospital (INR 8.5bn towards staff quarters). Further, the company acquired a 3.5 acre plot in Guwahati for the new greenfield unit for the cost of INR 600mn. Over the next 3-5 years, the company expects a cummulative INR 41.2bn in CAPEX; including INR 36.7bn for projects and is expected to be funded by combination of debt and internal accruals.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361