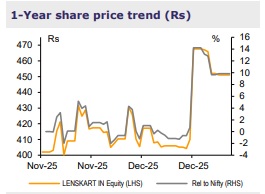

Buy Lenskart Solutions Ltd for the Target Rs.525 by Emkay Global Financial Services Ltd

Multifold India growth unlocking global TAM and adjacencies

We initiate coverage on Lenskart Solutions (Lenskart) with BUY and TP of Rs525, based on DCF implied multiple of 56x Dec-27E EBITDA. The Indian eyewear industry (worth USD9bn) has huge macro tailwinds—700bps GST cut, rising refraction error, and increasing adoptability as a fashion accessory— which should drive ~13% industry CAGR (Redseer). Lenskart is India’s leading eyewear retailer (market share: 5%) and aspires to become a global giant, helped by technology being at the core across all business functions. It is an agile firm, aided by automation/vertical integration at the back-end, remote optometry/virtual try-ons at the front-end, and use of geo-analytics/Vision AI for identifying new locations/merchandising. With scale-up, these moats are reflecting in the company’s superior value proposition (15-16% SSG), faster deliveries (the next day in 58 cities), accelerated network expansion (450 additions in FY26E), and leading share, even in international geographies such as Singapore/Dubai. Lenskart enjoys an attractive store-level payback of ~10M, on the back of high throughputs and low investment required at the store level; the metric stands favorably across leading peers in the discretionary space.

Strong medium-term prospects justify superlative valuations: With the recent turnaround in profitability, valuations appear to be optically high. However, we see scope for ~6x revenue scale-up in India over the next decade (~20% CAGR). With business model shift toward COCO stores and leverage over growth investments (~25% HO cost vs <10% HO cost for mature businesses), we see prospects of an average annual margin gain of ~150bps, driving EBITDA CAGR of ~30% over the next decade. In the near term (FY25-28E), we expect Lenskart to log a strong outperformance, with ~25%/50% revenue/EBITDA CAGR vs 12-26% for other leading retail players. In our view, the business has scalable optionalities, which enhance medium-term prospects.

Unit metrics better than the best: When compared with other leading names, Lenskart’s store-level payback of under a year clearly stands out. Lenskart’s vertically integrated supply chain ensures healthy gross margin (~64% in India) and significantly lower store-level capital requirement (~Rs5mn). Concurrently, the wide product range, strong value proposition, and quick deliveries (next day in 58 cities) ensure best-in-class revenue throughput. Within eyewear retail, Lenskart is a clear leader, with >3x scale of the next largest player—Titan Eyewear’s. Most players focus on 3 rd -party premium brands, which though are a small part of the Indian market (volume share: ~5%).

Our deep-dive into global peers suggests scalable optionalities: Our analysis of leading global peers suggests four scalable optionalities, in terms of 1) development of a managed care ecosystem (Vision Sure), 2) natural adjacencies like Audiology, 3) implementation of charges for comprehensive tests, and 4) ramp-up of AI-based smarteyewear in India. Lenskart has started pilots across some of these, and ramp-ups provide scope for significant earnings accretion over the medium term. A healthy balance sheet with ~Rs40bn net cash also supports such growth investments, in our view.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)