Buy Electronics Mart India Ltd For Target Rs. 156 By JM Financial Services

Weak profitability; sustaining SSSG and margin recovery will be key

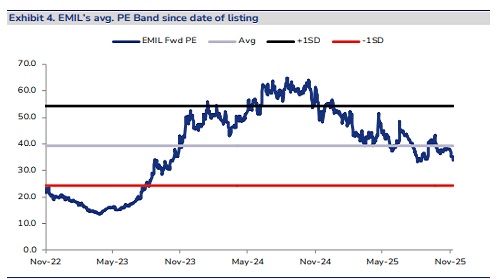

EMIL’s 2QFY26 performance was inline on sales but miss on profitability due to weaker margins. Same store sales growth (SSSG) of 11.4% was healthy, YoY margins were impacted by higher discounts (in first 20 days of September), higher store additions leading to increase in costs and an uptick in A&P spends due to early festive. In the near term, management is looking at strong 2H, led by healthy festive demand and benefit of GST rationalisation, which, along with better mix should aid margin improvement. Over the medium term, with share of mature stores (operating for >4 years) increasing, throughput/store and profitability of the business should also see gradual improvement. Factoring 2Q margin miss, we have cut our EPS estimates for FY26/27/28E by 23%/10%/8%. We reckon that the opportunity in organised electronic retail industry is large & EMIL has necessary ingredients to tap the same. Valuations at 29x/22x FY27/28E are not demanding and outlook is improving; hence, we maintain BUY with revised TP of INR 156 (27x Dec’27E, earlier INR 165). Sustaining SSSG/pace of recovery in margins will be key for rerating.

* Revenue performance inline with estimates; Healthy SSSG delivery led by uptick in south cluster: EMIL's 2QFY26 sales grew 19.1% YoY to INR 15.9bn, while EBITDA/reported PAT declined by 0.9% and 31% to INR 816mn and 161mn respectively. Sales growth was largely inline with our expectations benefiting from early festive season, healthy store additions (+21.5% YoY, net 8 stores added). Same store sales grew by 11.4% for the quarter. Sharp improvement in SSSG (much better vs. 2QFY25/1QFY26: -0.6%/-18%) was driven by visible uptick in south cluster. Hyderabad city and Telangana (UP country) reported robust sales growth of 15%/23.5% YoY with healthy SSSG of 12%/15% respectively (vs. decline of 15-18% in 1Q), while Andhra Pradesh sales grew 29.4% YoY with SSSG of 8%. North cluster - Delhi NCR continues to perform well with sales growth of 39% YoY and SSSG at 11%. Bill cuts were up 26% YoY led by festive demand while average ticket size was down c.5%. Going ahead with October seeing healthy traction led by festive season/GST rationalisation, management is hopeful of sustaining revenue momentum in 2HFY26E but unlikely to meet its 15% sales guidance (given the weakness seen in 1QFY26) and looking at low-double-digit sales growth for FY26E (largely similar to what we were factoring prior to 2Q).

* Higher discounting and aggressive store expansion led to scale deleverage resulting in lower profitability: Gross margin delivery was tad weaker and contracted c.50bps each on YoY and QoQ basis to 14.1% (JMFe: 14.4%). Despite better mix, the gross margins declined YoY on account of higher discounting (to drive sales) especially in the 20 days of September month prior to actual transition, while QoQ compression was due to lower salience of large appliances (sales impacted by GST transition). Staff costs grew 38.6% YoY due to higher store additions/incentives and other expenses grew 22.7% YoY owing to higher A&P spends/store additions. Weak gross margin progression along with scale deleverage resulted in EBITDA margin compression of 104bps to 5.1% (120-140 bps below our/street estimates). Overall preIND AS EBITDA margins were down c.100bps YoY to 2.9%. Going forward, management expects EBITDA margins to improve vs. 1H levels led by better mix (increase in salience of large appliance) and lower discounting (compared to 2Q). Reported PAT declined 31% YoY as company reported exceptional income of INR 152mn pertaining to full and final settlement of insurance claim on goods destroyed in fire (INR 75mn) and gain on sale of four IQ retail stores (INR 77mn).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361