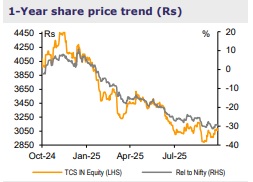

Add Tata Consultancy Services Ltd For Target Rs. 3,250 By Emkay Global Financial Services Ltd

Following Q2FY26 results, TCS hosted a call to elaborate on its AI data center investment plan, a part of its five pillar strategy, to accelerate its journey toward becoming the largest AI-led technology services enterprise. It outlined a multiyear, USD6-7bn investment plan to develop AI-focused data centers, to address the sharp rise in demand for high-density, energy-efficient infrastructure amid surging global AI workload. The company’s current plan is focused on passive DC; however, it is not averse to active DC, which would involve bespoke arrangements with anchor clients due to capex and technology refresh considerations. TCS aims to address India’s widening demand-supply gap in digital infra, where installed capacity is ~1.5GW (expected to expand to 10-12GW over 5-7Y). TCS plans to add 100-200MW of capacity over 18-24M, with an initial investment of USD600mn-1bn and revenue expected by FY27-28. It targets project-level IRRs in the mid-to-high teens. Leveraging Tata Group’s synergies in power, infrastructure, and networking, TCS aims to capture surging demand from AI companies and hyperscalers, building long-term annuity-based revenue streams within its digital infrastructure portfolio. We retain ADD on the stock with a TP of Rs3,250, at 21x Sep-27E EPS.

AI-optimized DC to bridge India’s capacity gap

TCS’s DC strategy focuses on AI-heavy, high-density infra, targeting India’s underpenetrated AI capacity (2-4% of the total now vs 10-15% globally). Facilities will be tier 3 plus and support 50–370kW per rack (average at 240kW per rack), employ liquid cooling systems (PUE 1.25-1.3; 70:30 mix of liquid and air) vs conventional aircooled systems (1.45-1.6), and host 100MW AI clusters optimized for GPU-led workloads. TCS will develop passive DC, with flexibility to transition into active DC via bespoke anchor-client partnerships. Construction will be in phases of 100-200MW, scaling to ~1GW cumulative capacity over 5-7Y, with each 150MW phase costing ~USD1bn and completing within 18M of land acquisition.

Cloud-AI integration to strengthen TCS’s infra positioning

The buildout complements TCS’s sovereign cloud business, for public and private sectors, and will help deepen relationships with hyperscalers and AI-native firms through codevelopment of workloads and infra. TCS views GPUs as the next compute backbone which would replace CPUs in AI DC. This integrated approach positions TCS as an endto-end digital infrastructure partner, combining cloud, compute, and connectivity rather than operating as a transactional colocation provider. TCS expects demand from AI players and hyperscalers, who seek local capacity and integration expertise, an area where TCS’s service depth and engineering credibility provide a key competitive edge.

Annuity-styled financial architecture

DC business is built on long-term annuity contracts with revenue model covering rental yields, margins on power supply, and interconnect revenue, with networking as a passthrough. TCS expects high EBITDAM and mid-to-high-teen IRRs, driven by power cost efficiency and renewable sourcing. While margins will be below core IT services, the management is confident of an industry-leading margin profile and return ratios at company level (financed by debt/equity); it retains its policy of returning 80-100% of FCF to shareholders.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354