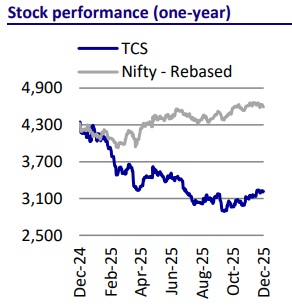

Buy Tata Consultancy Services Ltd for the Target Rs. 4,400 by Motilal Oswal Financial Services Ltd

TCS Investor Day 2025: A brave new world?

We attended the TCS Analyst Day, where the company outlined its aspiration to become the world’s largest AI-led technology services company through five pillars: 1) internal transformation with a focus on driving an AI-first operating model; 2) redefining services, including a new AI services transformation unit and a human + AI delivery model; 3) a future-ready talent model centered on AI fluency; 4) making AI real for clients through industry- and domain-specific solutions; and 5) an AI ecosystem strategy spanning partnerships, M&A, and new venture creation.

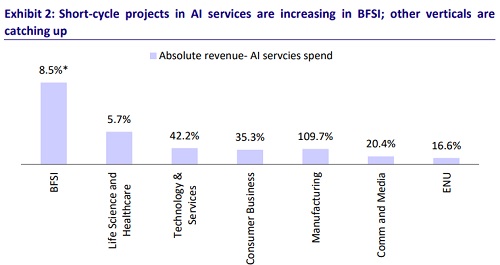

For the first time, TCS disclosed AI services revenue of ~USD1.5b on an annualized basis, growing ~16% QoQ in the most recent quarter, and highlighted its intent to play across the entire AI stack. We were encouraged by TCS’s changed stance on M&A, following its recent acquisitions (Listengage, Coastal), but were slightly disappointed when it reaffirmed its (slightly lofty) 26-28% EBIT margin ambition, which we believe could leave money on the table at this stage of the cycle. That said, we saw evidence of AI services demand taking shape, consistent with our IT services sector upgrade note (Time to buy the next cycle dated 24th Nov’25), and believe both TCS and Indian IT services can pivot in time to be on the right side of the GenAI wave. We value TCS at 26x FY28E EPS and reiterate our BUY rating with a TP of INR4,400, implying a 37% upside potential.

Five pillars of TCS’s AI strategy

* 1. Internal transformation: TCS highlighted AI-led internal transformation as a priority, led by large-scale hackathons involving ~281k participants, including CXOs and leaders across 100+ P&Ls. These initiatives combine ideation with AI over four weeks, followed by build phases using AI, with participation skewed toward Gen Z (38%) and non-technology roles (29%).

* 2. Redefining services through a ‘human + AI’ model: TCS is re-tooling services across business (BPO, industry value chains) and applications (operations, modernization) using a human + AI framework. Management likened this to an ADAS-style maturity model (Levels 1-5), spanning human-led to autonomous decision-making across services such as SAP and BPO.

* Level 3 was highlighted as an inflection point, where customer context, including code base and institutional knowledge, begins to meaningfully flow into AI systems, enabling customers to move progressively up the maturity curve.

* 3. Future-ready talent model: TCS outlined large-scale reskilling efforts, with ~580k employees AI-aware and ~180k employees with higher-order AI skills (~30% of total workforce, up from ~80k last year). The next layer of capability focuses on AI-native fresh graduates, with AI positioned as a day-to-day teammate. In parallel, TCS is doubling down on advisory and consulting talent as part of its future-ready hiring strategy.

* 4. Making AI real for clients: Management described a clear evolution in enterprise AI adoption: 2023 as a year of experimentation, 2024 as early scaling, and 2025 as a step change, aided by advances in reasoning models. Enterprise AI journeys were framed around two phases—getting AI-ready (addressing legacy infrastructure, core systems, and data foundations) and leading with AI.

* GenAI is seen as a strong tailwind for technology modernization, particularly in areas that were previously capital-intensive, such as large-scale code modernization.

* 5. AI ecosystem strategy: TCS emphasized an ecosystem-led approach, spanning AI-native partnerships (Cursor, Kore.ai, Vianai, Windsurf), strategic alliances with foundational model providers (OpenAI, Mistral AI), and infrastructure partners such as NVIDIA. The company also highlighted its work with Google Gemini Enterprise, including early efforts around agent-to-agent protocols.

AI ecosystem strategy: Build, partner, acquire

* TCS outlined its build-partner-acquire approach across the infrastructure-tointelligence AI stack, with a clear emphasis on ecosystem-led scaling. Management highlighted that AI data center capacity remains constrained, with industry-wide AI DC demand estimated at ~10-12GW by 2030, and emphasized the need for customer-specific AI DC configurations across hyperscalers, AInative companies, and public and private sector enterprises.

* For AI-native companies, TCS highlighted demand for high-performance infrastructure with lower total cost of ownership, noting that while current demand is skewed toward inferencing, TCS is also positioning for training workloads. This is where TCS’s AI data center practice is currently focused. On partnerships, management emphasized 360-degree collaboration with hyperscalers and AI innovators across the stack.

* On inorganic strategy, TCS reiterated that M&A is now a key lever, with a core focus on capability-led acquisitions, citing Listengage and Coastal as recent examples. Management characterized this as an important shift in approach, positioning M&A as a more active driver of AI capability build-out going forward.

More details on TCS's HyperVault data center venture

* TCS outlined a focused AI-first data center strategy centered on Tier-3+ facilities with PUE below 1.2, among the best in the industry. These data centers are built to NVIDIA specifications, enabling rapid deployment for hyperscaler clients (not necessarily sovereign entities) and supporting high AI compute intensity, with 240KW rack density.

* The commercial model is annuity-like, based on 15-year contracts combining lease rentals, power charges, and incremental revenues from cooling and networking. On the hardware side, TCS works with eight of the top 10 global semiconductor companies, positioning its data center offering as a scalable, long-duration infrastructure platform aligned with hyperscaler AI demand.

Valuation and View

* We have maintained our estimates for FY26/27/28. We expect TCS to deliver 4.5%/7.2% YoY CC growth in FY27/FY28, supported by a demand recovery from 2HFY27 and further acceleration in FY28. EBIT margins are expected at 24.8%/25.0% in FY27/FY28. Over FY26-28, this translates into a ~5.7% CAGR in USD revenue and ~9.0% CAGR in INR EPS.

* With its market leadership position and best-in-class discipline execution, the company has been able to sustain its industry-leading margin and demonstrate superior return ratios vs. peers (Exhibit 3).

* Valuations remain undemanding: At current valuations, TCS trades at a ~9% discount to its 10-year average P/E and at a ~19% discount to its 5-year average. As AI adoption transitions from pilot programs to scaled, revenue-generating deployments, we see an improving growth-visibility backdrop. We value TCS at 26x FY28E EPS, arriving at a TP of INR4,400, which implies a 37% upside from current levels. We reiterate our BUY rating, with risk–reward skewed favorably into the next cycle.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412