Hold Bharat Heavy Electricals Ltd For Target Rs.250 by Prabhudas Liladhar Capital Ltd

Gradual execution ramp-up of new orders in sight

We interacted with the management of Bharat Heavy Electricals Ltd (BHEL) to discuss the company’s execution trajectory, tendering pipeline, and overall business outlook. BHEL expects to sustain strong order intake momentum, supported by a robust pipeline across thermal, HVDC, railways and renewable energy segments. Further, it anticipates delivering ~9GW in FY26, broadly flat YoY, and expects the sizable orders secured over the past 2 years (~Rs1.7trn), with a state regulatory approval window of 1.5–2 years, to transition to execution from FY27, indicating medium-term execution ramp-up. The company is undertaking capacity enhancement and debottlenecking initiatives, including increasing thermal manufacturing capacity from 10GW to 12GW per annum and scaling up electrical equipment capabilities. We believe these initiatives, combined with higher execution, should provide operating leverage and support margin expansion. Moreover, improving receivable quality, better advances from NTPC, and systematic closure of legacy projects are expected to improve BHEL’s working capital position. The stock is currently trading at P/E of 27.7x/20.8x on FY27/28E earnings. We maintain our ‘HOLD’ rating valuing the stock at PE of 22x Sep’27E (same as earlier) with TP of Rs250 (same as earlier).

We believe execution is showing some sign of revival, despite not keeping pace with the strong order wins in recent years. Further, in the long run,

1) the large thermal power order pipeline,

2) diversification into railways, defense, green hydrogen, coal gasification, etc., and

3) growing spares & services business could augur well for BHEL. However, execution pace and balance sheet health will remain key monitorables.

Key takeaways:

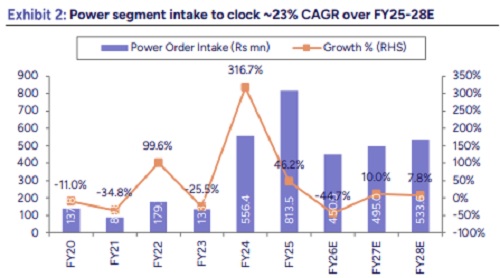

Power segment: ~9.0GW lined up to be executed in FY26

During FY25, BHEL delivered ~8.9GW of capacity, including ~1.2GW of renewable energy. For FY26, the company has outlined an additional delivery plan of ~9GW, supported by gradual execution ramp-up, albeit slower than previously anticipated.

A strong order pipeline improves visibility:

The favorable policy environment in FY25 led to exceptionally strong tendering for coal-based power projects by central and state utilities, enabling BHEL to secure ~14.6GW of thermal orders. While the company continues to see healthy momentum, the mapped tendering pipeline for FY27 is strong at ~8.0GW, though not at the extraordinary levels witnessed in FY25.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271