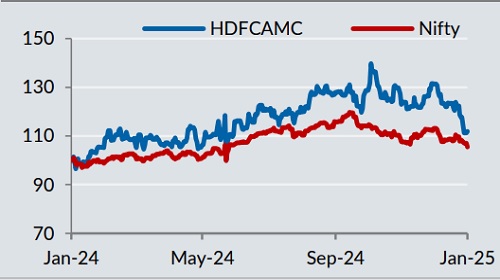

Add HDFC Asset Management Company Ltd For Target Rs. 4485 By Yes Securities Ltd

Our view – Operating profit margin rises 244 bps on sequential basis

Revenue Yield - Revenue yield inched up on sequential basis:

Overall calculated revenue yield has inched up 1 bp QoQ to 47 bps in 3Q, despite share of equity in total AUM declining 80 bps QoQ. While there was no incremental change to distributor commission payout, some of the impact of changes in 2Q spilled over into 3Q.

Operating Expenses – While expenses were under control for the quarter, management guided for reasonable growth for the same:

The other operating expense for the quarter Rs 741mn, down by -14.4% QoQ but up by 7.2% YoY. Expenses for the quarter were lower due to lack of NFOs and lower CSR expenses. Management guides for overall cost to rise at 12-15%.

We maintain ‘ADD’ rating on HDFCAMC with a revised price target of Rs 4485:

We value HDFCAMC at 39x FY26 P/E, with the implied P/B being 11.3x.

Other Highlights (See “Our View” above for elaboration and insight)

* Revenue: Revenue from operations at Rs 9,344mn was up 5.3%/39.2% QoQ/YoY, leading/lagging the growth in QAAUM of 3.8%/42.8% QoQ/YoY

* Share of Equity in AUM: Share of Equity in AUM (including Hybrid funds) at 64.9% was down -80 bps QoQ but up 430 bps YoY

* Share of B-30 in AUM: Share of B-30 in AUM at 19.3% was down -20 bps QoQ but up 50 bps YoY

* Channel mix: Share of Banks, MFDs, NDs and Direct channel was 13.1%, 34.4%, 25.4% and 27.1%, respectively in Equity QAAUM

* Operating profit margin: Operating profit margin for the quarter, at 81.8%, was up 244 bps QoQ and 562 bps YoY

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632