Buy Lumax Auto Technologies Ltd For the Target Rs.851 by Choice Broking Ltd

LMAX Revenue & EBITDA Slightly Above Estimates, PAT Misses Expectations

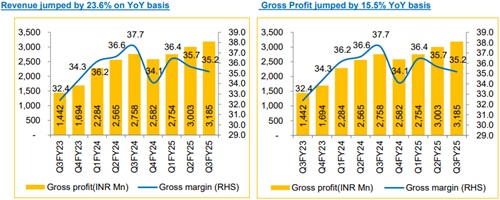

* Revenue for Q3FY25 was at INR 9,056Mn up 23.6% YoY and 7.5% QoQ (vs Consensus est. at INR 8,814Mn).

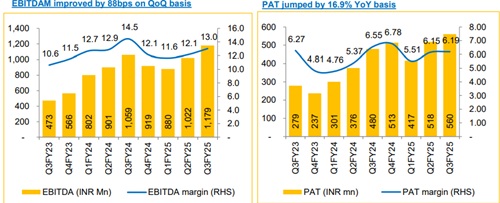

* EBITDA for Q3FY25 was at INR 1,179Mn, up 11.3% YoY and 15.3% QoQ (vs Consensus est. at INR 1,142Mn). EBITDA margin was down 144bps YoY and up 88bps QoQ to 13.0% (vs Consensus est. at 13.0%).

* PAT for Q3FY25 was at INR 448Mn, up 23.0% YoY and 4.6% QoQ (vs Consensus est. at INR 478Mn).

Margin Outlook:

Stabilization at 13.2% Amid Business Mix Shift: LMAX has demonstrated strong margin resilience, with consolidated EBITDA margins reaching 13% in Q3FY25 and a target of 15% for FY26. Standalone margins hit a 14-quarter high of 10%, supported by cost pass-through mechanisms with OEMs, higher-margin contributions from joint ventures, and a recovery in the aftermarket segment. The Green Energy Solutions segment further enhances profitability with 17-19% margins. However, we anticipate margins to stabilize at 13.2% levels due to the increasing revenue contribution from the lower-margin Lumax Ancillary business and the rampup of new product lines

Strong Growth Trajectory Driven by Lumax’s JVs:

LMAX is positioned for strong growth, with IA India reporting a 20% YoY revenue increase to INR 800 crore in 9MFY25, supported by a INR 500 crore order book and a 15%+ growth outlook driven by new EV launches and its strong partnership with Mahindra & Mahindra. The implementation of OBD2 norms is expected to add INR 60-70 crore in revenue for Lumax FAE through increased demand for secondary oxygen sensors, raising capacity utilization from 10% to 45% and increasing content per vehicle by INR 800. The mechatronics segment grew 75% and is expected to double next year, backed by strong JV contributions and a INR 3200Mn order book, with a potential INR 100 crore addition.

View and Valuation:

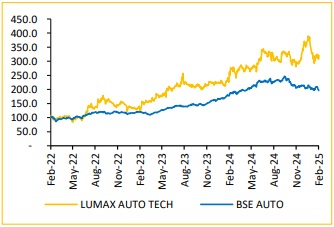

We have upgraded LATL to ‘BUY’ with a revised target price of INR 851, valuing it at (20x FY27E EPS), after increasing our FY26/27 EPS estimates by 25.2%/34.9%. Growth will be driven by the scale-up of IAC India and GreenFuel Mobility acquisitions, along with ramp-up in JVs. Strong business ties with leading OEMs such as M&M, Maruti Suzuki, Tata Motors, Bajaj Auto, and HMSI position LATL to outperform industry growth over FY24-27E.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131