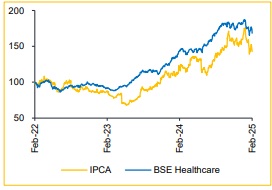

Buy IPCA Laboratories Ltd For the Target Rs.1,492 by Choice Broking Ltd

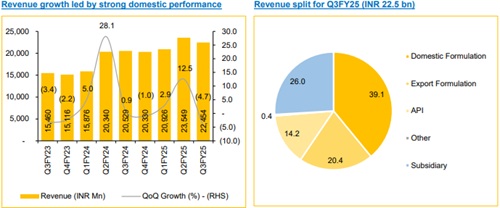

Revenue in line while EBITDA and PAT beat the consensus

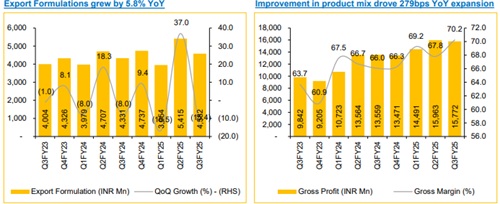

* Revenue came at INR 22.5 Bn (vs. CEBPL est. of INR 21.0 Bn), up 9.4% YoY and down 4.7% QoQ.

* EBITDA came at INR 4.6 Bn ( vs. CEBPL est. of INR 3.9 Bn), up 39.8% YoY and up 4.9% QoQ. EBITDA margin came at 20.6% (vs. CEBPL est. of 18.5%), improved by 448bps YoY and 188bps QoQ.

* PAT came at INR 2.5 Bn (vs. CEBPL est. of INR 2.0 Bn), up 37.9% YoY and up 8.1% QoQ, with a PAT margin of 11.1% (vs 8.8% in Q3FY24)

Expansion in the US Market via Unichem to support the growth

Unichem’s integration with IPCA strengthens US expansion, making it a key growth pillar for international business with improving profitability. Unichem’s EBITDA margin improved from 5%-12%, driven by operational efficiencies and cost synergies with IPCA. Capacity utilization at 50-60% is expected to reach full capacity in 4-5 years, improving fixed cost absorption. Unichem has shipped around 4 products and has 7-8 more in the pipeline. We expect that the backward integration with IPCA’s API business will enhance Cost Competitiveness but Competition in the US generics space is high, making it difficult for Unichem to gain meaningful market share

India Business will sustain 1.5x industry growth

IPCA’s India business (~40% of the total revenue) grew 13% YoY, outperforming the IPM growth. Growth in acute (8.7% vs 6% market growth) and chronic (17.1% vs 9.7% market growth) segments drove strong performance, with six brands among the top 300. Pain management (contributes 52% of revenue), grew 14% YoY. The company's strong presence in pain management, anti-infectives, and respiratory segments contributes to this growth. We anticipate that the expansion into new high margin divisions (cardiology, dermatology, and urology), operational efficiencies, better product mix, will sustain 1.5x industry growth and maintain its strong market position.

View and Valuation:

We anticipate the company’s growth will be driven by strong domestic performance, increasing market share, and improving margins. Expansion in the US market via Unichem, API growth, and backward integration will further strengthen margins. But slower-than-expected US business expansion, pricing pressure on the generic portfolio, and volatility in the API cost could impact the performance. We revise our rating to HOLD (from SELL) with a revised target price of INR 1,478 valuing on 27x (unchanged) of FY27E EPS, reflecting a CAGR of 14.2%/20.3%/28.5% for Revenue/EBITDA/PAT over FY24-27

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131