Buy Anant Raj Ltd For Target Rs. 800 By Emkay Global Financial Services Ltd

Riding India’s data center drive

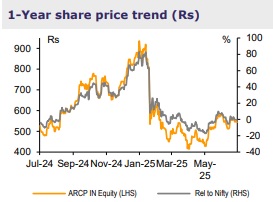

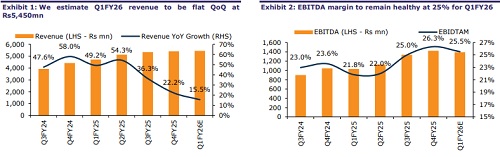

We reiterate BUY on Anant Raj with an unchanged TP of Rs800. The company has announced the commissioning of its second Data Center (DC) facility at Panchkula, and is also expanding its existing capacity at Manesar, Haryana. We expect operations to start over the next two months, with annualized occupancy at ~70%, which would improve ahead. This would take total operational DC capacity to 28MW (including 0.5MW of cloud capacity), from 6MW currently. For the next two years, we factor in capex of Rs19-20bn toward DC capacity. To achieve 63MW of DC capacity in the next two years, capex will be met through ~Rs20bn cash flows (to be generated from the real estate business). We expect DC business revenue to sharply increase to Rs7bn in FY27E, from Rs455mn in FY25. Overall, we expect ~20% IRR for the DC business till FY45E. Accordingly, despite the delayed fund raising, expansion via internal accruals would keep net debt low at Rs3bn by FY27E (currently Rs1.2bn), in our view.

Announces commissioning of 22MW of DC capacity

The company’s DC operational capacity is at 6MW (including 0.5MW of cloud capacity). Its 22MW addition (Manesar: 15MW and Panchkula: 7MW) witnessed delays, caused by pollution control regulations in the NCR. The company has now announced the commissioning of both its capacities which would take total capacity to 28MW. Ahead, we expect it to achieve 63MW/107MW capacity by H2FY27/FY28E. We believe that the company’s overall target of 307MW DC capacity would be achieved by FY33-34E (vs FY31E previously), contingent upon fund raise. Thus, the increase of cloud mix to 25% (company target) will be gradual and materialize by FY34.

Healthy pre-sales and cash flows expected from the real estate business

In the real estate business, with requisite approvals in place, the company plans to launch 2.8msf/3-3.5msf in FY26/27. It is likely to add more land in this micro-market in 2-3Y. Additionally, we believe it would sign a JDA for 5-7msf in the NCR; this would further enhance growth visibility. Overall, we expect FY26E/27E pre-sales and collections at Rs30/36bn and Rs15/23bn, respectively. Accordingly, it would generate cumulative net cash flow of ~Rs20bn over the next two years which would fund DC capex.

Valuation; reiterate BUY

For the real estate business, we have maintained NAV premium at 75% on the existing portfolio (ex-Delhi land), which gives a value contribution of Rs427/share (includes contribution from rental assets). In the DC business, we build in revenue of Rs2.3mn/Rs7bn for FY26E/27E, respectively, with EBITDA margin at 80%. Our DC equity value stands at ~Rs128bn, ie Rs374/share. We maintain BUY on the stock.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354