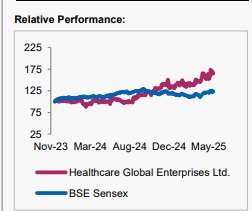

Buy Healthcare Global Enterprises Ltd For Target Rs. 620 By Axis Securities Ltd

Est. Vs. Actual for Q4FY25: Revenue – INLINE; EBITDA Margin – INLINE; PAT – MISS

Changes in Estimates post Q4FY25

FY26E/FY27E: Revenue: -1.5%/-0.1%; EBITDA: -2.5%/-2.9%; PAT: -2.4%/-2.2%

Recommendation Rationale

In-line revenue performance: HCG reported revenue in line with expectations, registering an 18.3% growth, driven by a 3.5% YoY increase in ARPOB and ~16.7% growth in occupied days. ARPOB stood at Rs 44,236, up 3.5% YoY but flat QoQ, reflecting healthy growth. Occupancy improved to 67%, marking a 310 bps YoY increase.

PAT lower than expected: The company reported EBITDA margins of 18.1%, down 50 bps YoY but up 220 bps QoQ. Reported EBITDA of 106 Cr grew by 15% YOY and 20% QoQ. Adjusted EBITDA margins stood at 18.7%. The company’s PAT increased to Rs 7 Cr, which was lower than expected due to higher tax expenses

Sector Outlook: Positive

Company Outlook & Guidance: The cancer industry is growing at a CAGR of 17%, and HCG is outpacing this growth. The company plans to add 900 incremental beds over the next 4 to 5 years to capitalise on emerging opportunities. Several margin improvement levers are in place, as most emerging centres have matured with margins exceeding 20%. HCG has strengthened its infrastructure and expanded its network through acquisitions and new investments, positioning itself for long-term growth and enhanced patient outcomes. The recent entry of new investors such as KKR, replacing CVC, signals confidence in the company’s strategic vision and growth prospects.

Current Valuation: EV/EBITDA 15x for FY26E

Current TP: Rs 620/share ( Earlier TP: Rs 575/share)

Recommendation: We maintain our BUY recommendation on the stock.

Financial Performance

HCG reported revenue in line with expectations, registering an 18.3% growth, driven by a 3.5% YoY increase in ARPOB and ~16.7% growth in occupied days. ARPOB stood at Rs 44,236, up 3.5% YoY, reflecting healthy growth. It, however, stayed flat on a QoQ basis. Occupancy improved to 67%, marking a 310 bps YoY increase. The company reported EBITDA margins of 18.1%, down 50 bps YoY but up 220 bps QoQ. It reported EBITDA of 106 Cr, which grew by 15% YOY and 20% QoQ. Adjusted EBITDA margins stood at 18.7%. The reported PAT rose to Rs 7 Cr, lower than expectations due to higher tax expenses.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633