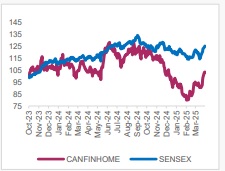

Buy Can Fin Homes Ltd for the Target Rs. 830 by Axis Securities Ltd

Growth Momentum to Improve from FY26 Onwards!

Est. Vs. Actual for Q4FY25: NII – INLINE; PPOP – INLINE; PAT – BEAT

Changes in Estimates post Q4FY25

FY26E/FY27E (%): NII -2.9/-4.4; PPOP -2.0/-4.6; PAT -1.3/-4.0

Recommendation Rationale

* Key states showing signs of recovery; Growth pick-up in sight: CANF’s disbursements witnessed improvement on a sequential basis, mainly driven by an improvement in the issuance of e-Khatas in the core geography of Karnataka (KA) and also signs of revival in Telangana (TL). Moreover, the West and North India zone, along with Tamil Nadu (TN), have also contributed to healthy disbursement growth during Q4FY25. Thus, (a) improving visibility on growth in core states, (b) branch expansion, and (c) increasing contribution to business from existing and new branches should collectively drive ~20% disbursement growth in FY26, thereby translating into a 13-15% AUM growth. Over the medium term, CANF will continue shifting its focus towards the SENP segment, improving its mix to 35% from ~30%. The portfolio mix is also expected to shift from housing loans (incl. housing CRE), with its share declining to ~80% from ~86%. Similarly, the newer focus markets will be North, West and TN, with the company adding a bulk of its new branches (of the 15 branches planned in FY26) in these markets. The company also plans to undergo a tech transformation, and the management remains certain of no adverse impact on growth. We expect CANF’s portfolio growth to be ~14% CAGR over FY25-27E.

* Confident of maintaining NIMs at 3.5+%: CANF’s margins should find support from the shift towards non-housing loans (LAP) and focus on SENP customers. Moreover, of the bank borrowings (55% mix in borrowings), the management stated that ~80% are linked to reporate and will reprice downwards, aiding CoF by 5-7bps. Furthermore, the rate of CPs has also seen a meaningful decline which should further support CoF for the company. Cumulatively, incremental borrowing from CPs and downward repricing of bank borrowings are expected to reduce CoF by ~10bps. The company does not intend to pass on the benefit of rate cuts to its customers until it reflects in the company’s CoF. The management has indicated that CANF’s peers (HFCs, private banks), excluding PSU Banks, have not passed on the benefit of the 50bps repo rate cut. Thus, spreads and NIMs are expected to be maintained at 2.5+/3.5+% over the medium term. We believe CANF remains well-positioned to deliver steady NIMS of 3.6% over FY26-27E.

Sector Outlook: Positive

Company Guidance: With challenges in the core states of KA and TL gradually receding, the visibility on growth has improved, and the management is confident that disbursement growth will pick up substantially in FY26. CANF’s focus on the higher-yielding SENP segment, a gradual portfolio shift towards non-housing loans and an optimal borrowing mix enabling CoF management should help the company support its NIMs. Opex growth is expected to remain under control, with the C-I Ratio remaining steady in FY26 before inching up in FY27 to reflect the investment towards tech transformation. The management does not expect any asset quality headwinds with the restructured book behaving well, thereby keeping credit costs in check. Thus, CANF remains well placed to deliver RoA/RoE of 2.1-2.2%/16-17% over FY26-27E. With the management showing confidence on growth resuming, we believe delivery and sustenance of growth trends remain key re-rating levers.

Current Valuation: 1.6x FY27E BV; Earlier Valuation: 1.7x Sep’26E BV

Current TP: Rs 830/share; Earlier TP: Rs 840/share

Recommendation: We maintain our BUY recommendation on the stock

Financial Performance:

* Operational Performance: CANF’s disbursements growth improved sequentially, growing at 31% QoQ, though YoY growth was modest at 6%. AUM growth was in-line with our expectations at 9/3% YoY/QoQ. AUM growth was mainly driven by the SENP segment which grew by 15/5% YoY/QoQ (in-line with management guidance of growing the SENP segment to support yields/NIMs), while the salaried segment grew by 7/2% YoY/QoQ. The share of Salaried to SENP borrowers stood at 70:30, flat QoQ.

* Financial Performance: NII grew by 6/1% YoY/QoQ. NIMs (reported) were higher QoQ at 3.82% vs 3.73% QoQ. Yields declined by 8bps QoQ, while CoF inched-up by 5bps QoQ. Spreads contracted by 13bps QoQ and stood at 2.6%. Non-interest income grew by 6/188% YoY/QoQ. Opex growth was higher sequentially, growing at 19% QoQ and degrew by 2% YoY. C-I Ratio stood at 19.4% vs 20.9/16.9% YoY/QoQ. PPOP growth was muted at 8/1% YoY/QoQ. Provisions came in marginally lower than expected at Rs 15 Cr (credit costs stood at ~16bps vs 2/24 bps YoY/QoQ). PAT grew by 12/10% YoY/QoQ.

* Asset Quality: GNPA/NNPA improved slightly to 0.87/0.46% vs 0.92/0.49% QoQ.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633