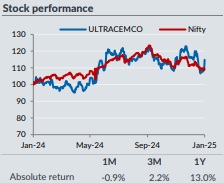

Sell UltraTech Cement Ltd For Target Rs. 9,039 By Yes Securities Ltd

Weak demand and pricing, increase in debt structure, and near-term underperformance of acquired company leads SELL rating

Result Synopsis

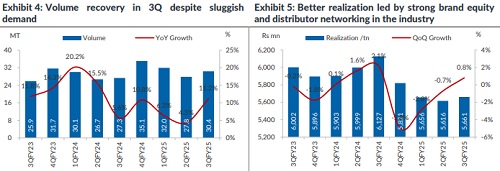

In 3QFY25, UTECM’s numbers are better than our estimates driven by better-thanexpected realization and improved cost efficiency level. Our assumption on revenue, volumes and opex per tonne were in-line with reported number, while we missed EBITDA and Adj. PAT in absolute number mainly due to better-than-expected realization (+0.8% QoQ). As an industry leader the volumes could have much better (11.1% YoY and 9.1% QoQ). However, the numbers are relatively good amidst sluggish demand and weak pricing environment supported by strong cost reduction. EBITDA/tn has improved to Rs951 and increase of 31.1% QoQ, but down by 20.2% YoY due to high base impact. We believe, further improvement in EBITDA/tn in the range of Rs1000-1130 in 4Q FY25 supported mainly by cost reduction. However, the full year EBITDA/tn would remain lower in the range of Rs950-980.

We expect volume addition from its recently acquired India Cement (ICL) from 4Q FY25 and Kesoram Industry (KIL) from FY26E onwards. At present ICL/ KCL capacity utilization stands at 57%/ 70% respectively and the same has been factored in our numbers respectively. It would take few more quarter ICL to reach UTCEM’s efficiency level whereas not much head room left for KIL with respect to capacity utilization due to higher competition in southern region. However, the ongoing cost saving capex program in ICL/ KIL would add profitability in next 12-15 months’ time frame. At current scenario we are quite cautious on demand and realization front, until unless we observe any strong demand uptick or stable to marginal increase in cement prices, our view on the stock remains negative with SELL rating. We are factoring ICL and KCL’s volume from 4Q FY25/ FY26E onwards respectively to arrive Revenue/ EBITDA/ Adj. PAT CAGR of 10.9%/ 13.5%/ 13.1% over FY24-FY27E. Our valuation is purely based on 1). volume addition from new units as well acquired units, 2). Improvement in capacity utilization, 3). Flattish to marginal increase in realization, 4). Cost efficiency level, and 5) High debt level. At present the stock is trading at 22x Sep’26 EV/EBITDA (25% premium to its historical avg. EV/EBITDA multiple, and 50-60% premium to peer avg. EV/EBITDA) looks over valued, we believe, sluggish demand, weak pricing, underperformance of ICL and increased debt structure are the key reason to squeeze profitability to some extent in near-term. Therefore, we value the stock at 16x Sep’26 EV/EBITDA with revised target price of Rs9039 (Earlier Rs8272) and maintain SELL rating.

Result Highlights

* Revenue Rs172bn (+2.7% YoY/ +10% QoQ), is ~1.6% above our est. of Rs169bn. EBITDA Rs29bn (-11.3% YoY/ +43% QoQ), is ~11.3% above our est. of Rs26bn. Adj. PAT Rs15bn (-17.3% YoY/ +79% QoQ), is ~28% below our est. of Rs12bn.

* Volumes 30.4mt (+11.2% YoY/ +9.1% QoQ), is in-line with our estimate. While Realization Rs5661/tn (-7.6% YoY/ +0.8% QoQ), is ~1.4% above our est. Rs5584.

* EBITDA/tn Rs951 (-20.2% YoY/ +31.1% QoQ), is ~11.1% above our est. of Rs855 - Mainly due to better-than-expected realization .

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632