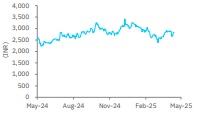

Reduce CEAT Ltd For Target Rs. 3,153 By Elara Capital

Price hike and soft RM cost aid margins

CEAT (CEAT IN) revenue grew 14.6% YoY and 3.7% QoQ to INR 34.1bn in Q4, led by healthy volume growth of 11% YoY and 3.5% QoQ. EBITDA margin grew 120bp QoQ, driven by contraction of raw material (RM) cost by 60bp QoQ and price hikes implemented across twowheeler tyres. Management expects RM cost to remain flat QoQ, with likely reduction from Q2FY26. Further, with the CAMSO acquisition in H1FY26, the company expects to improve its export share to 26% by FY27 (19% in FY25) . We retain our cautious stance on the tyre sector, given a mere 9% EPS CAGR during FY24-27E, and expectations of structurally high natural rubber (NR) prices during FY26-27. We are yet to factor in the CAMSO acquisition. We reiterate Reduce with a higher TP of INR 3,153 on 14x June FY27E P/E as we roll forward.

Healthy volume performance high single-digit growth expected for FY26: Overall volume grew by 11% YoY, led by double-digit growth in OEM of ~22-25%, followed by low single-digit growth for replacement. On the OEM side, while 2W posted healthy growth, the MHCV segment is likely to post robust performance with the commissioning of new truck bus radial (TBR) plant at Chennai. On the replacement side, while MHCV (TBR) posted robust double-digit growth, 2W witnessed high single-digit growth, led by robust demand traction from rural areas. On the other hand, exports reported a muted performance, particularly in LATM. CEAT expects exports growth in FY26 of ~10-11%, driven by recovery in demand for the EU and Latin America. Exports are set to inch up to 26% of revenue in FY26E from 19% currently post the CAMSO acquisition in H1FY26. Operations in Sri Lanka will be subjected to US tariffs to the extent of 4% for track products and 44% on tyre exports. Currently, 28-30% of revenue for Sri Lanka operations of CAMSO come from the US market. CEAT is in talks with Sri Lanka’s government for seeking relief from US tariff.

Cost of RM basket flat QoQ in Q4; outlook flat for Q1FY26: Overall RM cost remains flat QoQ, in line with earlier guidance. The company expects RM cost to remain flat in Q1FY26, with reduction expected from Q2. CEAT has iterated its strategy to systematically retain current price levels despite input cost easing, which should bode well for margin.

Reiterate Reduce with a higher TP of INR 3,153: While there is likely to be margin relief in the upcoming quarters, especially from Q2FY26, due to lower crude prices recently, we believe NR prices will be on a structural uptrend, given the demand-supply dynamics due to the long gestation period of rubber plantations. We believe the tyre sector and CEAT will have reported peak margin in FY24 (13.9% for CEAT). We expect EBITDA margin of 13.2% in FY26E and FY27E. However, despite the likely recovery in EBITDA margin during FY26-27, we expect an EBITDA CAGR of a mere 8% and a PAT CAGR of 9% during FY24-27E. We reiterate Reduce with a higher TP of INR 3,153 from INR 2,483 based on 14.0x (from 12.0x) June 2027E P/E. We raise our EPS estimates by 9.4% and 8.1% for FY26 and FY27, respectively. We introduce FY28 estimates.

Please refer disclaimer at Report

SEBI Registration number is INH000000933