Buy Ceat Ltd for the Target Rs. 4,105 by Motilal Oswal Financial Services Ltd

* OE demand was steady in 2Q, though replacement demand was weak, especially post Aug 15th, in anticipation of GST rate cuts as retailers refused to take stock at earlier rates. For exports, some greenshoots appeared in Europe. However, demand in US remained weak given tariff impact.

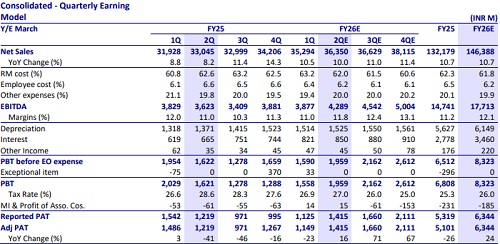

* We expect CEAT to post 10% revenue growth in 2Q.

* Input cost is expected to decline 1-2% QoQ.

* EBITDA margin is expected to improve 80bp YoY to 11.8%.

* Overall, PAT is likely to grow 16% YoY.

* CEAT would integrate Camso in 2Q. We have not considered Camso in our numbers as we await further clarity.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412