Buy CEAT Ltd for the Target Rs. 4,523 by Motilal Oswal Financial Services Ltd

Margin beat led by lower input costs

Camso integration benefits to be back-ended

* CEAT 2QFY26 earnings at INR1.85b came in above our estimate of INR1.4b, aided by higher-than-expected margin of 13.3% (est. 11.8%). The GST rate cut is expected to boost tyre demand in the replacement and OEM segments. Further, benign input costs would help maintain margins for the core business.

* While the recent Camso acquisition is expected to take time to be earnings accretive, we remain positive on the long-term benefits that this acquisition can deliver for the group. Hence, we reiterate our BUY rating on the stock with a TP of INR4,523 (based on ~20x Sep’27E EPS).

Beat on earnings due to softer commodity costs

* 2Q earnings at INR1.85b came in above our estimate of INR1.4b due to higher-than-expected margin.

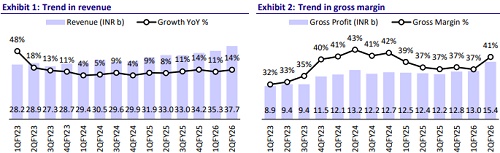

* Net sales grew 14.2% YoY to INR37.7b (+3.8% vs. est.) in 2Q, aided by healthy YoY volume growth, mainly for the OEM and export segments.

* OEM volume growth was driven by robust performance across all key segments, with festive demand restocking acting as strong tailwind. Realizations improved marginally on YoY and QoQ basis.

* 1H segment mix: Truck/bus 29%, 2/3Ws 28%, PV 21%, OHT 15%, Others 7%

* 1H market mix: Replacement 52%, OEM 29%, Exports 19%

* Gross margin expanded 350bp YoY/410bp QoQ to 41% due to lower RM costs YoY and QoQ. Input costs were down 5% QoQ, higher than earlier anticipated.

* Employee costs increased due to the annual increment. Other expenses were higher due to increased outsourcing, distribution, marketing, and higher manufacturing activities.

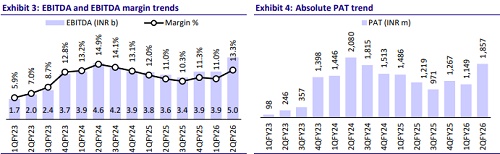

* EBITDA margin was up 240bp YoY/240bp QoQ at 13.3%, above our estimate of 11.8%. Margin expansion was driven by lower input costs.

* Interest burden was in line with expectations at INR870m (est. INR850m).

* Other income was lower at INR39m vs. our estimate of INR45m.

* PAT grew 52.3% YoY to INR1.85b, above our estimate of INR1.4b.

* Capex for 2Q stood at INR4.2b.

* In 2Q, debt grew by INR10.3b to INR29.4b. D/E stood at 0.64x, while debt/EBITDA stood at 1.8x due to acquisition of Camso.

* 1H cash flow from operations stood at INR8.7b, while capex (incl Camso acquisition) stood at INR15.4b, resulting in FCF outflow of INR6.6b.

Highlights from the management commentary

* Domestic outlook: The replacement segment is expected to record high singledigit growth, with TBR anticipated to be in line with the overall GDP growth. The 2W segment is expected to grow by 7-8%, and the PV segment is projected to grow modestly, ranging from 0% to low single digits. For the OEM segment, the MHCV segment is expected to stay flat or grow in low single digits, while the PV segment is expected to grow by 6-8% and the 2W segment is expected to perform well initially, but growth may slow as the year progresses.

* International business outlook: In the export markets, demand for Agri Radial and Off-Highway tyres is expected to remain strong in the EU, Africa, and LATAM. Exports of OHT to the US dropped to nil by 2Q end due to the sharp tariff hike, while exports of PV and TBR continued to perform well. Non-specialty business was strong on the back of growth in the EU and Africa regions. EU region remains the most profitable with the strongest potential (largely in PV segment).

* Guidance on input costs: 2Q input costs fell 5% QoQ. 3Q input costs are expected to remain in a similar range QoQ.

* Update on Camso: Currently sales are done through a sales and supply agreement with Michelin, which is expected to shift to direct supply to customers over the next 3-4 quarters. CEAT would continue to procure semifinished goods from Michelin for another 5-6 quarters until the complete value chain is established by CEAT. Capacity utilization at Camso currently stands at ~50%. Over the medium term, the business is expected to be margin-accretive.

* Update on capex and debt: In 2Q, the company spent INR1.85b on capex, with 1H capex totaling INR4.2b. Investments in Camso stood at INR2.4b for trademarks and patents. FY26 capex guidance was maintained at INR10b, and total debt stands at INR29.4b, with a debt/EBITDA of 1.8x and Debt/Equity at 0.64x.

Valuation and view

The GST rate cut is expected to boost tyre demand in the replacement and OEM segments. Further, benign input costs would help to maintain margins for the core business. While the recent Camso acquisition is expected to take time to be earnings accretive, we remain positive on the long-term benefits that this acquisition can deliver for the group. Hence, we reiterate our BUY rating on the stock with a TP of INR4,523 (based on ~20x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412