Buy Gland Pharma Ltd for the Target Rs. 2,310 by Motilal Oswal Financial Services Ltd

In-line revenue; margin miss transient

Niche approval – Near-term key to reviving growth/profitability

* Gland Pharma (GLAND) delivered in-line revenue in 2QFY26. However, EBITDA/PAT came in below our expectations by 9%/11%. A lowerthan-expected share of milestone income and lower tech transfer/CMO business in ROW markets impacted 2QFY26 performance.

* Having said this, GLAND has limited competition products in the pipeline to drive growth in 2HFY26/FY27. The base business is also witnessing an uptick with steady traction in already commercialized products.

* GLAND’s work on facility upgrade/modification and the addition of lyophilizers line at Cenexi facility is on track. It is expected to enhance the revenue run rate from 3QFY26 onward.

* GLAND is implementing a two-pronged strategy in GLP-1 opportunity. It is not only adding a customer base but also working on expanding the capacity to cater to future needs of the manufacturing of peptide products.

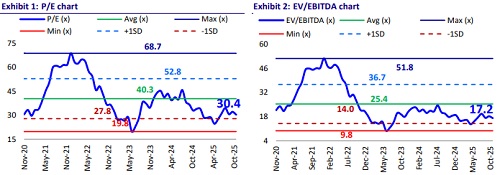

* We lower our FY26 estimate by 3% and largely maintain our FY27/FY28 estimates. We value GLAND at 33x 12M forward earnings to arrive at a TP of INR2,310.

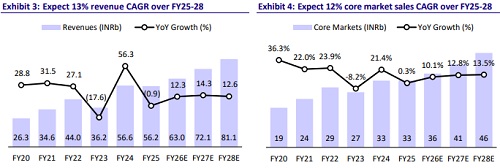

* We expect a CAGR of 13%/18%/24% in sales/EBITDA/PAT over FY25-28 to INR81b/INR20.6b/INR13.5b, factoring a) a revival in US business on the back of product introduction, b) increased revenue growth prospects in Cenexi after infrastructure upgrade, and c) increasing capacity utilization of GLP-1 pens/cartridge for non-regulated markets in the initial phase of patent expiries in these markets. Maintain BUY.

Cenexi drives revenue; margins remain steady

* 2Q revenue grew 5.8% YoY to INR14.8b (our est: INR15.1b).

* The base business (ex-Cenexi) was stable YoY at INR10.8b. Sales in core markets grew 4% YoY to IN8.5b (57% of sales). RoW sales remained stable at INR1.6b (11% of sales). India sales decreased 24%YoY to INR665m (4% of sales).

* Cenexi sales grew 21% YoY to INR4.1b (28% of sales).

* Gross margin (GM) expanded 370bp YoY to 62.8% due to lower costs of raw materials. EBITDA margin remained stable at 21% (our estimate: 22.7%). Higher employee costs (+240bp YoY as % of sales) and higher other expenses (+130bp YoY as % of sales) were offset by lower raw material costs (down 370bp YoY as %of sales).

* Exl. Cenexi, EBITDA margin was 35% (up 70bp YoY).

* EBITDA grew 5.7% YoY to INR3.1b (our estimate: INR3.4b).

* Adj. PAT rose 12%YoY to INR1.8b (our estimate: INR2.1b). ? In 1HFY26, revenue/EBITDA/PAT grew 7%/21%/30%.

Highlights from the management commentary

* GLAND remains confident of achieving mid-teen (+-2%) YoY growth in revenue in FY26. 1H revenue growth was 6.6% YoY.

* 2H YoY growth would be driven by few key launches, volume growth of existing products and better Cenexi performance.

* The milestone income/profit share for the quarter was 4%/13% as % of sales.

* The YoY growth in US base business was driven by 10% volume growth and 6-7% new launches. Lower milestone income dragged down YoY growth in 2Q.

* The goal date for Dalbavancin is in Nov'25. Another product opportunity (Congrelor) is subject to patent expiry/settlement of GLAND's partner with innovator.

* While GM of Cenexi was lower at 67%, GLAND remains confident of achieving GM of 74-75% in FY26.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412