Buy Astral Ltd for the Target Rs. 1,880 by Motilal Oswal Financial Services Ltd

Strong volume growth amid volatile pricing scenario

Big beat on operating performance

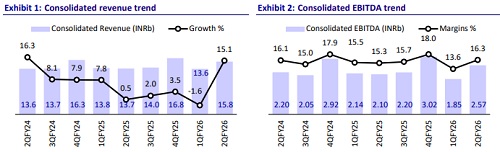

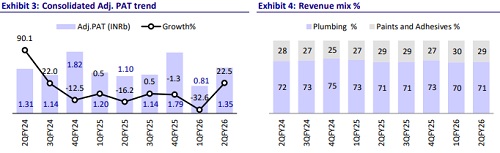

* Astral (ASTRA) reported a strong quarter despite volatile pricing scenario and a weak demand environment. Revenue grew 15% YoY, while volume rose 21% YoY to 61.2k MT. EBITDA margin also expanded by 100bp YoY to 16.3%, led by higher salience of VAP.

* Management commentary remained positive for 2H, led by an improving demand outlook for pipes (gaining market share), recovery in performance of UK adhesive business, steady growth in India Adhesive business, and healthy outlook of Paints business. The company is witnessing a good 3QFY26 to date for its piping and adhesives business (including paints) and remains confident of maintaining its earlier guidance of double-digit revenue growth in FY26.

* Factoring in a healthy operating performance in 2Q and unchanged management guidance, we raise our FY26E earnings by 6%. We broadly maintain our FY27/FY28 earnings estimates. We reiterate our BUY rating with an SoTP-based TP of INR1,880.

Healthy operating performance across all businesses

* ASTRA’s consolidated revenue grew 15% YoY/16% QoQ to INR15.8b in 2QFY26 (est. of INR14.6b), driven by increased VAP contribution, increased distribution network and decentralization of plants.

* EBITDA grew 22% YoY/39% QoQ to INR2.6b (est. INR2.2b). EBITDA margin expanded 100bp YoY/270bp QoQ to 16.3% (est. 14.9%), driven by a 70bp YoY improvement in gross margin. Adj. PAT surged 23% YoY/66% QoQ to INR1.3b (est. INR1.1b).

* In 1HFY26, revenue/EBITDA grew 7%/4% YoY to INR29.4b/INR4.4b, while PAT declined 6% to INR2.2b. For 2HFY26, implied revenue/EBITDA/PAT growth is ~20%/23%/31%.

* Plumbing business revenue stood at INR11.2b (+16% YoY, +17% QoQ), EBIT was INR1.6b (+19% YoY, +59% QoQ), and EBIT margin came in at 14% (+40bp, +370bp QoQ). Volume grew 21% YoY/9% QoQ to 61,224MT, while EBIT/kg was down 2% YoY/up 45% QoQ at INR25.7.

* Paints and adhesive business revenue stood at INR4.6b (+14% YoY, +13% QoQ), EBIT stood at INR313m (+30% YoY, +60% QoQ), and EBIT margin was 6.8% (+90bp, +200bp QoQ).

* As of Sep’25, ASTRA has a net cash position of INR4b vs. INR4.6b as of Mar’25. CFO stood at INR3.9b vs. INR1.1b as of Mar’25.

Highlights from the management commentary

* Guidance: ASTRA maintained double-digit growth guidance for the next five years. Margins are expected to stay at 15-16% and may improve with new plant utilization and CPVC integration by Sep’26. Adhesives should grow by 15%+ (India stable, UK returning to double-digit margins) in the medium term. Paints would grow by ~20% with single-digit margins. Bathware could post 20-25% CAGR. FY26 capex would be INR3.5b.

* Market strategy: 2Q saw good demand for certain products. The company adopted aggressive sales strategies and will continue this on the back of savings from decentralization of plants, which were passed on for gaining market share.

* UK adhesive business: UK adhesives business has turned around under the new leadership, following the full ownership acquisition. EBITDA improved from -2% to 7.3%, with 5% revenue growth in 2QFY26. Operational efficiencies and rising order flow support recovery, and management expects the business to achieve double-digit EBITDA margins by FY27 with sustainable growth.

Valuation and view

* ASTRA continues to strengthen its industry leadership through innovation, backward integration (CPVC resin), and capacity decentralization. Its investments in CPVC and new product categories underscore a long-term vision to reduce dependence on imports and enhance value addition. With consistent double-digit growth guidance and robust execution history, ASTRA remains one of the most agile players in India’s plastic pipes industry.

* We expect ASTRA to clock a 16%/17%/22% CAGR in revenue/EBITDA/PAT over FY25-28. We reiterate our BUY rating on the stock with an SoTP-based TP of INR1,880 (premised on 58x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)