Buy Anant Raj Ltd for the Target Rs. 793 by Motilal Oswal Financial Services Ltd

Growth in Real estate and data centers drives performance

* Anant Raj (ARCP)’s 2QFY26 revenue stood at INR6.3b, up 23% YoY/6% QoQ (18% above our estimate). In 1HFY26, revenue was INR12.2b, up 24% YoY. ? EBITDA grew 49% YoY/11% QoQ to INR1.7b (11% below our estimate). EBITDA margin stood at 26.6%, up 4.6pp YoY. In 1HFY26, EBITDA stood at INR3.2b, up 48% YoY, while EBITDA margin came in at 26%, up 4.1pp YoY.

* ARCP’s PAT was INR1.4b, up 31% YoY/10% QoQ (12% above our estimate). PAT margin stood at 22%, up 1.3pp YoY. In 1HFY26, adj. PAT came in at INR2.6b, up 34% YoY. PAT margin stood at 21.6%, up 1.6pp YoY.

* Real estate: The company has received additional approvals and is in the advanced stages of launching its luxury high-rise residential project, The Estate One, located on Golf Course Extension Road, Sector-63A, Gurugram. The project spans 5.1 acres with a total development area of ~1.1msf.

* Phase IV of Anant Raj Estate has commenced at Golf Course Extension Road, Sector-63A, Gurugram, covering 6.08 acres with a development potential of around 0.5msf, adding further value to The Estate Apartments and The Estate Floors.

* Approvals for Group Housing-3, spread over 5.21 acres, are progressing as planned and are expected to be received by 4QFY26.

* Project Navya is expected to begin Phase-2 deliveries from Dec’25, while deliveries at Ashok Estate, comprising 1.34msf, are nearing completion.

* Data centers: The capacity expansions at Manesar and Panchkula have strengthened ARCP’s presence in the data center business, with both facilities designed to function as mutual data centers and disaster recovery (DR) sites.

* Anant Raj Cloud, a wholly owned subsidiary, is leading the expansion of data center, colocation, and cloud services across Manesar, Rai, and Panchkula, targeting a total IT load of 117MW by FY28, with full capex funding already secured.

* Data center expansion at Rai, Sonipat, has commenced, with an initial capacity of 20MW IT load and a total planned capacity of around 200MW.

* The company has completed a QIP of INR11b to support its growth plans, receiving strong participation from both foreign portfolio investors (FPIs) and domestic institutional investors (DIIs).

* ARCP is net cash positive and has also prepaid INR1.3b of debt.

Key highlights from the management commentary

* The company is in advanced stages of launching its luxury high-rise project, The Estate One, on Golf Course Extension Road, Gurugram, spanning 5.09 acres with 1.09 msf development potential.

* Construction of Phase IV of Anant Raj Estate has begun over 6.08 acres, adding 0.5 msf of development area and enhancing the overall project value.

* The company has received approvals to develop a community center and a commercial tower at Ashok Estate, Sector 63A, Gurugram.

* Work has commenced on Ashok Towers in Gurugram and Bella Monde in Delhi, the latter being the company’s first capital city project spanning 0.7 msf, with Phase 1 completion expected by FY28.

* The company raised INR 11 billion through a QIP, strengthening its balance sheet and maintaining a net cash positio

Valuation and view

* ARCP’s residential segment is expected to deliver 14msf over FY25-30, generating a cumulative NOPAT of INR75b.

* The residential business cash flow, discounted at an 11.6% WACC with a 5% terminal growth rate, accounts for INR2.5b in annual business development expenses, yielding a GAV of INR87b, or INR241/share.

* The annuity business cash flow is discounted at a capitalization rate of 9.5%, valuing it at INR10b or INR29/share.

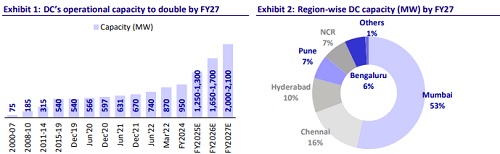

* We expect ARCP’s DC revenue to grow materially, with capacity increasing from 6 MW in FY24 to 307 MW by FY32, along with a shift towards cloud services, which will expand from 0.5 MW to 75 MW over the same period.

* We model the free cash flows for the data center business till FY32, using a discount rate of 11.6%, a rental escalation of 3%, and a terminal growth rate of 3%, resulting in an EV of INR158b or INR439/share post deferral of the cloud capex in initial years.

* We have added INR11b of QIP issued this quarter, and hence, the number of shares has increased to 360m from 343m.

* We reiterate our BUY rating on the stock with a revised TP of INR793 (earlier INR831) based on our SoTP valuation.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)