Buy Keystone Realtors Ltd For Target Rs. 800 By JM Financial Services Ltd

Growth outlook intact

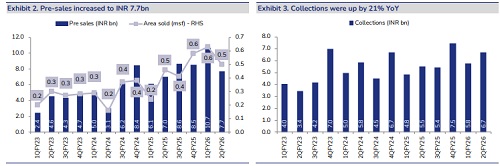

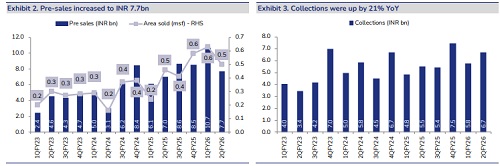

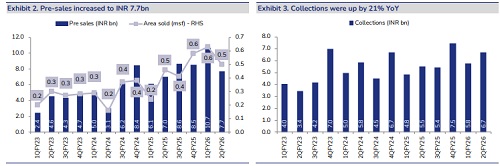

Keystone Realtors (Rustomjee) reported a steady quarter with pre-sales of INR 7.6bn (+9% YoY; down 29% QoQ), slightly above our estimate of INR 7bn. Collections were healthy at INR 6.7bn, up 21% YoY while the outflow towards construction was up 2x YoY resulting in OCF of INR 1.1bn (down 32% YoY). In 1HFY26, it has launched c. INR 49bn worth of inventory across four projects in Mumbai, helping pre-sales to grow 40% YoY to INR 18.4bn. Given the equally strong pipeline for 2H, it remains on track to exceed its FY26E annual pre-sales guidance. Addition of three redevelopment projects worth INR 77bn has resulted in robust BD performance for the year and it continues to evaluate opportunities in new micro markets. While the company is well placed in terms of operational KPIs and we expect it to achieve 34% CAGR in pre-sales over FY25-28E, improvement in P&L performance remains the key monitorable. We reduce the business development premium and maintain BUY with a revised TP of INR 800.

* Steady quarter: Rustomjee reported quarterly pre-sales of INR 7.6bn (+9% YoY; down 29% QoQ), slightly above our estimate of INR 7bn. During the quarter, it had a sole launch at Bandra with a GDV of INR 10bn, taking the total launches for the first half to c. INR 49bn across four projects. The mid & mass category contributed 33% to the pre-sales, followed by the premium/super-premium segment at 29%. Collections were healthy at INR 6.7bn, up 21% YoY and outflow towards construction was up 2x YoY, resulting in an OCF of INR 1.1bn (-32% YoY). It also spent INR 1.5bn on land/project related investments but net cash flow was higher at INR 2.5bn aided by a debt raise of INR 3.3bn via NCDs. In 1HFY26, company achieved pre-sales of INR 18.4bn (up 40% YoY) and collections were up 20% YoY to INR 12.4bn.

* Strong show on BD: While the company hasn’t added new projects during the quarter, it has already exceeded its annual BD guidance by signing three large redevelopment projects in 1Q with a cumulative GDV of INR 77bn. It has spent c. INR 3bn on new projects in 1H and expects to maintain the same run-rate and reach c. INR 6bn for the year. It continues to evaluate projects in city centric locations in Mumbai (especially where it doesn’t have much presence) and is also looking to venture into the Pune market.

* Launch pipeline: In 1HFY26, Rustomjee had four new launches (one each in Pali Hills and Chembur and two in Bandra) with a cumulative saleable area of 1.1msf and an estimated GDV of INR 49bn. With the new launches being positioned in the (slow moving) premium/luxury segments, the company has achieved pre-sales of c. 10% of the launched inventory, reflecting healthy initial traction. It intends to launch 3 projects during the rest of the year – 1 each at Sewri, Thane and Bandra (Bandstand) with GDV of c. INR 40bn.

* Financial performance: Revenue for 2QFY26 came in at c. INR 4.9bn (down 6% YoY), EBITDA for the quarter stood at c. INR 154mn with PAT of c. INR 86mn. EBITDA margins came in at 3%, while adjusted EBITDA came in at 16.5% (after grossing up of finance cost). Management has highlighted that the impact of legacy projects will be fully absorbed in FY26. It has now transitioned to the percentage completion method of accounting for new projects and as it makes progress on execution, financial performance will improve from FY27E.

* Valuation and view: While the company is well placed in terms of operational KPIs and we expect it to achieve 34% CAGR in pre-sales over FY25-28E, improvement in P&L performance remains the key monitorable. We reduce the business development premium and maintain BUY with a revised TP of INR 800.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361