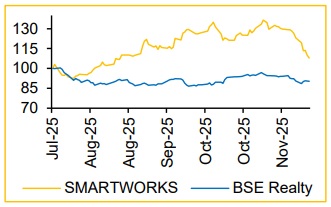

Buy Smartworks Coworking Spaces Ltd for Target Rs. 630 by Choice Institutional Equities

Strong Sectoral Tailwinds Prod Demand for Office Space

India’s flexible workspace market is projected to expand at a CAGR of 13.7% (CY25-30E), nearly twice the pace of the overall office market, expanding from 98 msf in CY25E to 186 msf by CY30E. This growth will be driven primarily by GCCs, BFSI and IT services, supported by India’s vast STEM talent pool, which accounts for 28% of the global supply. The number of GCC units and their office space absorption are projected to expand at ~7% CAGR, respectively, over the next five years.

Scale and Cost-efficiency Drive Market Leadership

SMARTWORKS has pioneered India’s managed office segment, achieving 6x growth in four years through an asset-light strategy centred on Grade-A properties across major cities. By leasing entire buildings and campuses – primarily from non-institutional landlords, such as HNIs and family offices (76% of its portfolio) – the company secures favorable terms, cost-efficiency and economies of scale. Its annuity-driven model offers REIT-like cash flow predictability while scaling up faster, supported by efficient cost structures and high utilisation. Mature centres operate at 88% occupancy with payback achieved in just ~36 months. SMARTWORKS has one of the lowest industry capex of INR 1,350 per sq ft and opex of INR 30–35 per sq ft, this cost advantage leads to faster breakeven and stronger returns. Its enterprise-focused model serving clients like Google, Groww and EY, clients with >300 seats and over 1,000 seats contributing 65% and 35%, respectively of H1FY26 revenue, supporting sustainable growth.

Low-risk, Scalable Model Resilient Across Market Cycles

SMARTWORKS’ business model is built to withstand market fluctuations through long-term agreements with both landlords (~15 years) and enterprise clients (~4 years), ensures stability in occupancy and rental income with a revenue to rent ratio of 2.0x. Revenue concentration is also well-managed — the top 10 clients account for less than 20% of total income, while multi-city tenants contribute roughly 30%, adding depth and diversification. A balanced geographical footprint across 19 clusters in 9 Indian Tier 1 cities, 4 Tier-2 cities and Singapore minimises regional dependence. The Tier 1 focus ensures premium demand and lower vacancy risk. Even during COVID-19, SMARTWORKS’ mature centres maintained ~85% occupancy in their mature centres.

Valuation and View

We initiate coverage on SMARTWORKS with a BUY recommendation and target price of INR 630, which is an upside of 31%, valuing the company at a 12 month forward EV/Adjusted EBITDA multiple of 15x, timeweighted. Our base case scenario TP is INR 630/sh and upside scenario (10–20% probability event) fair value is INR 720/sh. On the other hand, our downside scenario (5–10% probability event) fair value is INR 547/sh. (Bull Bear Case Scenario)

Key Risks

SMARTWORKS relies heavily on GCCs and MNCs in IT and BFSI sectors, exposing it to sectoral slowdowns. Possible economic downturns or weaker startup funding may further dampen demand. With ~94% revenue from annuity rentals, it is highly vulnerable to demand shocks. Liquidity risk — trading volumes remain modest.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131