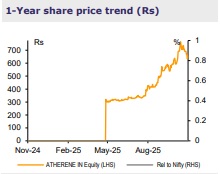

Buy Ather Energy Ltd for the Target Rs.925 By Emkay Global Financial Services Ltd

A robust Q2; Ather best bet in e-2Ws

Ather reported a strong Q2 (in line with our estimate), with revenue up 54% YoY to Rs8.9bn led by 67% YoY/42% QoQ volume rise, while EBITDA loss narrowed to Rs1.3bn (EBITDAM at –14.7% vs –21% in Q1/-24% in Q2FY25) aided by better scale/cost optimization. Gross margin (GM; ex-incentive) improved to 17.3% (16.5% in Q1; 10% in FY25), reflecting benefits from the LFP transition and operating leverage. Festive offtake was strong; retails outpaced wholesales leading to stockouts across locations. Ather is deepening its network (78 stores in Q2; 524 in total; FY26 target: 700) with sustained share gains in non-South (14.5% vs 4% in Q1FY25). Despite near-term supply issues and AURIC’s slight delay by ~2-3M (regulatory-based), the EL platform launch is on track via existing Hosur plant. We believe Ather’s premium positioning, high margin non-vehicle revenue (12%), and upcoming EL platform (mass e-2W) are added levers to play India’s e-2W shift (refer to our thematic: Yet another Mega shift in motion; Ather - the Frontrunner), with potential to deliver 10x return in 10Y. We keep estimates/TP largely unchanged; retain BUY at Rs925 TP (7x Sep-27E EV/S, like EIM’s implied valuation of 7.5x EV/S for Royal Enfield during the 2013-2017 high growth phase; 10x peak valuation).

Revenue growth in-line; margin trajectory improving

Revenue grew 54% YoY to Rs8.9bn, led by volume growth of 67% YoY/42% QoQ, while realization was down 2% QoQ at Rs137k/unit. GM (reported) stood at 18.8% (vs 19.6% in Q1) and GM ex-incentive stood at 17.3% (16.5% in Q1; 10% in FY25). EBITDA losses stood at Rs1.3bn, with EBITDAM (reported) improving by 920bps YoY to -14.7% while EBITDAM ex-incentive was -16.2% (-24% in Q1). Loss stood at ~Rs1.5bn.

Earnings call KTAs

1) The management is bullish on the e-scooter industry, with volume growth expected to be ~4-5x faster than the 2W industry and ~2x the scooter industry. 2) Ather follows a structured maturity cycle for new stores: i) focus on entry-level variants/Pro Pack penetration (early attach rate: ~45-50%); ii) as local brand awareness rises, premium mix improves, and ASPs rise; iii) accessory attach rates then start to kick in and service revenue begins contributing meaningfully. 3) Ather sustained ~17.4% national e-2W market share with strong traction from new store additions, given the strong festive offtake. 3) The Q2 GM dip was due to a one-time rare-earth magnet supply issue that led to a section of vehicles not qualifying for subsidy. 4) Despite temporary supply constraints (rare-earth shortage) and ~2–3M deferment at the Auric plant, the EL platform remains on track, with production to commence at Hosur itself. 5) Ather added 78 stores in Q2, totaling 524 (FY26 aim: 700); key target for next leg of growth will be Middle India (MP, Maharashtra, Odisha, Gujarat), which will drive incremental share gains. 6) Recently launched BAAS/buyback programs are currently low-volume (single-digit attach rate), albeit play a crucial strategic role in building trust and easing adoption among 110–125cc mainstream buyers, by offering ~50-60% resale assurance. 7) The mgmt is confident of EBITDA breakeven in 2-3Y, led by GM expansion/disciplined cost structure.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354