Buy C E Info Systems Ltd For Target Rs. 2,330 By JM Financial Services Ltd

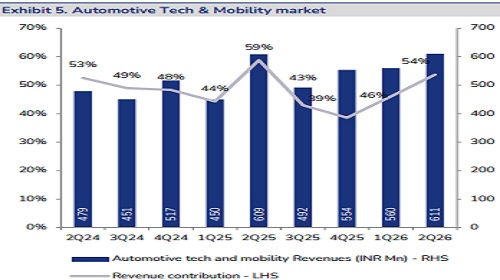

MapMyIndia (MMI) 2Q print, when seen in isolation, was disappointing. Revenues grew 9.7% YoY – slowest since 2QFY22, missing JMFe: 17%. Mix deteriorated with share of higher margin map-led segment dropping 15 ppt YoY to 55%, lowest ever. Besides, an unusual INR 100- 150mn (9-13% of rev) expense pulled down EBITDA margin by 11ppt YoY to 24.7% - lowest since listing. The underlying reasons explaining these movements however were far more encouraging. GST-led disruption in Auto sales merely pushed out A&M revenues, implying stronger Q3. IoT-led revenues were driven by higher sales of map data and services (+182% YoY) which are recurring with better margins. In fact, if not for the one-time expense, IoT margins would have reached 36%, per our estimates. MMI’s INR 100–150mn technical outsourcing expense was investment towards a government’s road-safety project, which could potentially open up INR 1bn+ opportunity. Besides, MMI won other large-scale, platform-led deals from PSUs such as IOCL (INR 1.1bn), Survey of India and MoHFW, reflecting its strategic focus and its offerings’ resonance within the government sector. Ramp of government deals, pent up demand in A&M and seasonal strength in Q4 underpin confidence of an H2 recovery. Q2 miss and lower margin assumptions drive 3-20% cut to our FY26-28E EPS. But we view these investments essential for MMI to maintain its headstart in geospatial space and capture the burgeoning opportunity. Maintain BUY with a revised TP of INR 2,330

* 2QFY26 – Misses the mark: MMI reported revenue of INR 1,138mn (+9.7% YoY), 6% below JMFe (16.6% YoY). IoT-led revenue beat estimates at INR 511mn (+68% YoY) vs JMFe: INR 331mn (+8.4% YoY). Within IoT, sale of map data & services surged 182% YoY (JMFe: 45%) as SaaS annuity revenue and opex-based sales increased. A&M remained flat YoY due to GST disruption, while C&E grew 23% YoY. EBITDA margin fell 11ppt YoY to 24.7% (JMFe: 38%) as the company incurred an upfront technical outsourcing charge (c.INR 100–150mn) for a govt. project. Adjusting for the outsourcing charge, EBITDA margin stood at c.35%. IoT margin declined 90bps YoY to 11.5% as the company booked the outsourcing charge in IoT. Map-led margin dropped 10.5ppt YoY to 35.4% due to C&E lumpiness. PAT declined 40% YoY to INR 185mn vs JMFe: INR 403mn. PAT was further impacted due to JV losses.

* Outlook – Reiterated: Management reaffirmed its FY28 revenue target of INR 10bn and expressed confidence in achieving FY26 growth goals, expecting a sharp Q4 ramp-up in C&E and a likely positive impact from strong Auto sales in Q3. Deal momentum stayed strong - in A&M, the company went live with Maruti Victoris and TVS NTORQ; in IoT, it launched solutions for a leading ride-hailing fleet and a bus operator. The potential Railways MoU, along with DMRC’s existing MoU, provides a large opportunity. In C&E, MapmyIndia signed a multi-year partnership with the largest quick-commerce player and added clients including a private bank, payments provider, e-commerce platform, and a super app. In Oct, the company secured a 5- year INR 1.1bn IOCL contract to provide centralized tracking of IOCL’s 23k trucks and won Survey of India project to build the national geospatial platform. The company incurred upfront technical outsourcing costs in 2Q for MOHFW’s “Golden Hour Management” project, this could evolve into a sizeable opportunity. These expenses have peaked and will taper over the next few quarters. Management remains committed to their stated 35–40% EBITDA margin goals.

* EPS cut by 20%-3%; Retain BUY: We change consol revenues by (2.3%)-0.8% and cut EBITDA margin by 382–161bps over FY26-28E, which drives a 3–20% PAT downgrade. We retain our 40x target multiple, given strong deal wins and a sustained growth outlook. Maintain BUY.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361