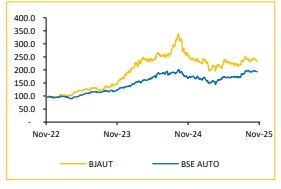

Buy Bajaj Auto Ltd For Target Rs. 9,975 By Choice Institutional Equities

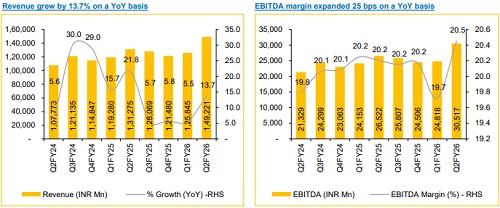

Best-ever Quarterly Performance: In Q2FY26, BJAUT delivered its strongestever quarterly results, reporting a revenue growth of 14% YoY. Growth was driven by a robust 24% YoY increase in export volumes and 7.3% YoY improvement in ASP, partly offset by a 4.6% decline in domestic volumes due to pre-festive purchase deferment. However, after GST rate rationalisation, demand rebounded sharply, with the festive season delivering strong double-digit growth across key segments. With sustained demand momentum, premium segment launches and robust export traction, we expect this positive trend to continue in the next few quarters, strengthening BJAUT’s market position across both, 2W and 3W segments

Margin Expansion Driven by Operating Leverage: EBITDA margin expanded by 25 bps YoY (+73 bps QoQ) to 20.5%, reflecting better operating leverage, favourable dollar realisation from a weaker rupee and strong export mix. These gains effectively offset cost pressure from rising input inflation. We believe margin may face slight near-term pressure due to ongoing cost inflation in metals and noble metals. However, improved product mix and export pricing discipline should provide medium-term support

Recovery in EV (Chetak): Chetak resolved rare earth supply crunch via secure components and diversified sources, restoring production. Vahan data shows regained market share in October 25, positioning it to capture India’s EV growth tailwinds with enhanced long-term visibility.

View and Valuation: We revise our FY26/27E EPS estimate upwards by ~2.8%/1.5%, driven by domestic recovery, robust export growth and market share gains in key segments. We maintain our target price of INR 9,975, valuing the stock at 26x (maintained) average FY27/28E EPS. Accordingly, we upgrade our rating, from ‘ADD’ to ‘BUY.’

BJAUT Q2FY26 results beat our estimate across the board

* Revenue was up 13.7% YoY (+18.6% QoQ) to INR 1,49,221 Mn (vs CIE est. at INR 1,45,090 Mn), led by volume growth of 5.9% YoY and ASP growth of 7.3% YoY.

* EBITDA was up 15.1% YoY (+23.0% QoQ) to INR 30,517 Mn (vs CIE est. at INR 29,163 Mn). EBITDA margin was up 25 bps YoY (+73 bps QoQ) to 20.5% (vs CIE est. at 20.1%).

* PAT was up 23.7% YoY (+18.3% QoQ) to INR 24,797 Mn (vs CIE est. at INR 24,302 Mn).

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131