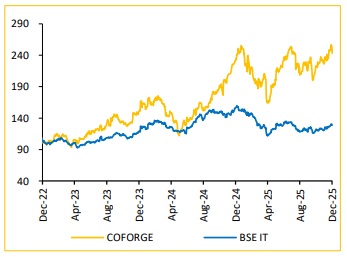

Add Coforge Ltd for Target Rs. 2,045 by Choice Institutional Equities

Analysts’ Meet: Key Takeaways

Coforge’s strong leadership continues to drive consistent execution, underpinned by organic growth as well as scaling up of strategic M&As. Coforge remains ahead of the curve through its Forge-X Agentic AI platform, deep engineering-led capabilities and hyperspecialisation across select verticals. It has been proactive in identifying client problems early and building differentiated, context-rich solutions. These strategic pivots strengthened its competitive positioning among Indian IT players, from 18th rank in 2017 to 7 th rank in 2025. Hyperscalers partnerships contribute USD550Mn+ annually and are scaling up at or above the company’s average growth rate, with ServiceNow emerging as a new strategic bet. Large-deal momentum remains strong, with Coforge closing 10 such deals in H1FY26 versus 14 in FY25, highlighting its superior win rate. Consistent large-deal ramp-ups with AI-led initiatives are enhancing non-linearity in revenue per billable headcount on a sequential basis. Together, these factors reinforce a strong growth outlook. However, given the recent rally in the stock, we revise our recommendation to ADD (from BUY), even as we raise our Target Price to INR 2,045 (earlier INR 2015).

Strategic Bets and Growth Differentiators for Coforge

Coforge differentiates itself by proactively structuring large contracts and taking solutions to clients rather than just servicing RFPs. This is reflected in acceleration of its large deals of over US$1bn in H1FY26 on the back of US$2.1bn win in Q4FY25 (includes Sabre deal of $1.6bn). It also bets strongly on its AI-led Engineering, Data and ServiceNow capabilities with N. America west & mid-west and Australia & New Zealand as potential geographies leading to high growth opportunities, going ahead. Moreover, in addition to the strong performance witnessed by TTH (Travel-Transport-Hospitality) and BFS Coforge is now betting on scaling up Healthcare and Public Sector verticals, targeting an order book run-rate of US$100Mn & US$200Mn, respectively. Coforge continues to scale up strategic accounts, with consistent client additions seen in large account relationships of above US$5-10mn size.

Themes Driving spends across BFSI and TTH verticals

BFSI is witnessing transformation led by AI, whether its about functional specialization, legacy modernization and Cloud transformation. BFSI vertical has witnessed 33% CAGR over FY20-25, serving 16 out of Top100 Global Banks, 8 out of Top30 US Banks and 2 Central Banks. Digital trends redefining banking and creating opportunities include: 1. API-driven ecosystem 2. Instant Insurance platform processing for Travel companies 3. Digital payments & tokenization, viz. GPAY, Digital currencies and Blockchains 4. Rapid growth is being witnessed in Regulatory & Compliance reporting with geographies, such as Hong Kong, Singapore and Thailand, introducing stringent financial reporting standards.

Evolving into an Intelligent & Connected Travel Experience Provider in TTH

Coforge has a strong presence in the TTH vertical, serving 60+ airline customers and delivering 20 distinct PSS implementations. Coforge has established deep partnerships across leading industry platforms—Amadeus, Sabre, SITA, CAE, SATS and Accelya—while also strengthening hyperscaler alliances. These position it to tap into USD 50bn+ travel-tech modernization opportunities over the next decade. Additionally, its AERONOVA.AI platform places Coforge well to capture a meaningful share of the USD-15bn Modern Airline Retailing market.

Talent a structural growth engine and value creator

Coforge continues to maintain one of the lowest attrition rates in the industry at ~11% for nearly 1.5 years, supported by above-market compensation and benefits which cover ~99.8% of its workforce. In parallel, its senior leadership and sales charter—representing ~0.1% of headcount—is tightly aligned to highimpact, performance-linked incentives, including large-deal commissions, such as the Sabre win, structured around clearly defined strategic milestones across verticals, service lines and geographies. The company also enforces swift corrective action when targets are not met, ensuring a disciplined performance culture and reinforcing its long-term growth ambitions and competitive positioning.

Valuation – Recommend ADD rating with a TP of 2045

We revise our estimates slightly upward and now expect Revenue/EBIT/PAT to grow at a CAGR of 22.2%/27.0%/39.1% over FY25–FY28E. Taking the average of FY27E and FY28E EPS at INR 58.4 and maintaining a P/E multiple of 35x, we arrive at a revised target price of INR 2,045 (earlier INR 2,015), recommending ADD rating given the recent rally in the stock.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131