Buy Ultratech Cement Ltd For Target Rs.13,625 by Prabhudas Liladhar Capital Ltd

Superior execution to lead to strong volumes

Quick Pointers:

* Demand momentum has picked up in H2FY26 aided by rural housing, commercial and urban housing.

* We expect pricing to improve in Jan’26 only, as demand is improving and recent weak prices would impact Q3 industry EBITDA.

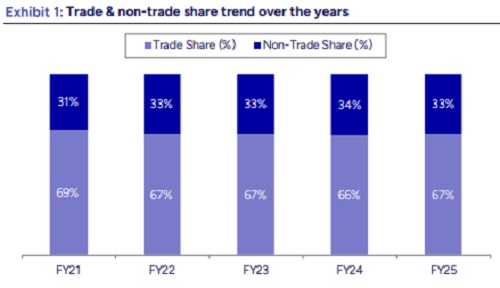

We upgrade Ultratech Cement (UTCEM) to ‘BUY’ as we expect cement pricing to improve from Jan’26 led by strengthening demand and impending pressure on industry margins due to current weak prices & elevated pet coke prices. The stock has also corrected ~11% from Aug’25 on account of muted demand amid monsoon and GST rationalization limiting price hikes. Cement demand momentum has improved in H2FY26, aided by rural housing, commercial and urban housing demand. While several infrastructure projects have been announced, activities have been muted post monsoon. Capex on roads has been growing from Sep’25 as per recent GoI spending data. We expect demand to improve across regions as GoI spending on infrastructure improves over next few months. Key regions such as South and East where stable governments have been formed recently are expected to drive this growth; while demand from North, Central and West would remain stable. This would reduce the gap between non-trade and trade prices, which has increased in recent months. Trade prices have been largely stable. While weak rupee and higher pet coke prices are expected to impact industry margins, UTCEM would benefit from higher coal share, logistics optimization aided by expanded manufacturing footprint, and synergy benefits of integration of acquired capacities.

We expect UTCEM volumes to clock ~12% CAGR over FY25-28E on the back of superior execution and ramp up of recent inorganic expansion. We have tweaked our estimates by -6%/-1%/+4% for FY26/27/28E on near-term weak cement pricing while maintaining volume assumptions. We expect EBITDA to deliver strong 24% CAGR over FY25-28E. The stock is trading at EV of 16.4x/14.1x FY27E/28E EBITDA. We upgrade the stock to ‘BUY’ from ‘Accumulate’ with revised TP of Rs13,625 (Rs13,425 earlier) valuing at 18x EV of Sep’27E EBITDA.

* Demand outlook improving sequentially: Along with GoI’s long term efforts in direct tax reduction and GST rationalization, seasonally stronger period for construction activities is expected to lead to an improvement in cement demand. Rural housing and commercial demand remain strong, while urban centers remain steady although infra execution continues to lag numerous announcements as government spending is skewed toward large strategic projects. Road activity has begun stabilizing from Sep’25 as per GoI data. Gap between non-trade and trade prices has increased as the former have fallen in recent months. Trade prices have been largely stable with limited decline in East and South regions. We expect cement prices to recover from Q4FY26 as demand improves further aided by infrastructure spending.

* Improved footprint to drive structural cost savings: With recent organic and inorganic capacity additions, UTCEM’s expanded manufacturing footprint stands at ~75 locations (from earlier ~50). This along with investments in bulk terminals will structurally reduce lead distances and logistics costs over the medium term. Average lead distance has declined from ~400km in FY25 to c. ~360km and is expected to further decline to ~340km by Mar’27, translating into savings of ~Rs3 per ton per km. These gains are expected to partially offset any inflationary pressures and support margin stability as new capacities ramp up.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271