Buy UltraTech Cement Ltd for the Target Rs. 14,460 by Motilal Oswal Financial Services Ltd

Earnings in line; positive demand outlook

200mtpa milestone ahead of schedule; phase IV expansion announced

* UltraTech Cement’s (UTCEM) 2QFY26 earnings were in line with our estimates. EBITDA grew ~53% YoY to INR30.9b. EBITDA/t increased ~32% YoY to INR914 (estimated INR951). OPM expanded 3.3pp YoY to ~16% (vs. our estimate of ~17%). PAT increased ~75% YoY to INR12.3b.

* Management indicated a positive demand outlook, supported by GST 2.0, rural market, urban real estate, steady infrastructure projects, and private capex. Brand transition is progressing well with India Cements at ~31% and Kesoram at ~55%. The full conversion is expected by Jun’26. Additionally, the company has announced Phase IV expansion with 22.8mtpa capacity in the northern and western regions. Upon completion of these expansions, its clinker capacity will reach 148mtpa, with a clinker conversion ratio of ~1.6x (currently 1.48x), as it is focusing on increasing blended cement.

* We have broadly maintained our earnings estimates for FY26-FY28. The stock is currently trading at 18x/16x FY27E/FY28E EV/EBITDA. We value UTCEM at 20x Sep’27E EV/EBITDA to arrive at our TP of INR14,460. Reiterate BUY.

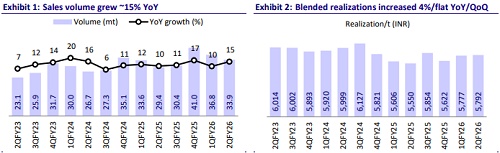

Blended realization up ~4% YoY; opex/t flat YoY

* UTCEM’s consol. revenue/EBITDA/PAT stood at INR196.1b/INR30.9b/ INR12.3b (+20%/+53%/+75% YoY and +6%/+1%/-4% vs. our estimates). Sales volume (on a like-to-like) grew ~7% YoY to 33.9mt (+4% vs. our estimate). RMC/white cement revenue rose 30%/27% YoY. Other operating income per ton stood at INR70 vs. INR112/INR64 in 2QFY25/1QFY26.

* Blended realization improved ~4% YoY (flat QoQ; 2% above estimate). Grey cement realization improved 4.5% YoY (dipped 1.4% QoQ). Opex/t was flat YoY (up 7% QoQ; 3% above estimate), with variable cost/other expenses per ton increasing ~3%/6% YoY. Freight/staff cost per ton declined 6%/3% YoY. EBITDA/t increased ~32% YoY to INR914. Depreciation/interest cost rose ~17% YoY (each), whereas other income declined ~23% YoY. ETR stood at 25.1% vs. 19.5%/26.1% in 2QFY25/1QFY26.

* In 1HFY26, revenue/EBITDA/PAT stood at INR408.8b/75.0b/34.9b (up 16%/ 49%/54% YoY). OPM expanded 4.0pp YoY to ~18%. In 1HFY26, OCF stood at INR55.7b vs INR27.3b in 1HFY25. Capex stood at INR48.0b vs 44.4b. OCF stood at INR7.7b vs. net cash outflow of INR17.0b in 1HFY25. We estimate revenue/EBITDA/PAT growth of ~15%/22%/18% YoY in 2HFY26.

Highlights from the management commentary

* Pricing largely remained stable during the quarter, with the Central region witnessing a higher decline than other regions. The recent GST reduction is likely to support premiumization by making UTCEM’s higher-end brands more accessible to consumers, enabling an improvement in the brand mix.

* Lead distance reduced from 370km to 366km QoQ. C:C ratio improved from 1.45 to 1.48. The Green Power mix stood at ~41.6% in 2QFY26 vs 38%/39.5% in 2QFY25/1QFY26.

* Total capex guidance for ongoing projects is expected to remain around INR100b per year for the next two years (FY26-27). Consolidated net debt stands at INR197.1b vs. INR176.7b in Mar’25.

Valuation and view

* UTCEM’s 2QFY26 EBITDA was in line with our estimates as better-than-expected realization was offset by higher-than-estimated opex/t. The company’s volume growth was above our estimates. Management indicated that the integration and brand transition of ICEM and Kesoram are progressing well. UTCEM’s brand growth stood at 13.2% YoY in 2QFY26. The company’s market share currently stands at ~28% and will rise to ~32-33% in the next three years.

* We estimate a CAGR of 13%/23%/27% in consolidated revenue/EBITDA/PAT over FY25-FY28. We estimate its consolidated volume CAGR at ~11% and EBITDA/t of INR1,090/INR1,206/INR1,260 in FY26/FY27/FY28E vs. INR924 in FY25. UTCEM’s improved earnings, return ratios, and low-cost expansions warrant a higher valuation multiple. We value UTCEM at 20x Sep’27E EV/EBITDA to arrive at our TP of INR14,460. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)