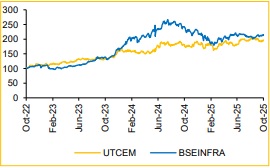

Buy Ultratech Cement Ltd for the Target Rs. 15,210 by Choice Institutional Equities

Sectoral Tailwinds To Complement Strong Execution

We maintain our BUY rating and TP of INR 15,210 on Ultratech Cement Ltd. (UTCEM) as our core investment thesis remains unchanged. We continue to be positive on UTCEM owing to: 1) Ambitious and continuous capacity expansion plan to add ~50 Mtpa of capacity by FY29E, 2) Funding expansion outlay largely via internal accruals, 3) Proactive cost optimisation strategy, 4) Favourable sectoral pricing environment and 5) Expansion in margin-accretive value-added businesses. Our EV to CE (Enterprise Value to Capital Employed)- based framework allows us rational basis to assign a valuation multiple which captures improving fundamentals (ROCE expansion by 736 bps over FY25– 28E).

We forecast UTCEM’s EBITDA to expand at a CAGR of 26.6% over FY25–28E, supported by our assumption of volume growth at 18.0%/8.0%/8.0% and realisation growth of 5.0%/0.5%/0.0% in FY26E/FY27E/FY28E, respectively.

We arrive at a 1-year forward TP of INR 15,210/share for UTCEM. We value UTCEM on our EV/CE framework – we assign an EV/CE multiple of 3.75x/3.75x for FY27E/28E. UTCEM’s ROCE projected to increase from 8.4% in FY25 to ~15.8% in FY28E under reasonable operational assumption. We do a sanity check of our EV/CE TP using implied EV/EBITDA, P/BV and P/E multiples. On our TP of INR 15,210, FY28E implied EV/EBITDA/PB/PE multiples are 19.0x/4.5x/31.6x.

Cost Pressure Weighs on Q2FY26 Margin :

UTCEM reported Q2FY26 consolidated revenue and EBITDA of INR 196.1Bn (+20.3% YoY, -7.8% QoQ) and INR 30.9Bn (+52.6% YoY, -29.8% QoQ) vs Choice Institutional Equities (CIE) estimate of INR 165.5Bn and INR 28.7Bn, respectively. In our view market expectation of Q2FY26 EBITDA was in the range of INR 28.0–32.0Bn. Total volume for Q2 stood at 33.9 Mnt (including Kesoram & India Cement) (vs CIE est. 29.2Mnt), up 6.9% YoY.

Realisation/t came in at INR 5,792/t (+12.6% YoY and +0.3% QoQ), which is higher than CIE’s est. of INR 5,661/t. Total cost/t came in at INR 4,878/t (+8.3% YoY and +6.5% QoQ). As a result, EBITDA/t came in at INR 914/t (vs CIE est. INR 981/t), up 42.8% YoY and down 23.7% QoQ.

Strategic Capacity Expansion to Drive Double-Digit Growth:

UTCEM is aggressively expanding capacity through phased organic growth, brownfield and greenfield projects and strategic integration of Kesoram and India Cements assets. With ~22.8 Mnt of new capacity expected to be commissioned and a targeted network of 82 plant locations by FY27E, the company is wellpositioned to achieve double-digit volume growth. We expect UTCEM volumes to grow by 18% in FY26E, outpacing industry growth and aligning with India’s infrastructure-driven demand.

Key Risks:

Integration Risk from Recent Acquisitions: Despite management's claims of smooth integration of India Cements and Kesoram assets, there remains a risk of potential delays or complexities in fully aligning operations, systems and realising targeted synergies.

Uncertainty in Brand Transition and Market Acceptance: UTCEM faces risks due to strong regional brand equity, especially in the South, as it plans to rebrand acquired assets, such as India Cements by FY27E.

Management Call – Highlights

* UTCEM is targeting rapid expansion, aiming to reach 200 Mnt of capacity by the end of FY26E. The company remains committed to its long-term plan of achieving 240–245 Mnt by FY29E.

* Geographic Focus: The expansion is primarily targeted at the Northern markets (18 Mnt) and the Western markets (4.8 Mnt).

* Clinker Investment: A key element of UTCEM strategy is maintaining full investment in clinker. Following the expansion, clinker capacity is expected to reach 148 Mnt, with the clinker-to-cement conversion factor projected to be around 1.6x. Emphasizing higher blending not only helps reduce cost but also supports sustainability initiatives.

* Clinker Addition: UTCEM plans to add around 15.68 Mnt of clinker capacity, consisting of two new plants and debottlenecking across multiple regions.

* Strategic Balancing and Optimisation: UTCEM has adjusted its capex plans following recent acquisitions to optimise logistics and reduce cost.

* Financing of ICL Assets: Investments in India Cements will be financed through internal accruals and a mix of debt. Importantly, proceeds from the sale of India Cements’ coal assets in Indonesia will help reduce ICL’s debt. The ICL assets are expected to deliver strong EBITDA, targeting a net debt/EBITDA of approximately 0.5x once the expansions are fully operational.

* Brand Strength and Premiumisation: The UTCEM brand grew 13.2% YoY in the quarter, driven largely by rapid integration of output from acquired assets. Rural markets also showed strong performance, expanding by 13%.

* Green Power Expansion: UTCEM is accelerating its green power capacity, targeting a 65% share by the end of the current growth phase, thereby reducing dependence on thermal power and associated cost.

* GST 2.0 Benefit: The reduction in the clean energy cess on coal provides a direct cost advantage to UTCEM, which has higher coal consumption than most of the peers. This regulatory change is also expected to support demand for premium cement brands by lowering cost for end consumers.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131