Neutral Piramal Enterprises Ltd For Target Rs.1,025 by Motilal Oswal Financial Services Ltd

AIF recoveries offset higher credit costs in legacy AUM

Retail loan growth remained strong; Asset quality stable except business loans

* Piramal Enterprises (PIEL) reported 3QFY25 net profit of ~INR386m (PQ: ~INR1.6b). This included exceptional gain of ~INR3.8b (PQ: INR770m) from recoveries in AIF portfolio. The company expects AIF recoveries to continue in 4QFY25 and FY26.

* NII rose 13% YoY to ~INR9.4b. PPOP at ~INR3.6b declined ~8% YoY.

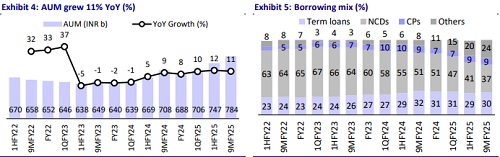

* Total AUM grew 11% YoY and 5% QoQ. Wholesale 2.0 AUM grew 13% QoQ to INR89.2b, while Wholesale 1.0 AUM declined ~45% YoY/14% QoQ to INR104b. Retail AUM grew ~37% YoY to INR591b, with its share in the loan book increasing to ~75% (PQ: 73%).

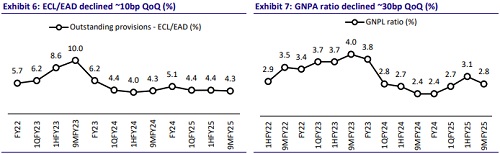

* Overall GS3 improved ~30bp QoQ to ~2.8%, while overall NS3 was stable QoQ at 1.5%. Stage 3 PCR declined ~4pp QoQ to ~49.3%. Retail 90+ DPD rose ~10bp QoQ to ~0.8%. (PQ: 0.7%)

* Management reiterated its target to reduce legacy AUM to <10% of the total AUM by Mar’25E. We still believe that this will entail elevated credit costs in 4QFY25 as well, but the same will be mitigated with AIF recoveries. PIEL is also eligible for a deferred consideration of USD140m expected in FY26 from its earlier divestment of Piramal Imaging.

* Management highlighted that it has not seen any spillovers from the MFI business into any of its other product segment. In terms of asset quality, the company believes that 4QFY25 will be similar to the current quarter; even as, Jan’25 was tracking slightly better than Dec’24.

* We estimate a total AUM CAGR of ~21% and a ~29% CAGR in Retail AUM over FY24-FY27. While its growth business (excluding one-off gains and exceptional items) is showing signs of improvement, it will still take at least 6-9 months for the company to mitigate the earnings and credit cost impact of the accelerated decline in the legacy AUM.

* Pockets of opportunity, which we earlier thought would be utilized for inorganic acquisitions in retail businesses or for strengthening the balance sheet, are being directed toward running down the stressed legacy AUM. In the near term, we still do not see catalysts for any meaningful improvement in the core earnings trajectory of the company. We reiterate our Neutral rating with a revised TP of INR1,025 (based on Sep’26E SOTP).

Highlights from the management commentary

* The company expects retail credit costs to remain range-bound with respect to the longer-term guidance that management had given in the past.

* The company achieved a reduction of ~INR42.2b in the legacy AUM during 9MFY25. A haircut of ~24% was taken in 9MFY25 to rundown the legacy wholesale AUM, which is similar to the haircut taken by the company between FY22 and FY24.

* The company is open to inorganic opportunities in MFI, small business loans, and gold loans.

* With regard to the PEL-PCHFL merger, the RBI advised PCHFL to change its name to Piramal Finance Ltd. It has been asked to submit a new certificate of incorporation and MoA, reflecting the new name and the intended business as an NBFC-ICC. The company expects to complete the merger process by Sep’25.

Strong growth in retail loans; mix improves to ~75%

* Retail AUM grew ~37% YoY to INR591b, with its share in the loan book increasing to ~75% (PQ: 73%). The company reiterated that it expects to bring the share of legacy AUM down to <10% of the total AUM by Mar'25.

* Retail disbursements grew ~9% YoY to INR84b. Except for unsecured business loans and digital loans, all other product segments exhibited YoY growth in disbursements. Digital loan disbursements improved sequentially to ~INR7.2b (PQ: INR5.6b).

Retail asset quality largely stable; credit costs higher due to a higher haircut on the rundown of legacy book

* Overall GS3 improved ~30bp QoQ to ~2.8%, while overall NS3 was stable QoQ at 1.5%. Stage 3 PCR declined ~4pp QoQ to ~49.3%. Retail 90+ DPD rose ~10bp QoQ to ~0.8%. (PQ: 0.7%).

* Growth business (Retail and Wholesale 2.0) gross credit costs rose ~30bp QoQ to 1.9% (PQ: 1.6%). The company guided for steady-state credit costs of ~2% in the growth business

Haircut on legacy AUM stood at ~24% for 9MFY25 (Refer Exhibit 1)

* The haircut on legacy AUM taken by the company during 3QFY25 was ~30%, compared to ~29%/8% in 1QFY25/2QFY25, respectively. However, the haircut for 9MFY25 stood at ~24% on a total rundown of INR44b in the legacy AUM.

* The haircut taken by the company in 9MFY25 to rundown its legacy AUM is similar to that undertaken to rundown its legacy AUM between FY22 and FY24.

Valuation and view

* Our earnings estimate for FY26 and FY27 only factor in exceptional gains from the AIF exposures and low tax outgo in the foreseeable future. Because of the uncertainty and unpredictability around the timing of the monetization of the stake in Shriram Life and General Insurance, we have not factored it in our estimates yet. It will, however, provide one-off gains, which can help offset the credit costs required to dispose of the stressed legacy AUM.

* We expect PIEL to deliver ~1.3% RoA and ~5% RoE in FY27E. We value the lending business at 0.7x Sep’26E P/BV and reiterate our Neutral rating on the stock with a revised TP of INR1,025 (premised on Sep’26E SOTP).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)