Neutral Tata Communications Ltd for the Target Rs.1,675 by Motilal Oswal Financial Services Ltd

Subdued 1Q; data EBITDA margin continues to contract

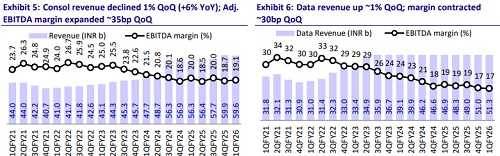

* Tata Communications’ (TCOM) 1Q results were subdued, with ~1% QoQ growth in data revenue and consolidated EBITDA.

* TCOM’s consol. EBITDA came in ~4% below our estimate, as data EBITDA margin contracted further ~30bp QoQ to 17.2% (-250bp YoY, 90bp miss) due to lower net revenue and rising salience of the lower-margin digital business.

* Management indicated that despite ongoing macroeconomic headwinds and continued pressures across the industry, TCOM’s order book recorded double-digit growth, driven by multiple million-dollar deal wins.

* Further, it indicated that losses in the digital portfolio have narrowed. However, we believe the improvement will likely be modest, given a 30bp QoQ decline in data EBITDA margins despite slower growth in the lowermargin Incubation segment.

* We build in ~8% data revenue CAGR over FY25-28E, with data revenue reaching INR248b by FY28. We believe the ambition of doubling data revenue (INR280b by FY28) remains a tall ask without further acquisitions.

* We also believe reaching 23-25% EBITDA margin by FY28 would be difficult and build in ~21.4% consolidated EBITDA margin in FY28.

* We lower our FY26-28E revenue and EBITDA by 2-3% and build in ~11% consolidated EBITDA CAGR over FY25-28E.

* We value TCOM’s data business at 9.5x Sep’27 EV/EBITDA and the voice and other businesses at 5x EV/EBITDA to arrive at our revised TP of INR1,675. We reiterate our Neutral rating. Acceleration in data revenue growth, along with margin expansion, remains key for re-rating.

Subdued quarter; data revenue and consol. EBITDA up ~1% QoQ

* Consolidated gross revenue declined ~0.5% QoQ (+6.6% YoY) to INR59.6b (2% below our estimate).

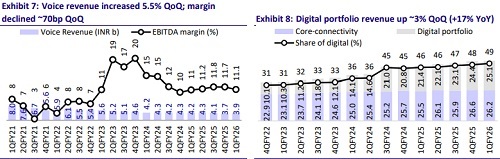

* Data revenue at INR51.3b (in line) grew 9.4% YoY (+1% QoQ), driven by ~17% YoY (~3% QoQ) growth in the digital portfolio and ~3% YoY growth in core connectivity (though down ~1% QoQ).

* Consolidated net revenue (a proxy for gross margin) at INR32.9b declined ~1% QoQ (+1% YoY) due to continued weakness in net revenue growth for the data portfolio (up 2% YoY).

* Consolidated adjusted EBITDA grew 1% QoQ (flat YoY) to INR11.4b (3.5% miss) due to weaker revenue growth and higher staff costs (up 7% QoQ).

* Consolidated adjusted EBITDA margin expanded 35bp QoQ (but contracted 125bp YoY) to 19.1%. However, it came in ~30bp below our estimate due to weaker gross margin (lower net revenue) and rising contribution of the lower-margin digital portfolio.

* Reported consol. PAT, including discontinued operations, stood at INR1.9b.

* Adjusted PAT declined ~55% QoQ (-15% YoY) to INR2.1b (~30% below our estimate) due to lower EBITDA, other income, and high losses in discontinued operations.

Key takeaways from the management interaction

* Order book and funnel additions: Despite ongoing macroeconomic headwinds and continued pressures across the industry, TCOM’s order book grew in healthy double digits, driven by multiple million-dollar deal wins with good representation of deals across both India and international markets. Further, management indicated that the deal funnel continues to remain healthy across the core connectivity and digital portfolios.

* Margin: Management indicated that losses in the digital portfolio have narrowed. However, reported data EBITDA margins were impacted by a decline in core connectivity revenue. Gross margin (net to gross ratio) remains impacted in the core connectivity business due to continued challenges in the SAARC region, which carries a higher share of on-net revenue (100% gross margin).

* Levers for margin improvement: Key levers for margin improvement include: 1) scaling up of digital revenue, 2) cost efficiency measures, including the rationalization of lower margin deals (especially in the CIS portfolio), and 3) better product mix, such as diversification into more value-added services in CIS.

* Core connectivity: Some of the large deal wins are currently under implementation, and revenue is expected to be recognized in the latter part of FY26. Management believes that low- to mid-single digit growth should be achievable

Valuation and view

* We currently model ~13% CAGR in digital revenue over FY25-28 and expect digital to account for ~54% of TCOM’s data revenue by FY28 (vs. ~49% currently). Acceleration in digital revenue remains key for re-rating.

* We lower our FY26-28E revenue by ~2-3% each and believe TCOM’s ambition of doubling data revenue by FY28 remains a tall ask without further acquisitions. Overall, we build in ~8% data revenue CAGR over FY25-28, with data revenue reaching INR248b by FY28 (vs. TCOM’s ambition of INR280b).

* We lower our FY26-27E EBITDA by ~2-3% each and believe that margin expansion to 23-25% by FY28 could be challenging, given the rising share of inherently lowermargin businesses in TCOM’s mix amid weakness in core connectivity.

* We ascribe 9.5X Sep’27E EV/EBITDA to the data business and 5X EV/EBITDA to voice and other businesses. We ascribe an INR30b (or INR106/share) valuation to TCOM’s 26% stake in STT data centers to arrive at our revised TP of INR1,675.

* After significant time correction (TCOM: +10% over the last two years, vs. 30% for BSE 100), the stock still trades at ~12x one-year forward EV/EBITDA (~15% premium to the LT average).

* We reiterate our Neutral rating as we await sustained acceleration in data revenue growth, along with margin expansion, before turning more constructive on TCOM.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412