Buy Cyient DLM Ltd for the Target Rs.600 by Motilal Oswal Financial Services Ltd

Improved business mix aids margin expansion

Operating performance beats estimates

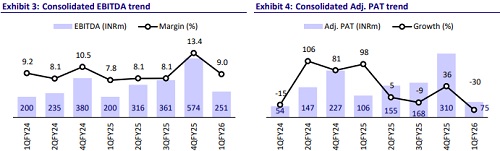

* Cyient DLM’s (CYIENTDL) 1QFY26 consolidated revenue/EBITDA grew ~8%/25% YoY to INR2.8b/INR251m. EBITDA beat our estimates as margins expanded 120bp YoY to 9% (est. 7%), led by a better business mix (higher Aerospace mix of 40%).

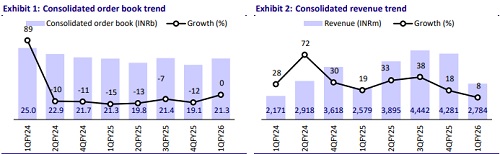

* The order book rose 12% QoQ to INR21b (flat YoY). The growth was fueled by an order intake of INR5b (the highest quarterly order intake in the past 10 quarters). 50% of this inflow is executable in FY26. With this addition, the company’s book-to-bill ratio stands at ~2x, and it aims to maintain the ratio over 1x for FY26.

* Factoring in better-than-expected operating performance, we increase our EBITDA estimates by 12%/9% for FY26/FY27, driven by an improving margin scenario and a favorable business mix. However, we largely maintain our earnings estimates for FY26/FY27 due to lower other income (utilization of IPO proceeds) and higher depreciation (integration of Altek). We reiterate our BUY rating on the stock with a TP of INR600 (30x FY27E EPS).

Strong order inflow improves growth visibility

* Consol. revenue grew 8% YoY to INR2.8b (est. in line) in 1QFY26, led by the integration of Altek from 3QFY25 (base effect), which was partly offset by the completion of a large order in FY25.

* Excluding the defense segment (declined 83% YoY due to the completion of BEL orders), other segments showcased strong growth. Aerospace grew 63% YoY, while the inclusion of Altek drove ~5x/2.4x YoY growth in the Industrial/Medtech segments.

* EBITDA margin expanded 120bp YoY to 9% (est. 7%). EBITDA grew 25% YoY to INR251m (est. INR194m). The expansion of EBITDA margin was largely led by a favorable business mix. Gross margin expanded 14.9pp to 40.2%.

* Adjusted PAT declined 29.6% YoY to INR75m (est. INR85m), led by higher depreciation YoY (integration of Altek) and lower other income (utilization of IPO proceeds).

* CYIENTDL generated healthy free cash flow of INR802m, reflecting an improving business scenario.

Highlights from the management commentary

* Outlook: With a current book-to-bill ratio of ~2x, the company aims to maintain a ratio above 1x by the end of FY26. It has also guided for a revenue CAGR of ~30% over the next five years.

* Order flows: The company plans to maintain continued strategic focus on the defense sector. It is working closely with a key customer to secure repeat business and anticipates fresh order inflows from clients in geopolitically sensitive (war-prone) regions.

* Inorganic acquisitions: Early-stage discussions are underway with several potential acquisition targets. The company will continue to explore inorganic growth opportunities within similar business segments.

Valuation and view

* We expect the growth momentum to continue, supported by macro tailwinds in the form of the China + 1 strategy, significant opportunities in the renewable energy space, and new customer additions in the industrial and med tech segments.

* With an increased order book size and improving visibility of its execution over the medium term, we expect the company to show healthy growth going forward.

* We estimate CYIENTDL to report a CAGR of 18%/34%/47% in revenue/EBITDA/adj. PAT over FY25-27. We reiterate our BUY rating on the stock with a TP of INR600 (30x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412