Buy LTIMindtree Ltd for the Target Rs.6,000 by Motilal Oswal Financial Services Ltd

A steady quarter

Margin trajectory improving

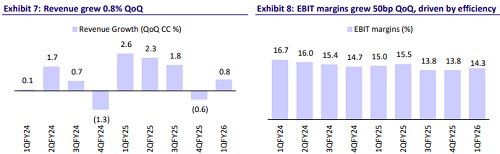

* LTIMindtree (LTIM) reported revenue of USD1.1b in 1QFY26, up 0.8% QoQ CC, below our estimate of 1.5% QoQ CC growth (in line with consensus). EBIT margin at 14.3% was in line with our estimate of 14.4%. PAT stood at INR12.5b, up 11.2% QoQ/10.5% YoY and in line with our estimate of INR12b. In INR terms, revenue/EBIT/PAT grew 7.6%/2.6%/10.5% YoY. In 2QFY26, we expect revenue/EBIT/PAT to grow 8.8%/4.2%/2.1% YoY. We value LTIM at 30x FY27E EPS with a TP of INR6,000, implying a 16% upside potential.

Our view: Agro deal to provide growth momentum

* Decent start to FY26; large deals provide visibility: LTIM reported 0.8% QoQ CC growth in 1QFY26, in line with the consensus expectations. The company won its largest-ever deal (~USD450m TCV) mid-quarter with a US-based agro company, which will ramp up through 2Q-3Q with no material margin impact. With the deal pipeline remaining strong, we expect ~5.6% CC revenue growth in FY26.

* Broad-based growth across verticals; BFSI outlook slightly divergent: LTIM’s commentary around BFSI deviates slightly from that of peers (which have reported so far). Management expects clients to be a bit more cautious; however, LTIM is taking an account-specific approach to client mining to drive growth. Consumer and Healthcare verticals delivered strong growth (6.2%/4.8% QoQ in USD) and are expected to remain robust.

* In the Hi-Tech vertical, top clients’ productivity pass-through headwinds are now behind, which should support growth going forward. While the last few quarters were certainly a headwind for this vertical, we believe Hi-tech growth could recover in FY26.

* The worst for margins could be behind: EBIT margin expanded 50bp QoQ to 14.3%, aided by initial gains from the Fit4Future program, which contributed 100bp in efficiency, partially offset by higher visa and travel costs. While the worst on margins may be behind, further expansion depends on continued cost actions, moderation in SG&A, and timing of wage hikes (likely in 3Q). We build in 14.7% EBIT margin for FY26, factoring in 3Q wage hike pressure and gradual improvement thereafter, though we await clearer signals from management on trajectory.

Valuation and changes to our estimates

* We maintain our BUY rating on LTIM, supported by its capabilities in data engineering and ERP modernization. The company’s decent start to FY26, including the largest-ever TCV win and broad-based vertical performance, gives us confidence about our 5.6% CC revenue growth estimate. Our estimates remain unchanged for FY26/FY27. We value LTIM at 30x FY27E EPS with a TP of INR6,000, implying a 16% upside.

Miss on revenue (in line with consensus) and in-line margins; broad-based growth across verticals

* Revenue stood at USD1.1b, up 0.8% QoQ CC, below our estimate of 1.5% QoQ CC growth (in line with consensus). Reported USD revenue was up 2.0% QoQ/ 5.2% YoY.

* Order inflows stood at USD1.6b, up 17% YoY.

* Consumer/Healthcare & Life Sciences grew 6.2%/4.8% QoQ in USD terms. BFSI/ Technology were also up 1.6%/0.8% QoQ.

* EBIT margin at 14.3% was in line with our estimate of 14.4%.

* Employee metrics: Software headcount declined ~350 (flat QoQ), utilization grew 230bp QoQ to 88.1%, and attrition was flat QoQ at 14.4%.

* PAT came in at INR12.5b, up 11.2% QoQ/10.5% YoY and in line with our estimates of INR12b.

Key highlights from the management commentary

* Robust strategy and disciplined execution helped the company navigate through uncertain macroeconomic conditions. Sales transformation has played a key role in improving deal win rates.

* Launched GCC as a service this quarter; offerings include entity setup, infrastructure management, and access to an agentic AI suite.

* Management remains confident of driving growth and improving margins.

* Order inflows stood at USD1.6b, up 17% YoY. 1Q was the third consecutive quarter with deal TCV exceeding USD1.5b.

* Secured a deal with a leading agribusiness firm to build an AI model for application management, driven by vendor consolidation. Any large deal won mid-quarter will see revenue contribution spread over multiple quarters; it will stabilize thereafter. No material margin impact is expected.

* Fit4Future is not merely a cost initiative but includes levers such as internal AI adoption, a restructured sales strategy, and overhead reduction.

* The JV with Aramco Digital is expected to operate at margins lower than the company average.

* BFSI: Spending remains cautious, especially in certain accounts. The company is prioritizing accounts with high growth potential.

* In Insurance, demand is being driven by tech modernization, but the deal flow remains lower compared to BFS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)