Buy Allied Digital Services Ltd For Target Rs. 225- Choice Broking Ltd

Broad-based Growth; Short-term Margin Pain

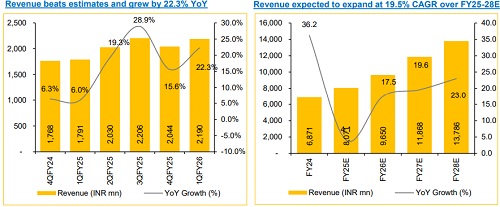

ALDS posted strong broad-based revenue growth, reinforcing its positioning in high-growth segments, such as Smart Cities and Global Workplace Services. While near-term margins remain subdued due to ramp-up costs and pricing pressure in services, the medium-term outlook remains stable. Margin recovery is expected to be driven by a higher Solutions mix, AI-led automation, strong order book and early signs of global demand revival. Inorganic growth opportunities in cloud and cybersecurity also offer strategic upside. We believe ALDS is wellpositioned to scale-up over the next 12–18 months, with improving operating leverage, strong execution in India and a rebound in international markets. We expect Revenue/ EBITDA/ PAT to expand at a CAGR of 19.5%/46.3%/48.2% over FY25-FY28E.

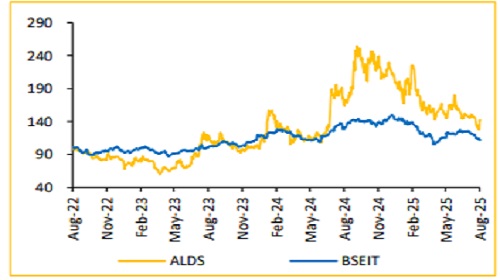

View & Valuation: Given strong execution across Smart Cities, expanding Solutions contribution, global enterprise deals and a healthy order book, we maintain our one-year forward P/E multiple of 15x despite short-term margin pressure. We may consider an upward revision to our PE multiple when there is a meaningful improvement in margin. As we roll forward our FY28 estimates, we value the stock on average FY27E & FY28E EPS of INR 14.9 to arrive at a Target Price of INR 225 and upgrade our rating to BUY with an upside of 30%.

Revenue Beat, Margins Miss; Strong Order Booking

* Revenue for Q1FY26 came at INR 2,190 Mn up 7.2% QoQ & 22.3% YoY(vs CIE est. at INR 2,115 Mn).

* EBIT for Q1FY26 came at INR 138 Mn, up 156% QoQ while it was down 5% YoY (vs CEBPL est. at INR 186 Mn). EBIT margin stood at 6.3% vs 8.1% in Q1FY25, a decline of 180 bps YoY(vs CIE est. at 8.7%).

* PAT for Q1FY26 stood at INR 144 Mn, up 289.8% QoQ and 38.7% YoY (vs CIE est. at INR 137 Mn).

* In Q1FY26, ALDS secured INR 1,880 Mn in new orders & renewals, registering a strong growth of 41% QoQ. Management indicated a healthy deal pipeline across segments

Solid Q1: Growth Led by India; Global Recovery Gaining Pace

ALDS started Q1FY26 on a good note, reporting 22% revenue growth YoY to INR 2,190 Mn, driven by India business (up 27% YoY) with sustained traction across both, Enterprise and Government segments. Further, the US market showed early signs of recovery & rise in customer engagements. Europe and the Middle East also delivered steady performance supporting global revenue mix.

Revenue Guidance maintained; Margin Outlook Steady

Management reaffirmed its INR 10Bn annual revenue run-rate target over 4-5 quarters, with INR 2.5Bn quarterly run-rate by H2FY26 backed by a strong order book. Margins are expected to remain stable in the near term, with the mediumterm EBITDA margin target of 11-12% unchanged. Recovery is expected to be driven by AI-led automation, higher Solutions mix and contract ramp-ups. Direct sales and p

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131