Buy Midwest Ltd for the Target Rs. 2,000 by Motilal Oswal Financial Services Ltd

Strong core | strategic diversification | superior profitability Leading player in the black granite market

* Midwest Ltd. (MIDWESTL) is India’s largest producer and exporter of premium Black Galaxy Granite. It holds over 60% of India’s export market share and is a leading player in Absolute Black Granite. The company is vertically integrated across the granite supply chain, operating 20 mines, and has generated ~INR6.3b in revenue during FY25, with a CAGR exceeding 21% over the past five years. MIDWESTL boasts a best-in-class EBITDA margin of 27.4%, with a CAGR of more than 44% during the same period, outperforming its granite industry peers. Management has a multi-pronged growth strategy focused on leveraging the company’s leadership in Black Galaxy and Absolute Black granite while diversifying into highgrowth sectors such as quartz grit and powder and beach-sand heavy minerals.

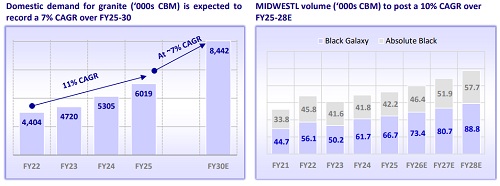

* The company’s granite (core operations) volumes are projected to scale up to ~150,000 CBM by FY28 through new mine- and cluster-based expansions, ensuring steady and sustained earnings growth, with revenue and EBIT likely to clock a CAGR of ~12% each over FY25-28E. The primary opportunity lies in the quartz processing plants, which require a capex of ~INR1.3b in Phase II to reach a capacity of about 600 ktpa by FY27E vs. the current 300 ktpa. This expansion aligns seamlessly with domestic demand, which is poised to record a CAGR of ~25%. Additionally, the company is foraying into the mining (having obtained four mines in Sri Lanka) and processing of heavy mineral sands (HMS), primarily used as feedstock for Titanium Dioxide.

* MIDWESTL offers a unique combination of a near-monopoly cash cow (Black Galaxy/ Absolute) that funds two new high-growth, high-margin businesses (Quartz and HMS) with minimal balance-sheet strain. These expansions will diversify revenue, reducing concentration risk from ~96-98% granite share in FY25 to ~50% by FY28E. Its overall revenue and EBITDA are likely to post a 36% and 47% CAGR (vs. ~12% CAGR for Granite) over FY25-28E, respectively, supported by the Quartz and HMS businesses. Given this, we expect the Adj PAT to see 56% CAGR growth over FY25-28E.

* MIDWESTL’s net debt stood at INR2.2b, translating into a Net Debt/EBITDA of 1.3x as of FY25. The ratio is expected to dip to less than 1x due to the rising operating profit going forward. As quartz and HMS operations scale up by FY27-28, OCF is likely to exceed INR2b annually, turning FCF structurally positive. This will support deleveraging, expansion opportunities, and a clear rerating potential over the next 3-4 years. We initiate coverage on MIDWESTL with a BUY rating. We value the company at 13x FY28E EV/EBITDA to arrive at our TP of INR2,000. ? Key risks: 1) export concentration; 2) regulatory uncertainties; 3) delays in the ramp-up of quartz production; and 4) the dependence of granite demand on global real estate cycles.

Steady growth in granite, led by market demand and a stronger resource base

* MIDWESTL remains the dominant Black Galaxy granite player, commanding ~64% of India’s granite export share in FY25. Its three operating mines produced ~66.5k CBM of Black Galaxy granite (overall granite ~105k CBM) in FY25, with two more mines (Black Galaxy/Absolute) under development to improve long-term availability.

* MIDWESTL has taken a cluster-based acquisition strategy by targeting mines near to existing assets. This will aid efficient extraction, optimal reserve replenishment, and first-mover advantage in high-quality deposits. With a strong reserve base and integrated operations, we believe it is well-positioned to benefit from rising export demand for black galaxy and domestic demand for absolute black granite.

* We expect granite revenue and EBIT to clock ~12% CAGR each over FY25-28E vs. 21% CAGR each in the past five years. This will be driven by a sustainable improvement in NSR and robust volume growth.

Diversification into quartz and beach sands the next growth engine

* MIDWESTL is scaling two new high-value verticals beyond its core granite operation: 1) high-purity quartz grits & powder and heavy mineral beach sand mining/processing.

* Quartz: Backed by 2.1mt of proven reserves, the company has commissioned a 303ktpa phase-I quartz plant in Vizag SEZ, operational from Sep’25. The phase-II capacity will be doubled to 606ktpa with an outlay of INR1.3b. This expansion is expected to be funded through internal accruals and IPO proceeds. The quartz business will target import-substitute, high-purity (+99.99%) quartz grits and powder with applications across semiconductors, solar PV, and optical fiber.

* Beach sand: MIDWESTL holds four mining leases in Sri Lanka for ilmenite, rutile, zircon, garnet, and sillimanite, aimed at producing titanium-rich intermediates such as titanium slag. Exploration is complete and approved by Sri Lanka GSMB, while operations are likely to start by the end of FY27, pending environmental clearances.

* Together, these new businesses will reduce Granite’s revenue share to ~50% by FY28E from ~96% in FY25. Granite is likely to clock a 12% CAGR, but the overall revenue is projected to expand at a 36% CAGR, driven by quartz and beach sand. This diversification will reduce the concentration risk (w.r.t. business/customers) and position the company as India’s emerging critical minerals supply chain player

Improving efficiency and sustainability to generate a strong OCF

* Operational efficiency enhancements like yield improvement, power and fuel optimization, and tightly managed inventories have significantly strengthened financials. Operating cash flow improved significantly, whereas the leverage positions remained modest at 0.43x D/E by FY25. This enables the company to fund its announced INR2-2.5b capex (Quartz Phase-II + mining equipment) entirely through internal accruals and IPO proceeds.

* The phase-I quartz plant is expected to reach full utilization by FY28. This, coupled with the new entry of HMS business, will exceed annual OCF by INR2b in FY28E, translating into positive FCF going forward. The deleveraging initiative and robust cash flow will keep MIDWESTL well-capitalized for future potential inorganic expansion in the domestic emerging critical minerals space.

Cash-cow granite + high-conviction upside (Quartz + HMS) → Initiate with BUY

* MIDWESTL is evolving from India’s leading Black Galaxy Granite producer into a diversified critical and advanced materials platform. With a dominant ~64% market share in black galaxy granite exports, strong reserve visibility, and integrated operations, it remains well-positioned for steady growth in its core business.

* A strategic pivot into high-purity quartz and heavy beach-sand minerals is set to materially shift the revenue mix from ~96% granite in FY25 to ~50% by FY28E, driving a 36% revenue CAGR vs. 12% for granite alone. Given this, we expect the EBITDA and Adj PAT to see 47% and 56% CAGR growth over FY25-28E

* Improved yields, cost optimization, and working-capital discipline have sharply strengthened cash flows, while keeping leverage low. As quartz and HMS operations scale up by FY27-28E, the OCF is expected to exceed INR2b annually, turning FCF structurally positive and supporting deleveraging and expansion.

* MIDWESTL offers steady granite cash flows, two high-growth structural businesses, improving capital efficiency, and a clear FCF inflection point. It is a compelling play on India’s expanding footprint in advanced materials and critical minerals. We initiate coverage on MIDWESTL with a BUY rating and a TP of INR2,000, valuing the company at 13x on FY28E EV/EBITDA.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)