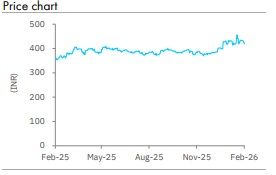

Accumulate Coal India Ltd for Target Rs 458 by Elara Capitals

Coal India (COAL IN) top line declined 5.2% YoY while PAT fell 15.6% YoY in Q3FY26, with revenue at INR 349bn, up 15.7% QoQ, and EBITDA, down 24.2% YoY, to INR 93bn amid a sharp 21.8% YoY rise in employee expenses. PAT stood at INR 71bn. Operationally, coal production declined 1% YoY to 200mn tonne in Q3FY26 and offtake fell 3% YoY to 188.6mn tonne. While FSA realization improved 5% YoY to INR 1,504/tonne, eAuction realization dipped 9% YoY to INR 2,434/tonne, leading to a 1.7% YoY drop in overall realization to INR 1,638/tonne. We retain Accumulate with a higher TP of INR 458.

Top line decreases 5.2% YoY; PAT falls 15.6% YoY: Revenue from operations declined 5.2% YoY and rose 15.7% QoQ to INR 349bn. Employee expenses increased 21.8% YoY and 23.2% QoQ to INR 132bn. Employee expenses surged on account of one-time provision of pay scale upgradation of executives of ~INR 22.0bn. EBITDA dipped 24.2% YoY to INR 93bn. Interest cost was up 42% YoY to INR 3.2bn. Other income increased 11.6% YoY to INR 24bn. Reported PAT declined 15.6% YoY to INR 71bn.

FSA realization improves but eAuction margin under pressure: FSA volume declined by 3.3% YoY to 165mn tonne. eAuction volume increased 1.4% YoY to 19.5mn tonne. eAuction volume constituted 11% of total production volume. FSA realization improved 5% YoY to INR 1,504/tonne, but eAuction realization fell 9% YoY to INR 2,434/tonne. eAuction premium was at 62% in Q3FY26. Overall realization dipped 1.7% YoY to INR 1,638 per tonne. COAL secured Kawalapur REE Block, Maharashtra, in January 2026, making a foray into critical minerals. MoU signed on 30 June 2025 with Hindustan Copper to collaborate in copper and critical minerals sectors. Subsidiary firm BCCL shares listed on the BSE and NSE on 19 January 2026.

COAL misses production target: Coal production declined 1% YoY to 200mn tonne in Q3FY26. Production dropped 3% YoY to 529mn tonne in 9MFY26. Coal offtake dipped 3% YoY to 188.6mn tonne in Q3. Coal offtake fell 3% YoY to 545mn tonne in 9MFY26. Muted coal production was on account of weak power demand in Q3. Coal production was 13% lower than that of targeted production for 9MFY26. Coal offtake was 17% lower than targeted offtake for 9MFY26

Retain Accumulate with a higher TP of INR 458: Long-term tailwinds are: 1) rising acceptance of coal as a dominant fuel mix and good volume delivery in the past few quarters, 2) better evacuation infrastructure in terms of first-mile connectivity projects, 3) healthy balance sheet, and 4) likely annual dividend payout of INR 26-27/share, implying a 7% yield. We retain Accumulate with a higher TP of INR 458 from INR 432 based on 6x (from 5x) FY28E EV/EBITDA. We revise our multiple on value unlocking from planned listing of its subsidiary, BCCL. We keep our earnings estimates unchanged.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)