Hold Wipro Ltd For Target Rs. 250 By JM Financial Services

.jpg)

Stable quarter with improving outlook, Deal ramp up to drive recovery

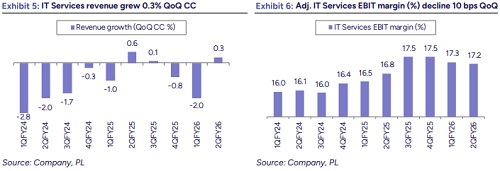

The revenue growth (+0.3% QoQ CC) was above our estimates (-0.3% QoQ CC), primarily attributed to continued momentum within Capco (BFS) and Tech vertical, which was partly offset by weakness in pockets beyond BFS. The company reported another quarter of elevated large deal TCV, that cumulatively adds up to USD 5.5b in H1, which in itself is higher than FY25 (USD 5.4bn). However, the nature of the deals is concentrated more on the vendor consolidation and cost optimization side, which ideally comes at a higher tenure and lower margins. With that the company is aspiring to deliver better Q3 with a mid-range revenue guidance of +0.5% QoQ. We expect the ramp up of two mega deals to support growth in H2, while also factoring in the seasonality and structural slowdown as the incremental headwinds. Additionally, we have not integrated DTS numbers into our forecasts, awaiting consolidation by the end of Q3. On the margins front, we expect the incremental ramp up of large deals will require upfront investments, while furlough impact in H2 would provide lesser margin headroom. We are broadly keeping our estimates unchanged at -1.6%/+3.5/5.2% YoY CC, while our margin estimates are 16.9%/16.8%/17.3% for FY26E/FY27E/FY28E. The stock is currently trading at 20x/19x FY26E/FY27E. We roll forward and assign 18x to Sep’27 EPS for a TP of 250. Retain HOLD.

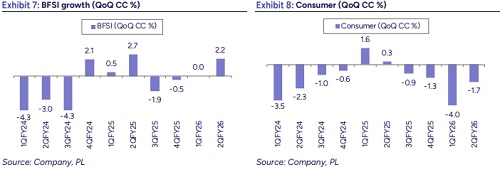

Revenue: IT services reported revenue of USD 2.6 bn, up 0.3% QoQ CC which was above our/consensus estimate of (-0.3%/0.2% QoQ CC). Growth (in QoQ CC) was a mixed bag with Europe (+1.4%) and APMEA (+3.1%) offset weakness in Americas 1 (+0.5%) and Americas 2 (-2%), while BFSI (+2.2%) and Technology (+0.8%) grew modestly amid declines in Consumer, EMR and Healthcare.

Operating Margin: Margins held up better than expected within the narrow 17% range. Adjusted IT Services EBIT margin stood at 17.2%, down just 10 bps QoQ, as large deal ramp-up costs were largely offset by currency tailwinds. On a reported basis, EBIT margin declined 60 bps QoQ to 16.7%, with a 50-bps impact from bad debt provisioning linked to client bankruptcy.

Deal Wins: Deal wins were strong again with total wins of USD 6.69 bn, up 30.9% YoY CC. Large deal wins were also robust at USD 2.85 bn, up 90.5% YoY CC including 1 mega deal in Health & BFSI verticals. Pipeline remains strong but comprises majorly of vendor consolidation and cost take out deals.

Valuations and outlook: We estimate USD revenues/earnings CAGR of 2.6%/6% over FY25-FY28E. The stock is currently trading at 20x FY27E. We are assigning P/E of 18x to Sep 27E EPS with a target price of Rs 250. We maintain “HOLD” rating.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361