Sell Wipro Ltd for the Target Rs. 200 by Motilal Oswal Financial Services Ltd

.jpg)

Growth pickup still awaited

Margins to stay range-bound

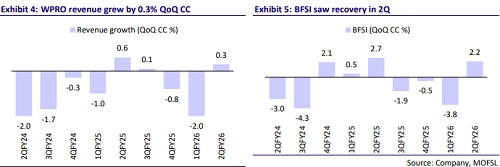

* Wipro (WPRO) reported 2QFY26 IT Services revenue of USD2.6b, up 0.3% QoQ CC, in line with our estimate of 0.3% QoQ growth. It posted an order intake of USD4.7b (down 5.7% QoQ), with a large-deal TCV of USD2.8b (up 7% QoQ). EBIT margin of IT Services was 16.7% (est. 17.0%). PAT stood at INR32b (down 2.5% QoQ/up 1.2% YoY) vs. our est. of INR31b. In INR terms, revenue/EBIT/ PAT grew 1.2%/1.0%/5.3% YoY in 1HFY26. In 2HFY26, we expect revenue to grow 6.0% and EBIT/PAT to decline 1.0%/5.3% YoY.

* We believe that broad-based growth across verticals and a stable conversion of deal TCV to revenue will be key to a constructive view. We reiterate our Sell rating on Wipro with a TP of INR200, implying 16x Jun’27E EPS.

Our view: BFSI/Europe provide support

* Deal momentum sustained, but revenue acceleration still awaited: WPRO reported modest IT Services growth of 0.3% QoQ CC in 2QFY26. The 3Q guidance of -0.5% to +1.5% CC (midpoint implying a mild uptick, the first positive midpoint in several quarters). That said, macro uncertainty, tariffrelated headwinds in consumer/energy/manufacturing verticals, and seasonal furloughs could continue to cap growth momentum. We build in the midpoint of guidance for 3Q and assume flat growth in 4Q, based on a gradual pace of conversion from recent deal wins.

* Execution to drive 2H delivery: Deal TCV remained healthy at USD4.7b in 2Q (USD9.5b in 1H), with good traction in BFSI and healthcare. In our view, while deal activity remains robust, the pace of conversion continues to be a key monitorable.

* BFSI/Europe showing early signs of stability: BFSI grew 2.2% QoQ CC, marking its first sequential improvement, led by good traction in Europe and APMEA. Phoenix deal is expected to ramp up in 3QFY26, supporting further recovery. That said, we believe overall demand in consumer and ENRU remains soft due to tariff-related pressure, and a broad-based recovery in spending is yet to be seen.

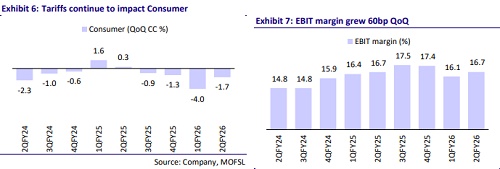

* Margins stable, but near-term headwinds likely as Harman integrates: IT Services EBIT margin stood at 16.7% (down 60bp QoQ), impacted by a oneoff provision related to a client bankruptcy. Adj. margin at 17.2% was stable, supported by INR depreciation, utilization gains, and SG&A efficiencies.

* Large-deal ramp-up and pricing pressure in vendor consolidation programs could weigh on near-term margins, and we see limited room for upside from the current levels. Management reiterated its comfort within the 17.0-17.5% range, but the pending Harman DTA acquisition (expected to close in 3Q) will likely dilute margins by ~60bp. We estimate 16.3%/16.5% EBIT margin for FY26/27E.

In-line revenues and margins; 3QFY26 guidance at -0.5 to 1.5% CC

* IT Services revenue at USD2.6b was up 0.3% QoQ in CC (reported USD revenue was up 0.7% QoQ), in line with our estimate of 0.3% QoQ CC growth.

* In 2QFY26, BFSI/Technology were up 2.6/1.0% QoQ CC. Consumer was down 1.1% QoQ CC.

* Americas1 grew 0.6% QoQ CC. Europe saw 2.7% QoQ CC growth.

* IT Services EBIT margin was 16.7% (down 70bp QoQ), below our estimate of 17.0%. IT Services operating margin for 2QFY26 was impacted by a provision of INR1,165m (USD13.1m) made with respect to bankruptcy of a customer. Adjusted for this event, IT Services margin for the quarter was 17.2%.

* PAT was down 2.5% QoQ/up 1.2% YoY at INR32b (against our est. of INR31b).

* WPRO reported deal TCV of USD4.7b in 2QFY26, down 5.7% QoQ/ up 31% YoY, while large-deal TCV of USD2.9b was up 7% QoQ/90% YoY.

* 3QFY26 revenue guidance was -0.5% to +1.5% in CC terms.

* Net utilization (excl. trainees) was up 140bp at 86.4%% (vs. 85% in 1Q). Attrition (LTM) was down 20bp QoQ at 14.9%.

Key highlights from the management commentary

* Sequential guidance for 3QFY26 is -0.5% to +1.5% in CC, translating into USD2.59-2.64b in revenue. Harman acquisition is expected to close during 3QFY26; current guidance excludes any contribution from it.

* The midpoint of guidance is positive for the first time in several quarters, indicating a gradual improvement in momentum.

* Management expects several large deals signed in 1H to begin ramping up in 2H.

* 1HFY26 bookings stood at USD9.5b; pipeline remains strong and broad-based.

* Large deal activity driven by vendor consolidation, AI-led transformation, and consulting-led programs.

* Two mega deals signed this quarter - one in healthcare and one in BFSI - largely renewals but important for deepening relationships and driving future growth.

* Margins were supported by INR depreciation, improved utilization, lower attrition, higher profitability in fixed-price programs, and SG&A optimization.

* Headwinds came from large-deal transition costs, which will continue in 3Q.

* Management aims to maintain operating margins within a narrow band of 17.0- 17.5%. 3Q is seasonally weak due to furloughs and fewer working days.

* A healthy pipeline exists in Europe. The Phoenix deal won in 4Q is expected to start contributing to revenue from 3Q onward.

Valuations and view

* We model flat YoY CC revenue growth for FY26E, factoring in a soft start (1Q services revenue down 2.0% QoQ CC), muted 2Q/3Q guidance, and a gradual recovery in 2H. We see limited room for margin expansion from current levels. We keep our FY26/FY27 estimates unchanged.

* Further improvement in execution and a stable conversion of deal TCV to revenue will be key to a constructive view. We reiterate our Sell rating on WPRO with a TP of INR200, implying 16x Jun’27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412