Buy Happy Forgings Ltd for the Target Rs. 1,200 by Motilal Oswal Financial Services Ltd

Growth to revive led by pick-up in demand and new wins

Industrials and PVs to be key growth drivers

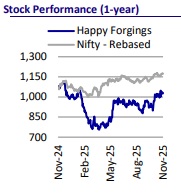

One of the key investor concerns for Happy Forgings (HFL) has been its subdued revenue growth over the past few quarters, despite a strong order backlog, which is also reflected in the stock’s underperformance over the past 12M relative to the broader index. Notably, this slowdown in revenue growth has largely been led by its exposure to overseas markets, which are currently experiencing a marked slowdown. While demand outlook in key export markets continues to remain weak, we expect HFL’s revenue to start picking up from the coming quarters, driven by: 1) an expected pickup in the domestic CV and PV business following the GST rate cuts, 2) the positive outlook for domestic tractors, 3) new order wins in key segments, including Industrials, 4) and stabilization of demand in Europe/US for CVs and tractors, albeit at lower levels. Overall, we expect HFL to post a CAGR of 17%/20%/22% in standalone revenue/EBITDA/PAT during FY25-28. We reiterate our BUY rating on the stock with a TP of INR1,200 (based on 27x Sep’27E EPS).

Industrials business to be the key growth driver

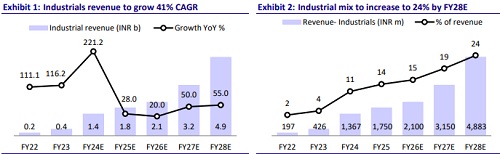

* The Industrials segment continues to be a key growth driver for the company. HFL is investing INR6.5b to set up a heavyweight precision components facility, which will be among the largest in Asia, capable of producing 250-3,000kg forged and fully-machined parts.

* The company has already secured orders worth INR3.5b from this new facility and expects a further boost once the new plant is on stream and customers gain confidence in its execution capabilities.

* Given the company’s healthy new order wins, we expect the Industrials segment to post a robust 41% revenue CAGR over FY25-28E.

* HFL appears well on track to achieve its guidance of 30% contribution from the Industrials sector by FY30E.

PV mix on track to reach 10% of the mix in a couple of years

* The PV segment, which is a focus area for the management, remains a major growth driver, contributing 6% of revenue in 1QFY26, up from just 1% in FY24.

* Leveraging its competitive advantage, the company has won multiple orders over the last few years, both for domestic and export businesses.

* To execute these orders, HFL plans to invest INR800m in the PV business in FY26. The company has also set a target for PV contribution to rise to 8- 10% of revenue over the next two years, up from 6% in 1QFY26 (this was just 0.9% in FY24).

* Accordingly, we expect the PV segment to post a robust 53% revenue CAGR over FY25-28E.

Outlook gradually improves in key core segments

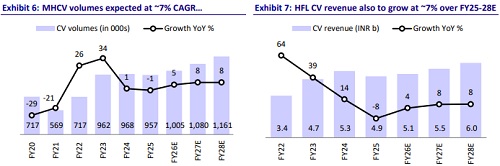

* The outlook for HFL’s core segments, domestic CVs and tractors, has improved following the GST rate cuts announced in Sept. While the domestic market outlook has improved, the demand in key developed markets such as the US and Europe remains weak.

* The silver lining is that demand for these segments, especially in Europe, is now stabilizing, albeit at lower levels.

* The outlook for CV exports has improved for FY27E, as one of the company’s key export clients anticipates a recovery.

* Tractor exports are also expected to drive a revenue pick-up for HFL next year, supported by new order wins.

* Overall, we expect the CV and tractor segments for HFL to deliver a steady 10% revenue CAGR over FY26-28E, after a projected flat growth in FY24-26E.

Valuation and view

* Given its healthy new order wins, we expect HFL to post a 17% standalone revenue CAGR over FY25-28E.

* Further, we expect HFL to post a 230bp margin expansion to 31.2% over FY25- 28E, led by an improved mix in the coming years.

* We, thus, expect HFL to post a 22% earnings CAGR over FY25-28.

* HFL’s superior financial track record compared to its peers serves as a testament to its inherent operational efficiencies and is likely to be a key competitive advantage going forward.

* We reiterate our BUY rating on the stock with a TP of INR1,200 (based on 27x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412