Neutral Prudent Corporate Advisory Services Ltd for the Target Rs.2,600 by Motilal Oswal Financial Services Ltd

Performance in-line across parameters

* Prudent Corporate Advisory (Prudent) posted an operating revenue of INR2.9b, +18% YoY (in line) in 1QFY26, fueled by a 17% YoY surge in commission & fees income.

* EBITDA grew 14% YoY to INR673m (in line), reflecting an EBITDA margin of 22.9% (vs 23.6% in 1QFY25 and our estimate of 23.2%). Operating expenses grew 19% YoY to INR2.3b (in line), with fees and commission expenses growing 22% YoY (inline), employee expenses growing 16% YoY (8% above estimates), and other expenses growing 2% YoY (12% below estimates).

* Top-line and expenses meeting our expectation resulted in an in-line PAT of INR519m, growing 17% YoY.

* Management expected yields to be largely stable at 90bp for FY26. However, the recent repricing done by SBI MF will have a further impact of ~INR6-7m in 2QFY26 (~INR3.5m in 1QFY26), while Kotak MF repricing will have an impact of ~INR27m for FY26.

* We have largely maintained our earnings estimates, considering the in-line performance during the quarter. We expect Prudent to deliver a revenue/EBITDA/PAT CAGR of 18%/16%/20% over FY25-27, fueled by growing MF AUM and a focus on increasing the share of non-MF business in the overall mix. The company is expected to maintain an RoE of >28% for FY26/FY27. We reiterate our Neutral rating with a TP of INR2,600 (based on 38x EPS FY27E).

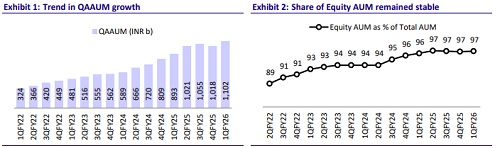

QAAUM maintains growth momentum as SIP flows remain strong

* Prudent’s QAAUM grew 23% YoY to INR1.1t, while the closing AUM stood at ~INR1.2t for the quarter. Monthly SIP flow grew to ~INR10b from INR7.8b in 1QFY25, reflecting a market share of 3.5%.

* Total insurance premium for the quarter came in at INR1.4b (+22% YoY), of which life insurance premium stood at INR1.1b (+19% YoY) and general insurance premium stood at INR376m (+33% YoY).

* Commission and fees income for the quarter rose 17% YoY to ~INR2.9b, of which INR2.5b (+21% YoY) was contributed by the distribution of MF products and INR291m (+11% YoY) by insurance products.

* Revenue from the distribution of MF grew 21% YoY and 8% QoQ, fueled by strong SIP inflows and active participation from MFDs.

* Revenue from the sale of insurance products increased 11% YoY, with the life insurance fresh book growing 3% YoY and the general insurance fresh book growing 57% YoY in 1QFY26.

* Revenue from the stockbroking segment dipped 35% YoY. Revenue from other financial and non-financial products declined 8% YoY.

* Commission payout grew 22% YoY to INR1.7b, with the number of MFD growing to 34,232 (30,349 in 1QFY25). This reflected 60.5% of consolidated distribution revenue (59.1% in 1QFY25), and management expects this to remain largely stable in the subsequent quarters, despite some impact from competitive pressure.

* Other income for 1QFY26 rose 47% YoY to INR103m (14% beat).

Key takeaways from the management commentary

* A 15-16% fixed salary hike was implemented in Apr’25, and management expects overall employee cost to rise ~20% in FY26. Despite near-term pressure on RM costs from increasing competitive intensity, management remains confident of achieving 23-24% margins (excluding ESOP costs) in FY26.

* Prudent started 2QFY26 with a 7% sequential uptick in daily average AUM compared to 1QFY26 QAAUM.

* Life insurance distribution remained muted as the previous focus on traditional products is being scaled back. Contribution from guaranteed plans has reduced from 70-80% earlier to 40-45% now.

Valuation and view

* We expect the revenue growth trajectory to remain in high teens during the medium to long term, primarily due to: 1) the rising MF AUM, mainly led by an improving SIP participation, 2) focus on a one-stop-shop solution, which should result in a rise in distribution revenue from higher-margin products such as insurance, and 3) healthy traction in AIF/PMS/FD segments.

* We have largely maintained our earnings estimates considering the in-line performance during the quarter. We expect Prudent to deliver a revenue/EBITDA/PAT CAGR of 18%/16%/20% over FY25-27, fueled by growing MF AUM and a focus on increasing the share of non-MF business in the overall mix. The company is expected to maintain an RoE of >28% for FY26/FY27. We reiterate our Neutral rating with a TP of INR2,600 (based on 38x EPS FY27E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412