Neutral Indus Towers Ltd for the Target Rs. 395 by Motilal Oswal Financial Services Ltd

Operationally in line; dividend deferral disappointing

* Indus Towers (Indus)’ 4QFY25 reported financials were impacted by several one-offs on account of the consummation of tower purchases from Bharti Airtel, prior period revenue, and provision reversals.

* Adjusted for one-offs, operational performance was broadly in line with the pick-up in tenancy additions. Indus’ 4Q recurring EBITDA grew 4% QoQ (+10% YoY) to ~INR41b and was largely in line with our estimate

* Driven by clearance of past dues (~INR51b) and moderation in capex, Indus’ FY25 FCF jumped to ~INR98.5b. Indus has used ~INR27.5b for buyback and paid ~INR18.3b to acquire towers from Bharti, which leaves ~INR53b (or ~INR20/share) for potential dividend distribution.

* However, Indus’ Board has deferred the decision on dividend/buyback and formed a committee to evaluate the modalities of returning cash to shareholders. We believe this deferral is sentimentally negative.

* We raise our FY26-27E EBITDA by ~3% each, primarily driven by contributions from towers acquired from Bharti. FY26-27E PAT increase is higher on account of lower net finance costs as the company turned net cash.

* We continue to model ~INR20b bad debt provisions (~25% of Vi’s annual service rentals) from FY27 to FY32 on account of Vi’s cash constraints (NPV impact of ~INR30/share).

* Further, we believe there could be downside risks to tenancy additions from delays in Vi’s debt raise and, in turn, its capex spends.

* We reiterate our Neutral rating with a revised DCF-based TP of INR395 as risk-reward remains fairly balanced (bull case: INR450, bear case: INR355).

Core-performance inline; lower bad debt provisions led to EBITDA miss

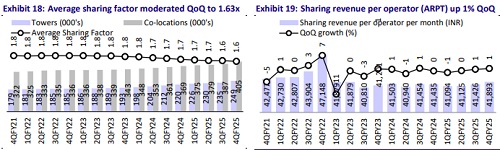

* Adjusted for the acquisition, Indus’ net macro tower/tenancy additions at ~4.3k/~8.2k were broadly in line as Vi’s rollout likely gathered pace in 4Q.

* Reported average revenue per tenant (ARPT) was up ~1% QoQ and YoY each to INR41.9k (broadly in line), as there were offsetting impacts from prior period revenue and a higher tower base due to acquisition.

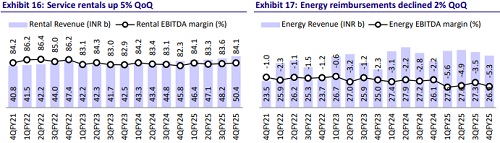

* 4Q service revenue at INR50.3b grew 5% QoQ (+10% YoY, 2% ahead) , mainly due to the recognition of prior- period revenue (~INR0.9b impact).

* Consolidated revenue was up ~2% QoQ to INR77b (+7% YoY), while reported EBITDA declined ~38% QoQ (+6% YoY, 5% below), largely due to lower prior period provision reversal of INR2.2b (vs. our est. of INR5.2b and INR30.2b in 3QFY25).

* Energy under-recovery rose to INR1.4b (vs. INR0.9b loss QoQ and our est. INR0.5b loss), largely due to costs for Bharti’s tower. Adjusted for the same, energy under-recovery would be in line with our estimate.

* Adjusted for provision reversals and one-offs in revenue and costs, recurring EBITDA at INR40.9b (+4% QoQ, +10% YoY) was broadly in line.

* Indus’ 4Q capex jumped to INR22b driven by higher maintenance capex, while FCF improved to INR39b, led by the collection of Vi’s past dues.

Collection of prior-period bad debt strengthens Indus’ balance sheet in FY25

* Service revenue grew 8% YoY to INR192b in FY25, driven by robust tower/tenancy additions, while FY25 consolidated revenue was up ~5% YoY to INR301b.

* Reported EBITDA surged to ~INR207b in FY25, mainly due to the reversal of ~INR51b provisions for bad debts. Adjusted for provisions, EBITDA at INR156b, grew ~7% YoY.

* Indus’ trade receivables declined ~INR25.5b QoQ to INR48b (from INR64.5b in FY24), driven by the collection of Vi’s past dues.

* FY25 capex excl. tower acquisition, moderated to ~INR69b ( vs. INR97b).

* With moderation in capex and ~INR51b collection of past dues, Indus reported robust FY25 FCF of ~INR98.5b and turned net cash (excluding lease liabilities) with ~INR9b net cash (vs. INR42.5b net debt in FY24).

* Out of INR98.5b, Indus has used ~INR27.5b for buyback in 1H, paid ~INR18.3b to Bharti for towers, and is left with ~INR53b (or INR20/share) for potential distribution to shareholders.

Key highlights from the management commentary

* Deferral of dividends: Indus’ Board has appointed a committee to evaluate the company’s need for growth capital and decide on the modalities of cash distribution to enhance shareholder returns. Management indicated that the company has internally funded the ~INR20b payments for the tower acquisition currently, but it still plans to raise debt at a later stage. The tower acquisition payouts, though, could impact the quantum of cash distribution to shareholders.

* Bharti’s tower acquisition: Indus acquired 12,606 towers from Bharti Airtel, including 2,226 leaner towers for a consideration of ~INR20b. Management indicated that the acquired towers were single-tenant towers and the ARPT for macro towers would be in line with MSA for the single-tenant towers. Further, there is an opportunity to increase tenancy on these towers.

* Tenancy additions and outlook: Excluding the impact of Bharti’s tower acquisitions, tenancy additions at ~8.2k again outpaced tower additions. The decline in the tenancy ratio to 1.63x is primarily on account of the acquisition of single-tenant towers from Bharti. Management indicated that the order book remains robust, and the focus is to drive growth both organically (through higher market share in key customers’ rollouts) and inorganically.

Valuation and view

* We believe Indus’ decision to defer dividend payments is negative for the sentiments, as we continue to view Indus as a dividend play (rather than growth).

* With the completion of the first phase of Bharti’s pan-India 5G and rural rollouts, we believe tower additions will remain muted over the near term.

* Further, we believe there could be downside risks to tenancy additions (our estimate of 35k tenancies and ~50k loadings) from delays in Vi’s debt raise and, in turn, its capex spends.

* We raise our FY26-27 EBITDA estimates by ~3% each, largely driven by contributions from towers acquired from Bharti. FY26-27E PAT increase is higher on account of lower net finance costs as the company turned net cash.

* We continue to build in ~INR20b bad debt provisions (~25% of Vi’s annual service rentals) from FY27-32 on account of Vodafone Idea’s cash constraints (NPV impact of ~INR30/share).

* Reiterate Neutral with a revised DCF-based TP of INR395 as the risk-reward remains fairly balanced (bull case: INR450, bear case: INR355).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412