Neutral Navin Fluorine International Ltd for the Target Rs. 5,060 by Motilal Oswal Financial Services Ltd

CDMO performance strong; order book visibility in FY26

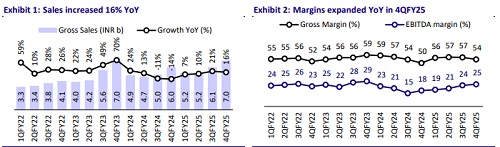

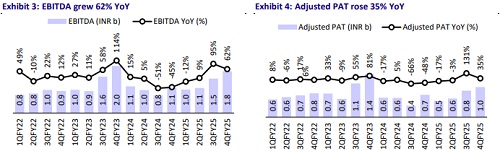

* Navin Fluorine International’s(NFIL) EBITDA in 4QFY25 came in line with our estimates, with strong YoY performance in the CDMO segment. Gross margin stood at 54.2%, while EBITDA margin expanded 720bp YoY to 25.5%. Earnings grew 35% YoY to INR950m in 4QFY25. There was stable momentum in all business segments as multiple strategic levers drove 4Q performance.

* HPP revenue was driven by higher volumes and improved realizations in 4Q. NFIL has signed a strategic agreement with Chemours for initial capacity deployment of their proprietary product. It has also entered into a technology tie-up with Buss ChemTech AG for high-purity N5 grade HF for solar applications, with NFIL branding, with no capex announced yet for the HF tieup.

* In Spec Chem, both Dahej and Surat plants operated at optimum capacity with strong order visibility for FY26; two new fluoro intermediates are being introduced for a validated agrochem customer. While Fluorospecialty plant utilization is expected at ~50-55% in FY26, pricing pressure is likely to persist despite volume-led growth in the segment, with expected ATR at ~1.3-1.5x.

* In CDMO, orders are secured for CY25 under a European MSA, with new molecule orders and confirmed supply orders from major EU and US customers lined up for FY26. The guidance remains intact for the aspirational ~USD100m revenue by FY27—split equally among new MSA, Fermion contract, and the base CDMO business. The expected ATR of the segment is ~2x.

* With new agreements and strong visibility of existing contracts, we increase our revenue/EBITDA/PAT by 7%/6%/7% for FY26 and by 12%/14%/17% for FY27. The stock is trading at ~41x FY27E EPS of INR112.4 and ~26x FY27E EV/EBITDA. We value the company at 45x FY27E EPS to arrive at our TP of INR5,060. Valuations remain expensive, thus we maintain our Neutral rating.

EBITDA in line; higher-than-expected interest cost leads to earnings miss

* NFIL reported revenue at INR7b (+16% YoY) and GM at 54.2% (+420bp YoY). EBITDAM came in at 25.5% (+720bp YoY), with EBITDA at INR1.8b (est. of INR1.8b, +62% YoY). PAT stood at INR950m (est. of INR1b, +35% YoY).

* For FY25, revenue stood at INR240b (+16% YoY), EBITDA at INR5.3b (+32% YoY) and adjusted PAT at INR2.8b (+22% YoY). EBITDAM was at 21.9% in FY25 (+260bp YoY).

* NFIL declared a final dividend of INR7/share (interim dividend of INR5/ share in 3QFY25, taking the total FY25 dividend to INR12/share).

Valuation and view

* The CDMO business is expected to drive robust growth (clocking a 53% CAGR over FY25-27) due to the increasing use of fluorine in the Pharma and Agro space, battery chemicals, and performance materials (Solar grid HF, Semiconductor grade HF, etc.).

* The company has already identified opportunities in its segments, such as: 1) a capability capex in Spec Chem with INR360m in peak revenue (first dispatch in Feb’25); 2) Fermion contract with a value of USD30m over three years; and, 3) a strategic agreement with Chemours to set up an initial commercial capacity for manufacturing of an innovative liquid cooling product (expected commissioning in 1QFY27), among others.

* We expect a CAGR of 24%/30%/39% in revenue/EBITDA/adj. PAT over FY25-27. The stock is trading at ~41x FY27E EPS of INR112.4 and ~26x FY27E EV/EBITDA. We value the company at 45x FY27E EPS to arrive at our TP of INR5,060. Valuations remain expensive, thus we maintain our Neutral rating.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)