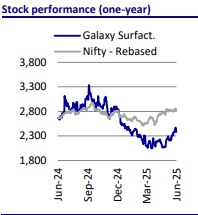

Buy Galaxy Surfactants Ltd for the Target Rs. 3,180 by Motilal Oswal Financial Services Ltd

Scaling with strategic clarity and focus

We attended Galaxy Surfactants’ (GALSURF) capital market day in Mumbai on 13th Jun’25. Below are the key highlights of the event:

A decade of strong foundations and profitable growth

* Over the past 10 years, GALSURF has demonstrated its ability to scale profitably while navigating cyclical and regional challenges. During FY15-25, the company doubled its total volumes, supported by deeper market penetration and category expansion, particularly in rinse-off personal care and home care products. During this same period, EBITDA tripled, driven by operational efficiencies, product mix enhancement, and innovation. PAT grew 5x, reflecting sharp execution and cost control.

* GALSURF achieved an average RoCE of 22%, a testament to disciplined capital allocation and return-oriented investment. EBITDA/kg also doubled, highlighting the company’s ability to extract more value per unit of product. Despite macroeconomic headwinds in the early part of this decade, including inflation and demand volatility, the company maintained strong profitability, setting a firm base for future expansion.

Vision 2030: Forging forward

* Looking ahead to 2030, GALSURF has outlined an ambitious but well-structured growth roadmap. Over the next five years, the company plans to double its volumes and grow EBITDA by 2.5x, while sustaining a RoCE greater than 22%. Its key internal goal is to achieve an EBITDA/kg of INR25 by FY30. This growth will be driven by a mix of organic, portfolio-led, and ecosystem-driven initiatives.

* The company expects 50% of incremental EBITDA to come from organic growth in rinse-off categories such as hair care, oral care, and body wash— segments where GALSURF already has a strong presence. Around 30% of EBITDA growth is projected to come from new product portfolios, particularly in high-value, leave-on categories like moisturizers, sunscreens, and serums. The remaining 20% will be driven by new avenues, including strategic partnerships, collaborations, and expansion into wellness and beauty-focused solutions.

* GALSURF's 2030 vision is centered on defending and deepening its leadership in India and AMET markets, winning new customers and applications in the Americas, and making focused inroads into specialties in the European Union. This will be enabled through what the management calls the ‘3D’ approach— Development, Digitalization, and Distribution—backed by investments in innovation, technology, and talent.

Riding on global trends: A shifting industry landscape

* GALSURF operates in an ingredients market with a total addressable value of USD42b, of which USD30b is directly relevant to its surfactants and specialty chemicals portfolio. The total global ingredient volume stands at 15mmt, with GALSURF’s focus market comprising 10mmt, of which 9mmt is surfactants and 1mmt includes preservatives, UV protection, and emollients.

* The global home care ingredients market is estimated at USD26b, dominated by surfactants (72% share). Evolving consumer preferences in developed markets are driving demand for unit dose detergents (pods), eco-friendly formats, and low-residue formulations due to stricter regulatory norms (e.g., 1,4-Dioxane limits). Meanwhile, in developing regions, there is a shift from bar and powder-based formats to liquids and premium detergents, opening new avenues for GALSURF.

* In the personal and beauty care segment, which is a USD475b market globally, GALSURF sees immense opportunities, especially in skincare, sun care, and clean beauty. The ingredients market within this segment is USD16b in value and 4mmt in volume. With a 5.7% CAGR, it is expected to outpace other segments, led by consumer shifts towards natural, multifunctional, and sustainable solutions.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412