Neutral Balkrishna Industries Ltd For Target Rs.2,630 by Motilal Oswal Financial Services Ltd

Operationally in line; Fx gains lead to PAT beat

Demand outlook remains challenging, particularly in Europe

* Balkrishna Industries (BIL) delivered an operationally in-line performance in 3QFY25, with Fx gains driving an Adj. PAT beat at INR4.4b (up 43% YoY, vs. est. INR3.8b). Current weakness in demand in European markets is likely to be offset by growth in America, India, and other regions, supported by BIL’s focus on product development and network expansion.

* Given the uncertain global demand macro, we have lowered our estimates by 5.5% for FY26E. We maintain our Neutral rating with a TP of INR2,630, based on ~22x Dec’26E EPS.

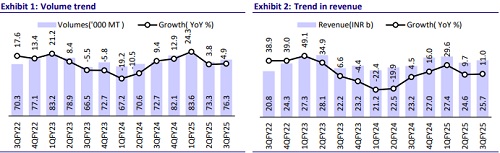

Posts 5% volume growth despite weak global cues

* BIL’s standalone 3QFY25 revenue/EBITDA/PAT grew 11%/9%/43% YoY to INR25.7b/INR6.4b/INR4.4b (est. INR25.2b/INR6.3b/INR3.8b). 9MFY25 revenue /EBITDA/adj. PAT grew 17%/22%/33% YoY.

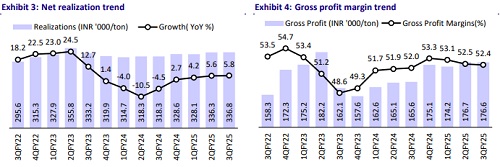

* Volumes grew 5% YoY/ 4% QoQ to 76.3k tons (in-line). Realizations grew 6% YoY (flat QoQ) at INR336.8k/unit (est. INR339.6k).

* Gross margin expanded 40bp YoY (stable QoQ) to 52.4% (est. 52.2%).

* Freight cost increased 200bp YoY/-70bp QoQ at 6.1% of sales.

* EBITDA margin contracted 40bp YoY/20bp QoQ at 24.9% (in line), as the benefit from a decline in freight costs QoQ was offset by higher employee costs and other expenses (ex freight).

* The company reported Fx gains of INR1.1b (INR0.5b in 2QFY25), resulting in Adj. PAT beat.

* Geography-wise performance: Tonnage declined ~16% YoY for EU markets in 9MFY25, while it grew ~14%/19% YoY for American and Indian geographies, respectively. For RoW, tonnage grew 61% YoY.

* Gross debt as of Dec’31 stood at INR30.45b, with cash and cash equivalents of INR29.42b, resulting in a net debt of INR1.03b.

* The BOD declared a dividend of INR4 per equity share, bringing the cumulative dividend to INR12 per share for FY25 so far.

Highlights from the management commentary

* Outlook: Management has maintained the guidance of minor volume growth in FY25. The market scenario continues to remain challenging. While volumes during the quarter grew despite channel de-stocking, management clarified that there are still no major market share gains.

* RM costs: Costs increased 100bp in 3Q, but the major impact is likely to be felt in 4QFY25 due to the lag in shipping time. However, RM costs are likely to remain stable in the coming quarters. The company has not implemented any price hikes in 3Q or in Jan.

* Carbon black project: The advanced carbon black plant with a capacity of 30,000 MTPA, was completed in September last year and is undergoing customer testing for non-tire grade carbon black applications in plastics, ink, and paint industries. Revenue contribution from third-party sales of carbon black stands at 9-10%.

* Capex: Management has guided for capex of INR11-12b for FY26. The company incurred capex of INR9.68b in 9MFY25. Capex for a 35,000 MTPA OTR tire range, announced in August last year, is progressing as planned, with completion expected in H1FY26.

Valuation and view

* The retail demand in key global markets is currently weak and likely to remain uncertain due to ongoing geopolitical challenges. Further, margins are likely to be under pressure as the impact of rise in input costs is expected to be felt in Q4. This is likely to limit earnings growth in the near term.

* Given the uncertain global demand macro, we have lowered our estimates by 5.5% for FY26E. At a P/E multiple of 25x/20.6x FY26E/FY27E EPS, most of the positives seem priced in. We value BIL at 22x Dec’26E EPS (in line with its 10- year LPA) to arrive at our TP of INR2,630. We reiterate our Neutral stance on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412