Buy Triveni Turbine Ltd for the Target Rs. 700 by Motilal Oswal Financial Services Ltd

Results in line, strong enquiry pipeline ahead

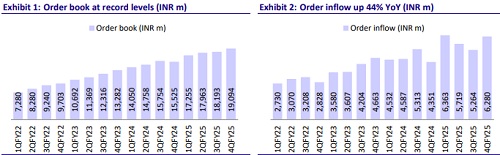

Triveni Turbine (TRIV)’s 4QFY25 results came in line with our expectations. For FY25, domestic order inflows were up 29% YoY, boosted by one-time large order inflow worth INR2.9b. Export order inflows were up by 23% YoY. Base order inflow was weak, but the enquiry pipeline for base orders is up strongly in both domestic and international geographies. We expect this enquiry pipeline to start translating into order inflows by 2HFY26, with some volatility expected in 1HFY26. Management is optimistic about the domestic order inflow pipeline coming from process cogeneration (doubling YoY), steel, cement, oil & gas, recycling, and food processing. TRIV also expects healthy export inflows from Europe and the US, where it has already made investments. This will further diversify its revenue stream and growth prospects. We cut our FY26/FY27 estimates by 9%/10% to factor in lower base orders in domestic geography. We maintain BUY with a TP of INR700, based on 42x Mar’27E earnings.

In-line quarter

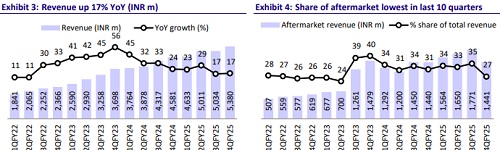

Revenue came in line with our estimates at INR5b (up 17.5% YoY) on the back of robust execution of the opening order book of INR18.1b. Domestic/export revenue grew by 17%/26% YoY. Exports as % of sales increased to 52% in 4QFY25 vs. 48% in 4QFY24. EBITDA at INR1.2b grew by 22% YoY on the back of operating leverage benefits as gross margin was down 40bp YoY at 50.1%. EBITDA margin expanded ~280bp YoY to 22.4%. PAT at INR946m (4% below estimates) grew 26% YoY, aided by higher other income (+16% YoY). As of Mar’25, TRIV recorded an outstanding carry-forward order book of INR19.09b, up 23% YoY. The export outstanding order book stood at a record INR10.9b as of Mar’25, up 36% YoY and contributing to 57% of the closing order book. Order booking for the year reached INR23.63b, up 26% YoY, supported by increased product-led demand. This is despite downward adjustments of ~INR1.4b in order booking due to slow-moving orders while having customer advances.

Domestic ordering expected to see an uptick from FY27

In FY25, domestic order bookings grew strongly by 29% to INR8.2b, with overall softness due to a ~10% decline in the Indian turbine market. Despite a muted year, Triveni saw a sharp rise in domestic enquiry levels (+120% YoY), indicating strong pent-up demand. Key sectors driving enquiries include process cogeneration (doubling YoY), steel, cement, oil & gas, recycling, and food processing. Although many orders were deferred in FY25 due to elections and macro uncertainties, management remains confident that these enquiries will translate into order finalizations over the coming quarters, supporting a domestic recovery in FY26. However, we expect domestic ordering activity to remain weak in FY26 for a few more quarters and to pick up from FY27

International ordering to remain strong

International ordering was a bright spot, growing 23% YoY to INR12.6b. The export order book stood at a record INR10.9b (+36% YoY), now accounting for 57% of the total order book. Strong demand was seen across regions - Middle East, Europe, North America, Southeast Asia, and Africa - spanning broad power ranges. We expect TRIV's expanding global customer base, combined with its strategy of deeper market penetration and increased references in larger turbines, to help it sustain strong international order inflows in FY26 and beyond.

Exports and aftermarket poised for global expansion and margin upside

The aftermarket business remains a stable, high-margin contributor (~32% of revenue). Growth prospects are particularly strong in refurbishment services, spares, and maintenance - both domestically and internationally. Management sees solid aftermarket expansion potential in North America and South Africa, with its US subsidiary positioned to cater to these services alongside product sales. Although aftermarket revenue as a percentage of sales remained stable, we expect steady annual increases in contribution, especially from high-margin refurbishment opportunities globally.

Future capex plans

TRIV has earmarked INR1.65b for capex in FY26 (including INR440m carry forward form FY25), focusing on capacity augmentation, R&D infrastructure, and international expansion. The Sompura facility will see new assembly bays and testing infrastructure to avoid operational bottlenecks. Additional capex is planned to strengthen international subsidiaries, notably the US unit, which will offer manufacturing flexibility amid tariff uncertainties. This investment is aligned with sustaining innovation, meeting growing order volumes, and supporting expansion in strategic markets. We have factored in capex of INR750m each in FY26/27.

API market outlook

The API turbine segment has emerged as a key growth engine, delivering strong order inflows across the Middle East, Southeast Asia, Americas, and Europe. TRIV secured approvals from multiple global refiners and petrochemical players, bolstering its inquiry pipeline. Both drive and power turbine applications are witnessing increased traction. Management emphasized that API will likely outpace renewable and energy efficiency segments in growth contribution going forward. Though highly competitive, TRIV’s technological expertise and faster turnaround capabilities position it well to capture a larger share of this lucrative market.

We expect a strong 19% CAGR in PAT over FY25-27E

We tweak our estimates to factor in lower base orders, improved export revenues and better margins for after-market. We expect TRIV’s revenue/EBITDA/PAT to clock a CAGR of 19%/18%/19% over FY25-27. Backed by a comfortable negative working capital cycle, strong margins, and low capex requirements, we expect its OCF and FCF to report a CAGR of 45% and 49% over the same period, respectively.

Valuation and view

The stock is currently trading at 43.6x/34.9x FY26E/27E P/E. We revise the TP to INR700 (from INR780) based on 42x FY27E EPS, which factors in lower base orders in domestic geography. Key risks to our recommendation would come from slowerthan-expected order inflow growth, particularly in domestic markets; lower-thanexpected margins; and a slowdown in global geographies.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)