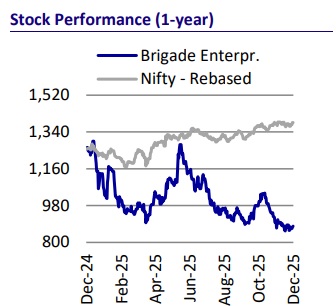

Buy Brigade Enterprises Ltd for the Target Rs. 1,338 by Motilal Oswal Financial Services Ltd

Scaling core South; upside in rentals starting from FY26

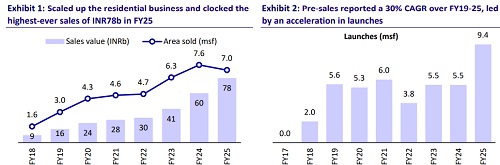

Brigade Enterprises (BRGD) posted a 30% CAGR in presales over FY21-25 and is expected to deliver 19% growth during FY25-28, guided by its strong launch pipeline and a scale-up in Hyderabad and Chennai. Collections are expected to increase to INR123b by FY28, posting a 32% CAGR over FY25-28, which should translate into a cumulative operating cash flow of INR151b over the same period. Additionally, the commissioning of rental assets across geographies is expected to drive a 7% CAGR in rental income over FY25-28. The hospitality portfolio is also expected to grow to 3,300 keys by FY30. We believe BRGD offers strong growth visibility for the coming years, and we reiterate our BUY rating with a revised TP of INR1,338/share, which implies a 52% upside.

Launch activity to drive 19% CAGR in presales

* In FY25, BRGD achieved bookings of INR78.5b, with 54% of sales coming from new launches. During 1HFY26, the company launched 4.3msf (3.5msf BRGD share) across eight projects—five in Bengaluru, two in Chennai, and one in Gujarat. Notable launches included Morgan Heights, Avalon, Lakecrest, and Cherry Blossom across Bengaluru and Chennai. These projects generated total sales of INR31.5b, with new launches contributing 40%.

* The introduction of these projects reinforces BRGD’s footprint in highdemand urban centers, consistent with its strategy of delivering premium properties tailored to affluent buyers. These launches showcase BRGD’s capability to address market demand for luxury residences and mixed-use developments.

* BRGD’s upcoming residential pipeline stands at nearly 11msf across key cities, comprising seven projects in Bengaluru, four in Chennai, three in Hyderabad, and four in Mysuru. Of this, ~7msf with an estimated GDV of INR80-83b is planned for launch in 2HFY26. Key upcoming projects include the Velacherry Project in Chennai with a GDV of INR20b (1msf), a 1msf second phase of Brigade Gateway Hyderabad, and two major mixed-use developments in North and East Bengaluru.

* In 1HFY26, BRGD acquired projects with a total GDV of INR140b (13msf), with INR80b allocated to Bengaluru, INR40b to Hyderabad, and INR20b to Chennai. The company is actively negotiating additional acquisitions and exploring opportunities in new regions.

* Presales are projected to clock a 19% CAGR, reaching INR133b by FY28. This is underpinned by a strong launch pipeline of 15msf, of which 11msf is residential, as indicated by the company. Bengaluru is expected to contribute roughly 50-80% of presales, while launch volumes are expected to post a 7% CAGR from FY25-FY28, reaching 11.4msf by FY28.

* While Bengaluru continues to be a core driver of BRGD’s performance, the company has strategically expanded into other major cities, such as Chennai, Hyderabad, and Mysuru. This geographic diversification is expected to account for 30-40% of presales in the near term, with approximately 40% of the current land bank located outside Bengaluru.

Poised for strategic market expansion

* BRGD is planning a premium residential development on Bogadi Road near the proposed Outer Ring Road in Mysore, spanning ~0.45msf with an estimated GDV of INR3b. The project will include 2- and 3-BHK apartments, along with senior living units, offering modern amenities, landscaped open spaces, and a clubhouse. This initiative strengthens the company’s presence in Mysore’s growing luxury housing market and is currently in the planning stage.

* After September 2025, BRGD submitted an Expression of Interest to invest INR15b across Kerala, targeting residential, commercial, IT office space, and hospitality projects. These initiatives form a part of a medium-term expansion strategy aimed at leveraging Kerala’s urban growth hubs and upcoming infrastructure corridors.

* BRGD is expanding its WTC campus in Infopark Kochi with a third tower, increasing the total IT office space to over 1msf. This expansion will cater to growing demand from technology and service companies, enhancing the company’s commercial real estate footprint in Kerala. The project is currently under execution, with phased construction and leasing plans.

* As part of its Kerala expansion, BRGD has proposed a new residential project in Kochi targeting mid-to-luxury buyers. The project is designed with modern amenities, sustainable design elements, and community facilities, addressing the city’s rising urban housing demand. It is awaiting approvals and pre-launch planning, forming part of the company’s integrated residential portfolio in the state.

* BRGD intends to develop a high-end island resort near Vaikom, targeting Kerala’s luxury tourism segment. The resort will feature premium accommodations, wellness facilities, and leisure amenities, positioning it as a destination for upscale travelers. This project is currently in the planning stage and aligns with the company’s strategy to diversify into hospitality alongside residential and commercial developments.

* BRGD has signed a long-term land lease in Technopark Phase?I, Thiruvananthapuram, to develop a World Trade Center campus (~1.2msf) integrated with a five-star hotel (200+ keys). The project aims to attract major IT and tech firms while enhancing office and hospitality infrastructure in the city. Currently in the pre-construction/planning phase, it reflects BRGD’s commitment to IT-led commercial expansion in Kerala’s state capital.

Valuation and view

* The company has a strong residential launch pipeline of ~11msf, which should enable it to sustain growth traction going forward.

* Management intends to continue assessing growth opportunities in the residential segment and expects to spend more on business development over the next two years. This will provide growth visibility in the residential segment and lead to a further re-rating.

* We reiterate our BUY rating with a revised TP of INR1,338, implying a 52% potential upside.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412