Buy TCS Ltd For Target Rs. 3,850 by Motilal Oswal Financial Services Ltd

Extreme short-term uncertainty to weigh on outlook

Margin recovery and valuation offer cushion; reiterate BUY

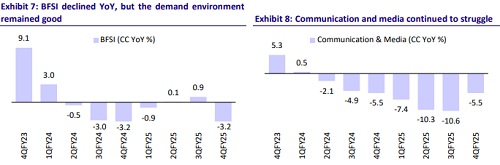

* TCS reported revenue of USD7.5b in 4QFY25, down 1.0% QoQ in USD terms vs. our estimated decline of 0.8%. FY25 revenue stood at USD30.2b, up 4.2% YoY in CC. 4Q growth was led by BFSI (up 1.3% QoQ). Regional markets declined 6% QoQ (BSNL), whereas all other verticals were down ~1.0% QoQ. In terms of geographies, India was down 15% QoQ, the US was flat, while Europe was up 2% QoQ. EBIT margin was 24.2% (down 30bp QoQ), below our estimate of 24.5%. PAT dipped 1.3% QoQ/1.7% YoY to INR122b (below our est. of INR126b).

* For the full year (FY25), revenue/EBIT/PAT increased 6.0%/4.6%/5.4% YoY (in INR terms). TCS generated an FCF of INR464b in FY25 (up 4.2% YoY). In 1QFY26, we expect revenue/EBIT/PAT to grow 2.2%/3.2%/2.8% YoY. TCS reported a deal TCV of USD12.2b, up 20% QoQ but down 8% YoY, bringing the FY25 TCV to USD39.4b. The book-to-bill ratio was 1.6x. We reiterate our BUY rating on TCS with a TP of INR3,850, implying a 19% potential upside.

Our view: Near-term revenue risks remain elevated

* Management guided international markets to be better in FY26 than in FY25; however, the magnitude of BSNL ramp-down (if it goes unreplaced) would mean FY26E on a full year could be a year of declining revenues (Exhibit 3). Further, the company's base case is that the current uncertainty will dissipate. However, we remain cautious; too little time has passed to ascertain whether the current events are short-lived, and we expect 1Q to be a QoQ decline (overall, including BSNL).

* Margins were a disappointment in 4Q; management attributed higher employee costs to employee interventions and promotions while deferring wage hikes that typically happen in 1Q. This was odd, as the demand environment does not warrant urgent employee interventions out of the cycle. That said, BSNL’s ramp-down would most certainly be accompanied by lower third-party expenses (Exhibit 2). We expect this to aid margin recovery in FY26E. We expect margins of 25.3% in FY26 (~100bp expansion YoY).

* Deal TCV of USD12.2b without any mega deal was encouraging. This will provide respite in the international business in 1H only if ramp-up happens on time and clients again do not ask for sudden deferrals, which is a key risk for the next couple of quarters, in our opinion.

* As we mentioned in our earlier reports (dated 4th Apr’25: Liberation Day and Indian IT: Breaking point or turning point? and dated 30th Mar’25: Technology 4Q Preview: Tempered expectations), there is earnings risk for Indian IT services across the board, and we prefer bottom-up and margin expansion stories in place of top-down discretionary plays. TCS's margin expansion aids earnings visibility despite the revenue risk. We continue to retain our BUY rating on the stock.

Valuations and changes to our estimates

* During FY25-27, we expect a USD revenue CAGR of ~3.1% and an INR EPS CAGR of ~6.8%. We have marginally tweaked our estimates, factoring in the BSNL ramp-down and near-term revenue risks. Our TP of INR3,850 implies 25x FY27 EPS, with a 19% upside potential. We reiterate our BUY rating

Miss on revenue and margins; TCV deal wins beat our estimates

* USD revenue came in at USD7.5b; down 1.0% QoQ in USD terms vs. our estimates of -0.8%. FY25 revenue stood at USD30.2b, up 4.2% YoY CC.

* Barring India, growth stood at 0.6% QoQ in USD terms.

* TCS’s 4Q growth was led by BFSI (up 1.3% QoQ). Regional markets declined 6% QoQ (BSNL), while all other verticals were down ~1.0% QoQ. In terms of geographies, India was down 15% QoQ, the US was flat, while Europe was up 2% QoQ.

* EBIT margin was 24.2% (down 30bp QoQ), below our estimate of 24.5%. For FY25, the EBIT margin stood at 24.3% vs. 24.7% in FY24.

* TCS reported a deal TCV of USD12.2b in 4QFY25 (USD39.4b in FY25), up 20% QoQ but down 8% YoY (vs. our estimate of USD8-9b).

* PAT dipped 1.3%/1.7% QoQ/YoY to INR122b (below our est. of INR126b). For FY25, PAT stood at INR486b. TCS generated an FCF of INR464b in FY25 (+4.2% YoY).

* The net headcount rose by 625 employees to 6,07,979 (flat QoQ) in 4QFY25. LTM attrition in IT services was 13.3% vs. 12.5% in FY24.

* The Board declared a final dividend of INR30/share in 4QFY25.

Key highlights from the management commentary

* The company observed delays in decision-making around discretionary spending. The anticipated revival in such spending, as expected in 3Q, has not materialized. However, the focus on cost optimization programs from clients is increasing, which presents new opportunities for TCS.

* Uncertainty in demand began to emerge in Mar’25, although no major project ramp-downs have been observed so far.

* Sectors such as Retail, CPG, Travel, and Automotive are expected to be the most affected due to tariffs.

* The demand environment in BFSI remains strong, except for Insurance, which has been experiencing some challenges.

* Management maintains a positive outlook for FY26 (to be better than FY25), especially in international markets. It is also exploring domestic opportunities to offset the impact of the BSNL ramp-down.

* Auto OEMs are witnessing weak demand, partly due to a downturn in the EV segment and turbulence in the ICE market with the increased inventories. Heightened caution was seen in the US following a decline in consumer sentiment from Feb’25.

* Margin walk: Tactical interventions, such as merit-based promotions effective from January 1, had a 100bp impact. Higher expenses in strategic marketing and travel contributed 60bp of pressure. However, currency movements provided a 40bp cushion, with the remaining impact mitigated through operating efficiencies.

Valuation and view

* Given its size, order book, and exposure to long-duration orders and portfolio, TCS is well-positioned to grow over the medium term.

* Owing to its steadfast market leadership position and best-in-class execution, the company has been able to sustain its industry-leading margin and demonstrate superior return ratios.

* We maintain our positive stance on TCS. Our TP of INR3,850 implies 25x FY27 EPS, with a 19% upside potential. We reiterate our BUY rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412